Articles

SADAD Cloud: The Merchant Dashboard Powering Qatar’s Smartest Payment Operations

Let’s say you run a growing business in Qatar.

Three branches. Online orders. A SoftPOS for delivery. By the end of the day, your WhatsApp is full of photos from staff, your finance team is chasing down bank statements, and customer complaints about “double charges” are starting to pile up.

You don’t have a payment problem. You have a visibility problem.

SADAD Cloud fixes that.

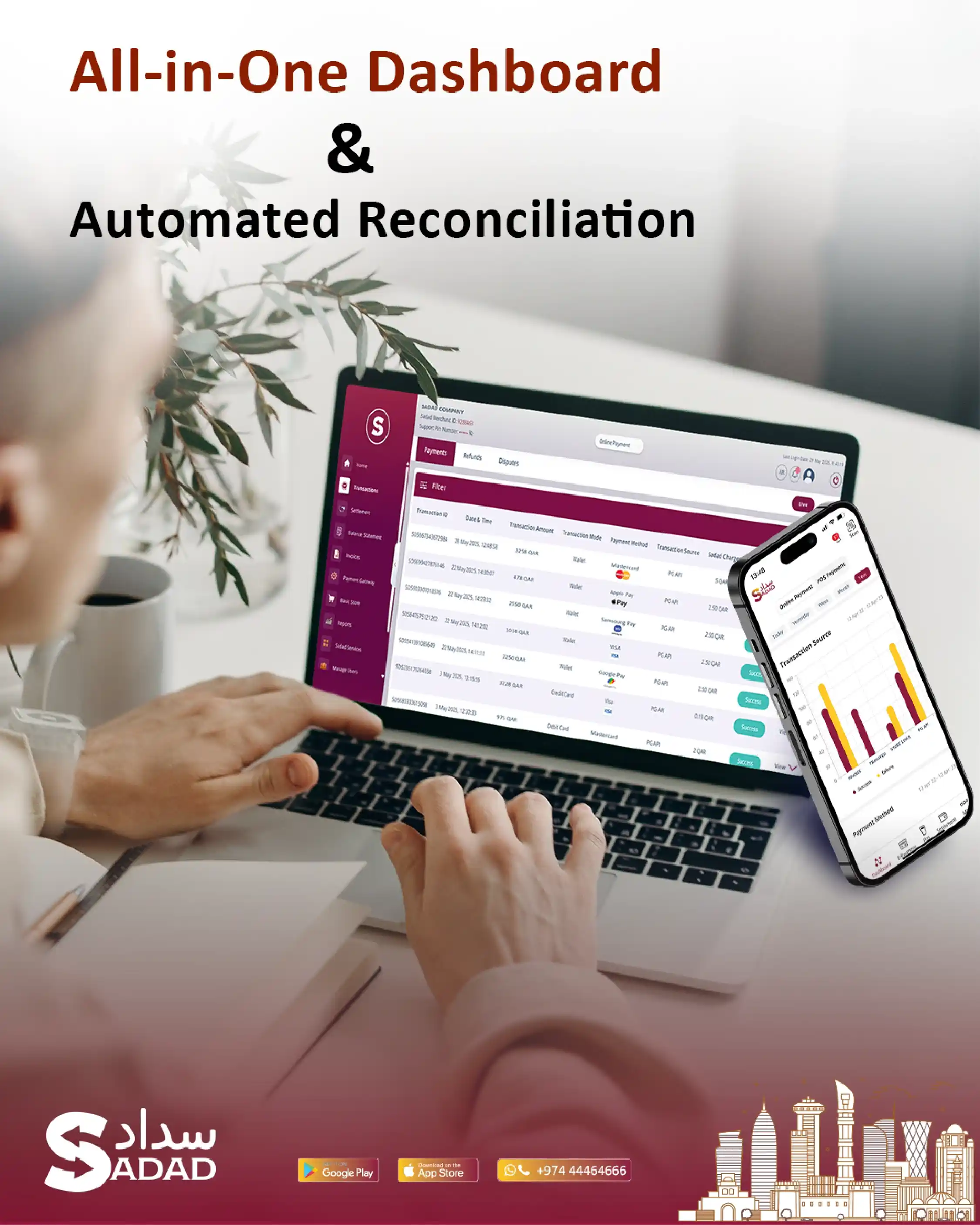

It’s not just a dashboard, it’s your business’s control center. One login shows you every QAR coming in, which terminal it came from, and whether it’s been settled, disputed, or flagged for fraud. From POS reconciliation to real-time transaction monitoring, SADAD Cloud replaces messy spreadsheets with clarity you can act on.

