Articles

Cloud Payments for Enterprises: The Qatar CFO’s Guide to QCB-Compliant Infrastructure

Cloud Payments for Enterprises: Top Features Every CFO in Qatar Should Care About

Last week, I sat across from a CFO managing a 700-employee enterprise in Qatar.

His board was pushing for “cloud payment infrastructure.”

He had three questions:

I’ve had this exact conversation with a dozen Qatar CFOs in the past year.

Here’s the thing: Cloud payments aren’t just “online payment forms.” When done right, they fundamentally change your cost structure, working capital, and decision-making speed.

When done wrong, they create compliance nightmares and hidden costs that dwarf any savings.

According to Gartner, 90% of organizations will adopt hybrid cloud infrastructure by 2027. In Qatar, with Vision 2030 pushing digital transformation and QCB actively encouraging modern payment systems, the question isn’t “if” but “which platform and when.”

Qatar’s regulatory environment eliminates about 90% of international cloud payment platforms. QCB licensing, data residency requirements, and direct NAPS integration aren’t optional; they’re the foundation.

In this guide, I’ll break down the 8 mission-critical features Qatar CFOs should demand, reveal the hidden costs of “cheap” cloud solutions, and explain why most international platforms can’t operate properly in Qatar’s regulatory environment.

But before we get into those features, let’s clear up a fundamental misconception I hear in almost every CFO meeting.

When I bring up cloud payments with CFOs, most point to their payment gateway and say, “We’re already using cloud payments; our checkout is online.”

That’s like saying you’re using cloud computing because you have Gmail.

True cloud payment infrastructure means your entire payment processing system runs on your provider’s cloud servers.

You don’t own, maintain, or upgrade any hardware. Your provider automatically handles server failures, applies security patches without downtime windows, and scales instantly from 100 to 10,000 transactions per hour with zero infrastructure changes.

This isn’t theoretical. According to Deloitte’s research, enterprises spend 25-35% of their payment infrastructure budget just maintaining legacy systems. That’s money going toward keeping the lights on rather than growth.

One CFO I spoke with calculated their true cost after we broke down IT staff time, downtime during updates, and idle overprovisioned capacity.

They budgeted QAR 300,000 for payment infrastructure, but the actual annual spend was QAR 620,000. Cloud infrastructure cut that to QAR 320,000 while eliminating capacity constraints.

The cost savings matter, but the real value is what becomes possible. Launch new payment channels in days, not months. Scale during Ramadan spikes without planning.

Make decisions based on real-time data rather than last week’s reports. This is why Qatar enterprises are increasingly moving to cloud infrastructure despite initial security concerns.

Once you understand what cloud payments are, the next question is which features distinguish platforms that work in Qatar from those that don’t.

I’ve watched CFOs get dazzled by vendor demos showing flashy dashboards and AI-powered analytics.

Then six months later, they’re dealing with QCB compliance issues or reconciliation nightmares because they didn’t verify the basics.

Your platform requires direct QCB licensing as an independent payment service provider, not a partnership. Ask to see the actual license. SADAD’s QCB licensing has been in place since 2018, with Qatar-based data infrastructure ensuring compliance by default.

PCI DSS Level 1 compliance and SOC 2 Type II certification aren’t checkboxes. According to IBM’s 2024 Cost of a Data Breach Report, the average breach in MENA costs $6.5 million.

Your CFO needs unified dashboards that show all channels, enable instant revenue recognition, and provide API access for ERP integration. This means board reports are in minutes rather than days.

Your system should handle a 10x increase in transaction volume without requiring new hardware or advanced planning.

eliminates vendor fragmentation. Online sales, in-store POS, invoicing, and mobile payments should run through a unified infrastructure.

Platforms should automatically match transactions to settlements and export them directly to your ERP, without requiring manual spreadsheet work.

For Qatar enterprises processing QAR 10 million per month, seven-day delays mean QAR 23 million is locked in transit. At an 8% cost of capital, the opportunity cost is QAR 153,000 per month.

From months to weeks. Well-documented APIs with prebuilt ERP connectors enable your IT team to focus on business value rather than integration troubleshooting.

These eight features might seem straightforward, but I’ve watched CFOs overlook them because they were distracted by low monthly pricing.

Last month, a Qatar CFO told me their finance team was spending 35 hours monthly reconciling payments across their “affordable” cloud platform.

