Articles

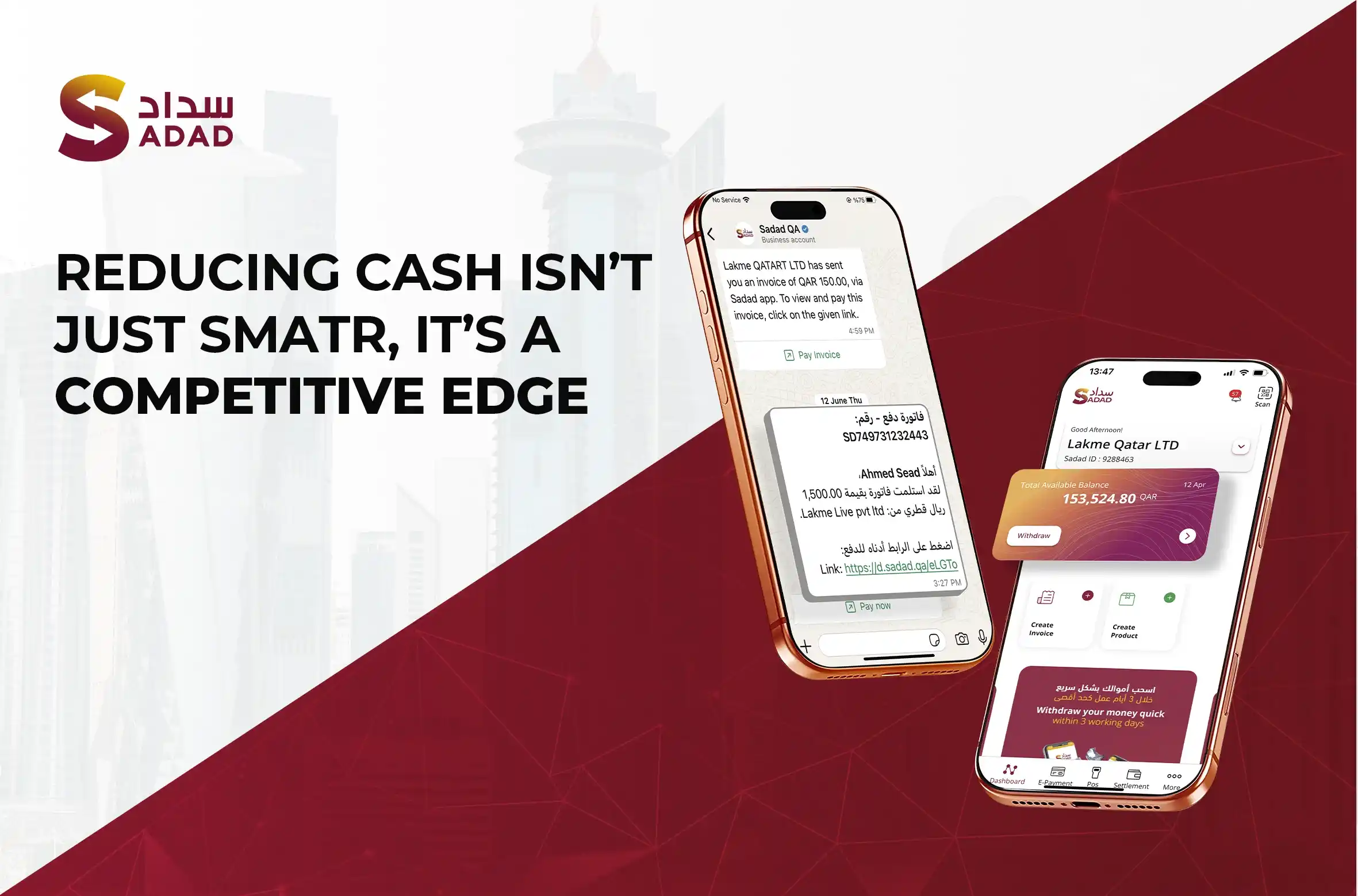

Reduce Cash Handling for Businesses Qatar: What Most Owners Get Wrong

Here’s the part no one talks about.