Unlike generic dashboards built overseas, SADAD Cloud is designed explicitly for Qatar, fully aligned with QCB regulations, NAPS, and multi-currency card processing.

In this guide, we’ll break down how SADAD Cloud empowers:

If you’re already using SADAD’s POS solutions, you already have the hardware. SADAD Cloud unlocks the full power of the system.

And if you’re still shopping around for a payment gateway, start here: The Fastest Onboarding Payment Gateway in Qatar.

Ready to take full control of your payment operations? Let’s dive in.

SADAD Cloud is more than a reporting tool; it’s a fully integrated merchant dashboard built for Qatari businesses. This guide breaks down how SADAD Cloud helps you:

Whether you’re a retailer, restaurant, or service provider, SADAD Cloud gives you the visibility, speed, and control to run payments like a pro.

Already using SADAD POS? Cloud is included. New to SADAD? Start here.

Most dashboards were built as an afterthought. They show you transactions, but not the whole picture. SADAD Cloud flips that.

This is SADAD’s merchant control panel, but it’s more than just a place to view numbers. It’s where your POS, eCommerce, SoftPOS, and QR payments come together in real time, with full context, and without the usual clutter.

With SADAD Cloud, you’re not toggling between systems or asking your accountant to “double-check the reports.” You’re seeing everything in one place:

It’s also fully aligned with QCB and built to support Qatar’s payment landscape, including NAPS, Visa, Mastercard, and AMEX. Whether you’re a service provider, retailer, or F&B chain, this is the back office your operations team has been waiting for.

Later in this article, we’ll break down exactly how SADAD Cloud handles settlement and reconciliation better than legacy systems. We’ll also show you how it manages fraud prevention and AI-based alerts (yes, it has those too).

If you’re wondering how SADAD Cloud fits into the full SADAD ecosystem, this page will give you the full picture: SADAD Acquiring Solutions.

Next up: let’s talk about real-time transaction monitoring and why that one feature alone can save your team hours every week.

Most dashboards show you yesterday’s data. By the time you see a failed payment or suspicious refund, it’s already old news.

SADAD Cloud changes that.

As soon as a customer taps, swipes, or clicks “pay,” whether on your website, POS terminal, or delivery driver’s SoftPOS, the transaction shows up instantly in your dashboard. You see:

This isn’t just useful. It’s a game-changer for businesses that operate across multiple channels. Especially for F&B or retail operations in Qatar, where peak hour payments can number in the hundreds, catching payment issues before customers complain is how you stay ahead.

You can even set alerts for:

Your ops or finance team doesn’t need to wait for a nightly report; they can act as things happen. That’s a huge advantage when you’re trying to protect revenue or respond to payment issues in real time.

Coming up: we’ll cover how SADAD’s AI fraud prevention builds on this monitoring foundation to protect your business. You can also jump ahead to see how SADAD’s POS system works with SoftPOS terminals and eCommerce.

And once your team sees live data, the next thing they’ll ask for is easier reconciliation which SADAD Cloud handles, too. That’s what we’ll dive into next.

If your finance team is still juggling Excel sheets, terminal slips, and bank statements you’re not alone. But you are wasting hours that SADAD Cloud can give back.

SADAD Cloud automates the full reconciliation and settlement process across:

Every transaction is matched with its corresponding payout. That means:

It’s the kind of visibility that turns a two-day reconciliation job into a 10-minute review.

This also means no more waiting for your bank portal to update. SADAD Cloud pulls everything into one real-time feed, synced with Visa, Mastercard, AMEX, and NAPS, so you always have the whole story.

If you’re managing a growing retail chain or running eCommerce campaigns during peak seasons, this alone can prevent thousands of Qatari riyals from falling through the cracks.