When we calculated the cost of that time plus settlement delays, their QAR 2,500 monthly platform fee brought the total expenses to QAR 18,000.

The sticker price almost never tells the real story. Here’s what actually drives up costs with budget platforms.

Cheap platforms typically have poorly documented APIs or outdated integration methods.

Your IT team spends 3-6 months building connections to your ERP, rather than 2-3 weeks. At QAR 250 per developer hour, that’s QAR 120,000-300,000 in unplanned integration costs.

I’ve seen enterprises hire external consultants just to decode vague API documentation.

When platforms take 5-7 days to settle funds, you’re essentially providing an interest-free loan.

For an enterprise processing QAR 15 million monthly, that’s QAR 35 million in transit at all times.

At your actual cost of capital, this compounds into a serious opportunity cost that never appears on the platform invoice.

Without proper automation, your team manually matches thousands of transactions monthly.

According to PYMNTS research, finance teams spend an average of 40+ hours per month on payment reconciliation when using basic platforms.

That’s QAR 72,000 in annual staff time that could be focused on analysis rather than data entry.

Platforms without proper QCB licensing or Qatar data residency create audit findings that require expensive remediation.

When your auditor flags payment data stored outside Qatar, you’re looking at platform migration under time pressure.

One enterprise spent QAR 180,000 switching platforms mid-year because their initial choice lacked proper compliance infrastructure.

The total cost difference over three years, budget platforms often cost 3-4x their advertised price when you factor in everything.

The hidden costs hurt, but they’re fixable if you catch them during evaluation; Qatar’s regulatory barriers aren’t.

Qatar isn’t just another market where international platforms can drop in their standard offering.

The regulatory and operational requirements here are sufficiently different that about 90% of global cloud payment platforms cannot operate properly.

I’ve sat in meetings where international vendors confidently claim they “support Qatar” until you ask about QCB licensing or data residency.

That’s when the story changes to “we’re working with local partners” or “we can route through our Dubai infrastructure.” Neither answer solves your compliance problem.

The Qatar Central Bank requires payment service providers to hold proper operating licenses. This isn’t a partnership agreement or a letter of intent. When your auditor requests the license, you need the original document.

Platforms operating through “local partners” create a compliance gap that surfaces during regulatory reviews. SADAD’s direct QCB licensing since 2018 eliminates this risk entirely.

Qatar regulations mandate that certain payment data stay in-country. International platforms storing data in Dubai, Bahrain, or Europe create audit exposure.

When QCB asks where customer payment data lives, “our regional data center” isn’t an acceptable answer. Your platform needs Qatar-based infrastructure by design, not as an add-on.

Routing through intermediaries adds 2-3 days to settlement times and incurs additional fees at each hop. Direct NAPS integration means same-day settlements and lower transaction costs.

For enterprises processing significant volumes, this difference compounds into millions of riyals annually in working capital improvements.

When your payment system has issues at 10 PM on Thursday night before a major sale event, you need someone who is available in your time zone and understands Qatar’s business calendar. International platforms route you through ticketing systems with 12-24 hour response times.

Understanding these requirements is one thing, but actually implementing cloud payments is where most enterprises either succeed spectacularly or struggle unnecessarily.

The CFO who budgets three months for cloud payment implementation and watches it drag into nine months didn’t fail at project management.

They failed at vendor selection.

Implementation speed depends almost entirely on choosing platforms built for enterprise integration from the start.

A Qatar enterprise with SAP or Oracle ERP should expect 10-14 weeks from decision to full operation with a properly designed platform.

That breaks down to assessment and planning (2-3 weeks), technical integration with pre-built ERP connectors (3-5 weeks), comprehensive testing (2-3 weeks), training and change management (2 weeks), and go-live with monitoring (1 week).

Platforms claiming faster timelines are either oversimplifying or selling you problems.

According to McKinsey research on digital transformations, 70% of enterprise tech implementations fail due to poor integration planning, not technology limitations.

Your platform needs documented APIs, proven ERP connectors for major systems, and integration support that answers questions in hours, not days.

SADAD’s ERP integration approach includes pre-built connectors and dedicated technical support during implementation, cutting typical integration time by 60%.

Your finance team needs hands-on training before go-live, not documentation to read afterward.