Cash is heavy, not just physically but operationally. It wastes time, creates accounting headaches, and slows your entire business down. You spend hours counting it, securing it, driving it to the bank, and reconciling every last riyal. And in the end? You’re still dealing with mistakes, delays, and exposure to loss.

That’s fine if you’re running a souq stall in 1999. But today?

Your customers are ready for digital. Your competitors are getting paid faster. And your business can’t afford to keep running on outdated habits.

In this article, we’ll break down why reducing cash handling isn’t just a convenience move; it’s a strategy shift. You’ll learn the real costs of cash, the operational risks hiding behind your tills, and how to switch to smarter, faster digital payments, even if you don’t have a website.

And yes, we’ll show you how tools like SADAD help businesses across Qatar move away from cash without slowing down or losing control.

Let’s start with the real reason cash is costing you more than you think.

Every time you accept physical cash, you’re adding friction to your business.

You’re assigning staff to count it, reconcile it, secure it, and sometimes deliver it to the bank. That’s time you’re paying for, not in strategy, not in service, not in growth, but in grunt work.

We worked with a café in Doha that was doing around 200 orders a day. Cash was about 65% of their sales. Between the manual tallying at close, float preparation in the morning, and the weekly cash deposit run, their team was burning 8 to 10 hours a week just handling cash.

And here’s the part that stings: the owner didn’t realize it until we showed her the numbers. That’s time she could’ve spent optimizing supplier margins or building a loyalty program. Instead? She was counting riyals in the back room.

Most businesses underestimate the actual risk of handling cash until something goes missing.

Whether it’s a misplaced envelope, drawer mismatch, or internal theft, cash disappears more than anyone wants to admit. According to the Association of Certified Fraud Examiners, nearly 40% of small business fraud involves cash theft or misappropriation (source).

And here’s what that looks like in Qatar: a restaurant chain we advised lost QR 17,000 over three months due to “inconsistent drawer counts.” The POS logs showed daily mismatches, but the owner only caught it after running full digital tracking alongside cash.

Going cashless wouldn’t have solved every problem, but it would’ve narrowed the window for theft, created tighter logs, and reduced the ambiguity that makes internal fraud so easy to hide.

This one stings for a different reason: your customers already moved on.

Qatar has one of the highest smartphone penetrations in the world, 99% of the population uses mobile internet, and most consumers prefer cards, Apple Pay, or QR code payments for day-to-day transactions (DataReportal 2023).

So when you make them dig for cash, they don’t just hesitate, they mentally check out. Literally.

We watched it happen at a clinic in Al Wakrah. The front desk asked a walk-in client to pay cash. He said he’d come back with it. He never did.

Reducing cash handling isn’t just about internal efficiency. It’s about removing friction at the moment that matters most, when your client is ready to pay.

Cool. But none of this matters if you don’t understand how cash handling quietly eats into your bottom line. Let’s break it down.

Cash delays money. It sounds obvious, but most businesses don’t calculate the drag. You wait for customers to have the right amount. You wait for them to show up in person. You wait to reconcile. Then you wait to deposit.

And during all that waiting? You’re not reinvesting. You’re not hiring. You’re not scaling.

We worked with a home-based baking business in Al Rayyan. Their custom cake orders were booming, but 70% of their payments were cash on delivery. Between missed handoffs and delayed reconciliations, they were losing nearly QR 19,00/month in stuck receivables.

Once they shifted to payment links via SADAD, collection time dropped from three days to same-day, and revenue finally kept pace with demand.

When cash enters the equation, automation exits.

We once shadowed a service business that provided on-site maintenance across Doha. Every team member returned with paper receipts and mixed bills. The office staff spent 15–20 hours per week reconciling these manually, not counting the time spent correcting errors or late-night WhatsApp back-and-forth with techs.

That’s not “admin.” That’s a payroll leak.