Still to come: we’ll cover dispute resolution tools that are already integrated into the same panel. You won’t need a separate portal to fight chargebacks. SADAD handles that in-platform, too.

Want a preview of how it all connects? Visit the full SADAD Acquiring Solutions page.

Next: let’s tackle what happens when things go wrong and how SADAD makes dispute management less painful.

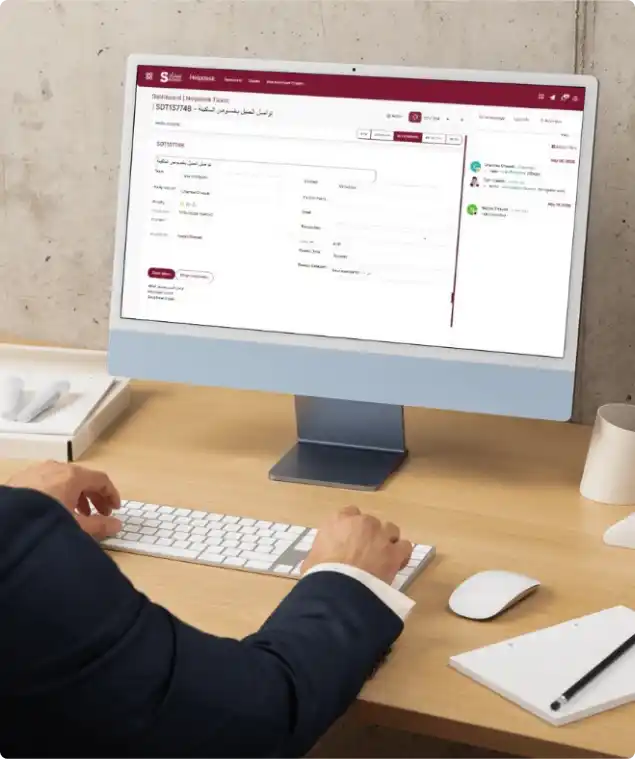

Disputes and chargebacks are part of doing business. But most systems make you chase them down across emails, bank calls, and clunky third-party portals.

SADAD Cloud makes it simple.

You get a built-in dispute management module that lets you:

No more guessing what’s happening. No more delayed responses that cost you revenue.

This is especially critical for high-volume businesses like F&B, delivery services, and fashion retailers in Qatar, where hundreds of small-ticket transactions happen daily. One dispute may not seem like a big deal, but five ignored ones per month? That adds up fast.

And because it’s integrated with SADAD’s acquiring system, the timeline is traceable, the history is clean, and the support team can step in with full context if needed.

Coming up: we’ll show you how AI-powered fraud prevention works behind the scenes to reduce these disputes by catching risky patterns before the damage is done.

You can also explore how SADAD helps businesses get started quickly in our breakdown of Qatar’s fastest payment gateway onboarding.

Next: let’s see what kind of analytics and performance insights SADAD Cloud gives you, and how merchants are using them to grow smarter, not just faster.