One Qatar enterprise I worked with conducted a two-week parallel processing run, processing payments through both the old and new systems simultaneously. This caught edge cases in testing and gave staff confidence before cutover.

When they went live, adoption was immediate because the team already knew the system worked.

Vendors who disappear after contract signing leave you to manage issues on your own.

During your first week live, you need 24/7 access to people who can actually solve problems, not escalate tickets.

These aren’t just implementation best practices; they’re what set successful Qatar enterprises apart from those still struggling with their platforms six months later.

Three Qatar enterprises switched to cloud payment infrastructure last year. Their CFOs agreed to share results on condition of anonymity, but the numbers tell a clear story about what proper implementation delivers.

Their legacy system held funds for seven days while they paid suppliers within three days, creating a working capital gap of QAR 4.2 million at any given time.

After moving to cloud infrastructure with instant settlements, they freed that capital immediately. Their CFO told me, “We stopped using our credit line for working capital. The interest savings alone paid for the platform switch in eight months.”

Before cloud payments, their average client took 68 days to pay invoices. After implementing automated invoice management with integrated payment links, the time dropped to 37 days.

The automated reminders and one-click payment option removed the friction that their clients didn’t know they were creating.

Cash flow predictability improved significantly, prompting them to restructure their growth investments.

Each location previously used different payment systems, requiring manual consolidation that took their finance team 50+ hours per month. Cloud infrastructure unified everything with automated reconciliation directly into their ERP.

Those 50 hours now focus on financial analysis instead of data matching. Their CFO said the productivity gains outweighed the cost savings.

Working capital improvements ranging from QAR 2.8-4.2 million, finance team productivity gains of 40-60%, and decision-making speed that fundamentally changed how they operate. None of them would consider going back to fragmented legacy systems.

Their success came down to asking the right questions before signing contracts, rather than relying on vendors to deliver on their promises.

Most RFPs ask the wrong questions because they’re written by procurement teams, not the CFOs who’ll live with the consequences. After watching enterprises choose platforms they later regret, I’ve seen what actually predicts success.

Request the actual QCB operating license, not a partnership letter or “we’re in process” explanation. Ask where exactly customer payment data gets stored and replicated. If the answer includes Dubai, Bahrain, or “our regional data center,” you’ll have compliance gaps during your next audit. Platforms built for Qatar have this documentation ready because they know you’ll ask.

Request access to the API documentation and have your IT director spend an hour reviewing it. Well-designed APIs have clear examples, error-handling documentation, and realistic use cases.

Vague documentation means months of integration problems.

Ask for references from Qatari enterprises that use the same ERP system you run. If the vendor hesitates or can’t provide local references, that says it all.

Include integration costs, staff time on reconciliation, opportunity cost of settlement delays, and potential compliance remediation.

A platform with QAR 5,000 monthly fees but seven-day settlements costs more than one charging QAR 8,000 with instant settlements when you factor in working capital impact.

Ask what happens when payments fail at 9 PM on a Thursday. Request the escalation path and response time SLAs in writing. Cloud platforms are only as good as the support behind them when something breaks.

Cloud payment infrastructure is no longer optional for Qatar enterprises pursuing the Vision 2030 digital transformation.

The question is whether you choose platforms built specifically for Qatar’s regulatory environment or international solutions that adapt afterward.

Since 2018, SADAD has powered the payment infrastructure for Qatar’s largest enterprises through direct QCB licensing, Qatar-based data infrastructure, instant settlements via direct NAPS integration, and dedicated enterprise support.

The CFOs who’ve made the switch report working capital improvements of QAR 2-4 million and a 40-60% increase in finance team productivity.

Your payment infrastructure decision effects operations for the next 3-5 years. Choose platforms designed for Qatar from the start, not adapted to it as an afterthought.

Articles

Cloud Payments for Enterprises: The Qatar CFO’s Guide to QCB-Compliant Infrastructure

Cloud Payments for Enterprises: Top Features Every CFO in Qatar Should Care About Last week, I sat across from a CFO managing a 700-employee enterprise in Qatar. His board was...