Digital payments remove the paperwork. More importantly, they build a real-time trail. And when your financial visibility is clear, your decisions become sharper.

Cash doesn’t lie, but it lets people do a lot of things off the record.

That creates headaches when you’re audited, when you’re applying for financing, or when you’re trying to grow. Regulators, partners, and banks want traceable flows. If you’re heavy on cash, your credibility takes a hit.

In Qatar, the push toward transparency is only getting stronger. The Qatar Central Bank has continued tightening requirements for invoicing and reporting, and businesses without digital systems are going to feel it first.

Want to reduce risk? Start by reducing the places money can hide.

Now that you’ve seen how cash kills speed, margin, and control, let’s talk about how to fix it , fast. Here’s what to do instead.

A point-of-sale terminal isn’t a solution if it collects dust.

We’ve worked with multiple small retail and food businesses in Qatar who had card readers, but still defaulted to cash 80% of the time. Why? Long setup times, outdated machines, or no tap-to-pay support. Customers would try to use Apple Pay or their cards, the terminal would fail, and they’d hand over cash.

So the fix isn’t “get a POS.” The fix is to get a modern, mobile-enabled POS that supports NFC, QR codes, and real-time cloud reconciliation. Most major Qatari banks, like QNB and Masraf Al Rayan, offer devices that connect via 4G, issue instant receipts, and link directly to digital dashboards. The tech is already there. You just have to choose it.

Cash on delivery is where cash control dies.

We helped a logistics client in Doha transition from COD to SADAD-based SMS payment links.

Missed payment rate dropped by 27%, and drivers finished routes an hour earlier, because they weren’t fumbling for change or waiting while the customer “runs to the ATM.”

If you’re doing on-site services, deliveries, or freelance work, stop accepting cash on trust. Set up branded payment links and send them before or during the transaction. Your team will move faster. Your risk will drop. Your revenue will show up on time.

Here’s where things get clean.

Cash handling is messy because it lives across notebooks, WhatsApp, pockets, and bank envelopes. A cloud-based dashboard removes the fragmentation. You see everything, paid, pending, and refunded, in one place.

With tools like SADAD, you can log in, send an invoice, track payment status, and export financials, without touching a spreadsheet. It’s not just cleaner. It’s scalable. And when you scale, chaos compounds. This kills it early.

This is the most underrated lever, and the one that flips behavior.

Every customer has a default. Some pull out their cards. Some reach for cash. Some wait for the cashier to guide them.

If your team is passive, the customer chooses. If your team leads, the customer follows.

We ran a two-week test with a grooming business in Al Wakrah. Same team, same clients, but one change: the receptionist began asking, “Would you like to pay with card or link?” before they reached the counter. Digital adoption jumped from 38% to 71%.

Cash handling isn’t just a technical problem. It’s a human one. Solve both.

Now let’s talk about the one tool built for businesses in Qatar that need all four solutions, without extra complexity. Let’s talk about SADAD.

The problem with cash is that it makes you wait. Wait for the customer to arrive. Wait for them to pull out the right amount. Wait to close the drawer at the end of the day. SADAD kills that wait with one feature: instant, branded payment links.

You open your dashboard, type the amount, choose the channel (SMS, WhatsApp, or email), and hit send. The customer pays on the spot using their card or Mada. You get notified instantly. No excuses, no missed change, no delayed runs to the bank.

We’ve seen this play out in real numbers. A cleaning services client in Doha switched to SADAD links for at-home sessions. Cash collection dropped by 80% in the first month. That’s time saved, risk lowered, and payment speed doubled.

Most tools assume you already have an online business. SADAD doesn’t.

You don’t need a store, app, or even a social media page. All you need is a service to offer, a price, and a phone number. SADAD’s Quick Invoice tool lets you get paid like a pro, even if you’re running things solo from your phone.

This is exactly why SADAD is the go-to for freelancers, home businesses, and on-demand services across Qatar. It meets you where you are, not where the software thinks you should be.