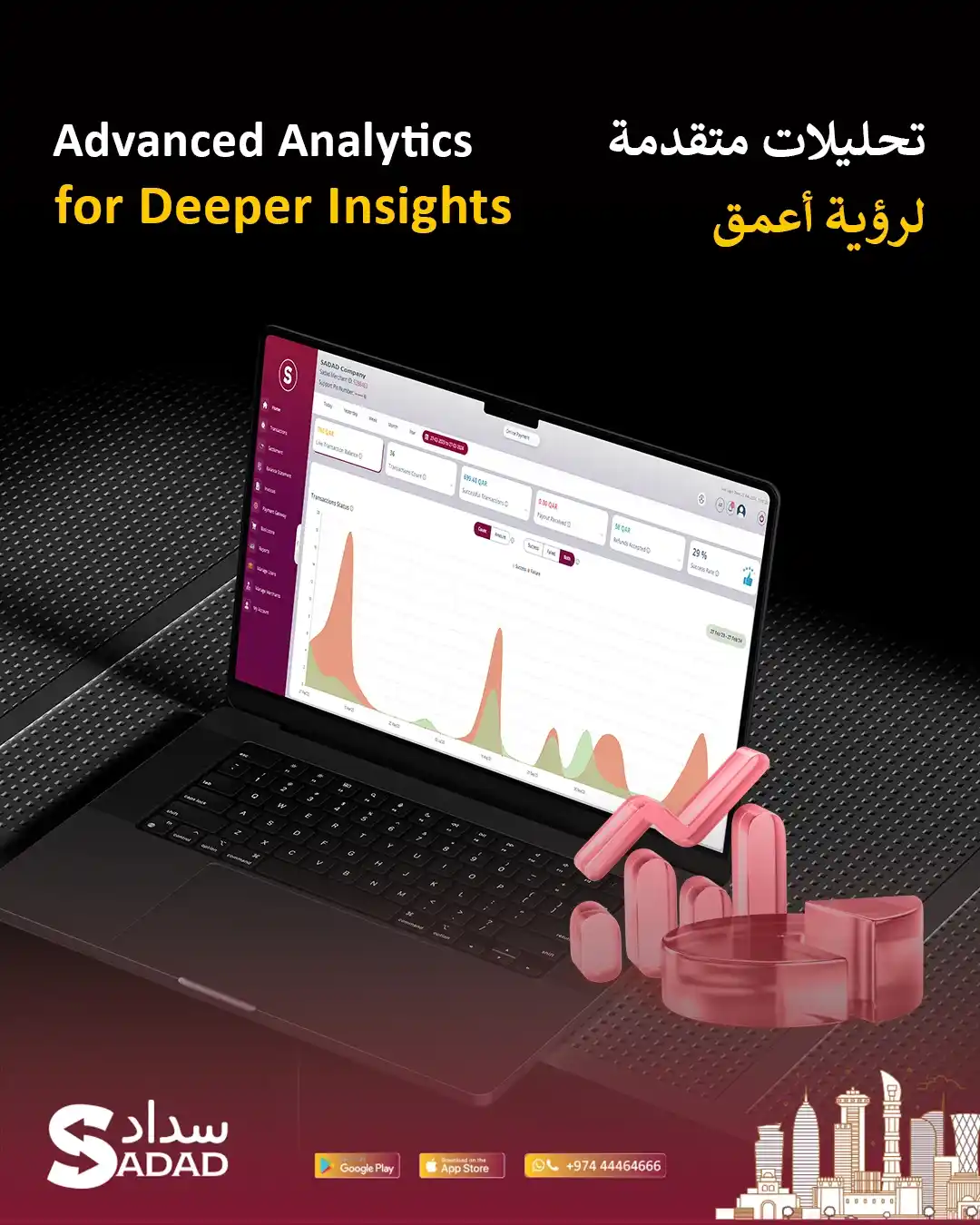

Most dashboards show you numbers. SADAD Cloud shows you patterns.

This is more than just a table of transactions. You get real-time analytics that let you zoom in on the day-to-day or zoom out to see the big picture:

No extra tools. No exports to Excel. It’s all inside your SADAD Cloud panel, designed for merchants who need to act fast, not wait for end-of-month reports.

If you’re running promotions, managing inventory, or planning staffing across multiple locations, these insights make it easier to predict, adapt, and grow.

Here’s an everyday use case we’ve seen: One Qatari retailer discovered a 3-hour dead zone every weekday, something they missed for months. After checking SADAD Cloud’s heatmap reports, they adjusted staff schedules and pushed a mid-day promo. Revenue per hour went up by 27% that week.

That’s the power of operational visibility in real time.

In the next section, we’ll dig into how this data is kept secure from end-to-end encryption to SADAD’s PCI DSS and ISO certifications. Because real insights only matter when you trust the system behind them.

To learn more about SADAD’s all-in-one approach to POS, SoftPOS, and mobile payments, visit the Acquiring Solutions product page.

Next up: let’s look at the compliance and security architecture that makes SADAD Cloud trusted by Qatar’s most regulated sectors.

For most merchants in Qatar, compliance feels like paperwork. For SADAD Cloud, it’s just part of the system.

Behind the scenes, every payment, reconciliation, and dispute you see on the dashboard is protected by a multi-layered security framework, built to meet both Qatari and international standards:

This isn’t a “security add-on.” It’s baked into how SADAD Cloud is built and operated.