Read more

Articles

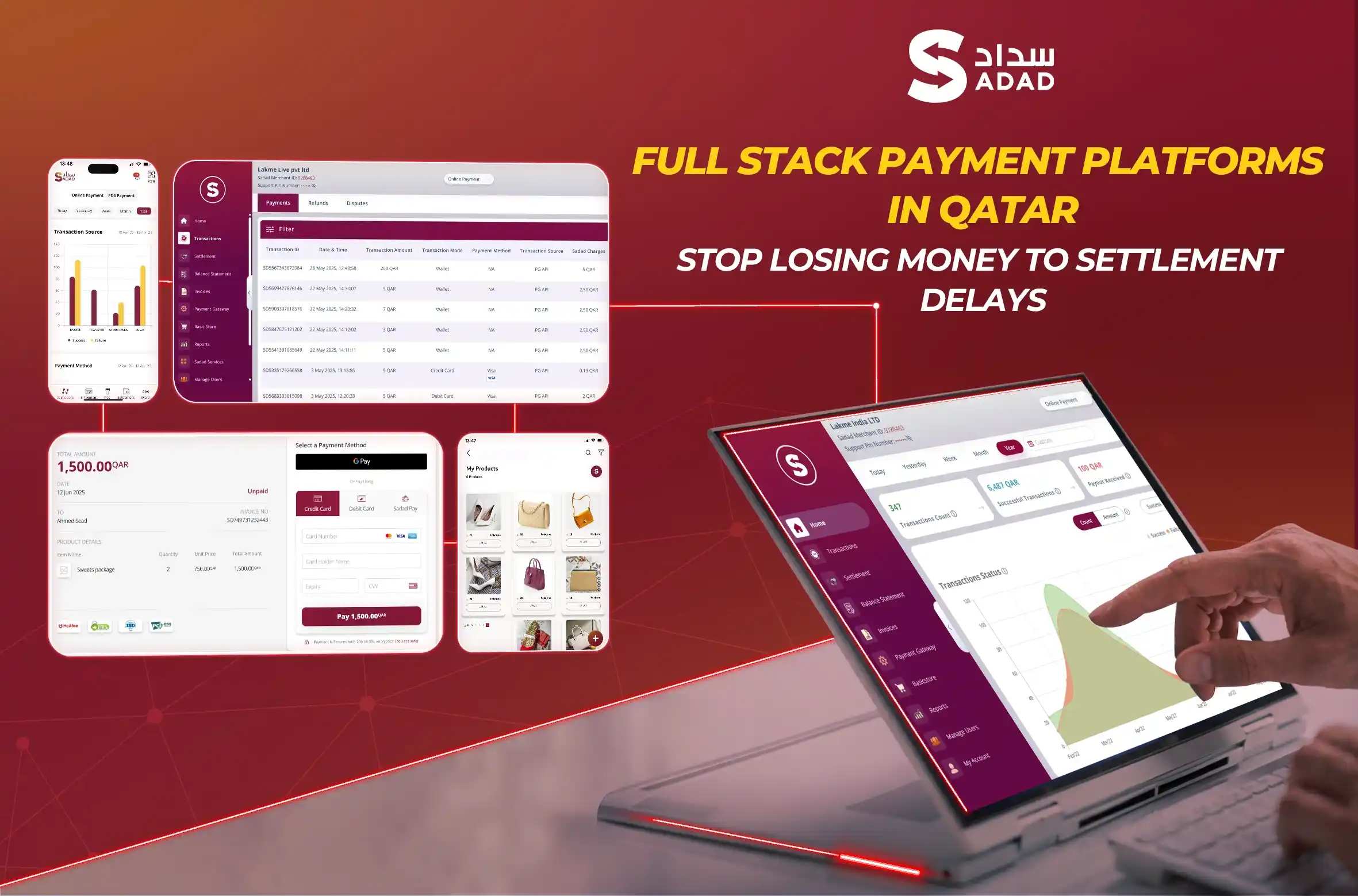

Full Stack Payment Platforms in Qatar: Stop Losing Money to Settlement Delays

Full Stack Payment Platforms in Qatar: The Complete Guide for Businesses If you're running a business in Qatar, you've probably felt the pain of cobbling together multiple payment vendors...

Read more

Articles

Stop Losing Ramadan Sales: A Qatar Payment Checklist That Actually Works

How to Prepare Your Business for Ramadan Payments in Qatar I've watched countless Qatar-based businesses scramble every year when Ramadan arrives, only to realize their payment systems weren't ready for...

Read more