So whether you’re handling 10 payments a day or 10,000, the system scales without exposing you to extra risk and without you having to think about it.

On top of that, SADAD’s AI-powered fraud detection is always on. It uses machine learning models trained on local transaction patterns in Qatar to flag:

We’ll explore this AI fraud engine more deeply in an upcoming section. But for now, just know this: the system doesn’t just protect, it learns.

If you’re currently comparing payment providers in Qatar, this side-by-side might help: The Fastest Onboarding Gateway in Qatar. It’s a good complement to the tech we’ve just covered.

Next: let’s take a closer look at SADAD’s support team and how they help merchants go from setup to scaling without needing a developer or IT guy on standby.

Great software is useless if you’re stuck waiting on support. SADAD Cloud was built to be different.

From the moment you activate your account, SADAD’s merchant success team is available to guide you not just through setup, but through every stage of your growth:

It’s not just about having support. It’s about having support that knows your setup, your terminals, and your transaction flow, whether you’re using SADAD POS, SoftPOS, or eCommerce plugins.

Here’s what this looks like in real life: A new merchant goes live with SADAD Cloud on Monday. By Tuesday, they’ve connected three terminals, synced their online store, and started tracking settlements without hiring a developer or calling a bank. When they hit a snag in NAPS settlement tracking, support walked them through it in under 15 minutes.

And because the same team handles regulatory support, you won’t need a compliance consultant just to stay aligned with QCB or PCI DSS.

In the next section, we’ll compare SADAD Cloud’s dashboard to other merchant portals and demonstrate that the difference isn’t just in speed or design, but in complete operational control.

Want to get a head start? You can explore SADAD’s acquiring features here.

Next: we’ll break down the core competitive advantage of SADAD Cloud, why merchants are switching from legacy systems and fragmented dashboards every month.

Most merchant dashboards feel like a patchwork. You log in, and it’s clear they weren’t designed for you, especially if you’re running a business in Qatar.

SADAD Cloud isn’t a rebranded foreign system. It’s built in Qatar, for Qatari merchants, with complete alignment to local infrastructure, like:

But it doesn’t stop there. SADAD Cloud also wins on:

And because SADAD owns both the hardware and the software, merchants get full support without being bounced between vendors.

Let’s say you’re comparing dashboards. Most legacy panels:

SADAD Cloud fixes all of that and gives you centralized control that grows with your business.

Coming up: we’ll wrap up with a soft CTA and next steps how to start using SADAD Cloud whether you’re a current POS customer or just exploring your options.

For more on how SADAD enables fast onboarding across Qatar, check out our breakdown of onboarding in under 60 minutes.

Next: let’s close it out with a final call to action for merchants ready to simplify operations and gain control.

If you’re still piecing together your payment view from POS reports, bank emails, and Excel sheets it’s time for a better way.

SADAD Cloud gives you total visibility, without complexity:

And here’s the best part: if you’re already using SADAD’s POS or acquiring tools, you don’t need to install anything new. SADAD Cloud is part of the package, and it’s already optimized for your terminals, SoftPOS devices, and online checkout.

If you’re still comparing providers, this guide will help you start where it matters most: The Fastest Onboarding Gateway in Qatar.

The next step is simple:

Because when you can see your business clearly, you can run it smarter.

Articles

What Are the Best Payment Gateway Solutions in Qatar? A Full Comparison for Business Owners

What Are the Best Payment Gateway Solutions in Qatar, And Which One Actually Fits Your Business? Most businesses in Qatar don't have a payment problem. They have a payment frustration....

Read more

Articles

The Future of Payments in Qatar: 5 Shifts That Will Change How Your Business Gets Paid

The Future of Payments in Qatar: What Every Business Needs to Know In July 2025, Qatari businesses processed $4.4 billion in digital transactions, totaling 51.7 million individual payments. SAMENA Daily...

Read more

Articles

Best POS device in Qatar: Why SADAD Plus Outperforms Bank-Issued Terminals

Best POS device in Qatar: Why SADAD Plus Outperforms Traditional Terminals Last month, a café owner in West Bay showed me his counter. Three different POS machines. One from his...

Read more