With cash, you never really know where you stand. You estimate. You hope the drawer matches. You wait for the bank confirmation.

SADAD replaces that fog with real-time clarity. You see every payment as it lands. Paid, pending, failed, it’s all in your dashboard. You can filter by customer, channel, or date and export reports with a click.

And here’s the part no spreadsheet can match: failed payments get auto-retried. If a card bounces, SADAD keeps nudging until the payment goes through. Quietly. Automatically. You don’t have to chase a thing.

This is where most global tools fail. They’re sleek, but they don’t play well with Qatari regulation. SADAD does.

It’s built on Microsoft Azure’s cloud infrastructure, approved by the Qatar Central Bank, and supports both Arabic and English invoicing. Your data stays secure. Your records stay audit-ready. Your customer experience stays seamless.

And because it’s local, support speaks your language and knows your market.

Now that you’ve seen how SADAD solves cash handling from every angle, let’s make it real. Here’s how businesses across Qatar are already putting it to work.

We worked with a boutique fashion shop in Msheireb that handled 90% of its sales in cash. End-of-day reconciliation was a 45-minute ritual. There were drawer mismatches at least twice a week. Once they switched to link-based payments using SADAD and enabled all payment cards on their POS, they cut their closing time to under 10 minutes. Shrinkage dropped to zero. More importantly, they stopped losing sales from tourists and locals who didn’t carry cash.

Now the only thing they count at the end of the day is what’s left in inventory.

If your crew is doing repairs, deliveries, or home services, cash is the last thing they should be managing. A cleaning company in Al Khor used to send their techs out with QR 1,000 in float. Too often, the change didn’t match. Or the money came back late. Or not at all.

With SADAD, they now send payment links when the job is complete. The customer pays before the team even leaves. No cash, no excuses, no float needed.

A personal trainer in West Bay used to bill monthly and wait a week for transfers or in-person cash handoffs. Now he sets up weekly auto-reminders through SADAD’s invoice tool. Clients pay via card or mobile in less than a minute.

Cash was used to delay his income and disrupt his schedule. Now it’s not even part of the process.

One small dental practice we worked with had two admin staff: one full-time and one part-time. Most of their front desk time? Not booking or follow-ups. Just handling physical payments and reconciling receipts.

After switching to SADAD, they digitized 70% of their payments in three weeks. The part-time admin now only works one day a week, and the clinic is still running more smoothly than before.

These aren’t hypotheticals. These are businesses across Qatar, real owners, real teams, real results.

So the next question becomes: how do you track the ROI of going cashless? Let’s break that down.

If you’re still measuring your business in daily sales only, you’re missing the bigger gain.

We helped a three-location bakery chain move 80% of its payments from cash to digital over six weeks. What surprised the owner most wasn’t the faster payments; it was the reclaimed time. Manual cash counting went from 12 hours a week to 1.5 hours a week. Staff now close faster, reconcile instantly, and focus on service instead of safes.

Don’t guess. Track staff hours before and after. Time saved is profit earned.

Cash has a way of slipping through cracks, and cracks get expensive.

A salon in Lusail used to report drawer mismatches almost weekly. After switching to 90% card and payment link usage, the mismatches stopped. Not reduced. Gone. That’s not just about money recovered. It’s about the owner’s peace of mind and the staff’s accountability.

If you want to see the real impact, compare three months of cash-only shrinkage with three months post-digital. You’ll feel the difference in your margin.

You can’t improve what you don’t see.

Reducing cash handling reduces friction at the payment stage. That means customers spend less time waiting, get cleaner receipts, and are more likely to come back or leave a review.

We helped a home-based F&B business implement instant payment links with receipts via WhatsApp. Within two weeks, customers began responding with voice notes: “Smoothest order I’ve done,” or “Loved that you didn’t ask for cash.” That’s feedback you can build on.

Less cash isn’t just less risk. It’s more speed, more clarity, and more capacity. And now, the next move is yours. Let’s bring it home.

If you’re still building your business around physical cash, you’re not playing the same game as your competitors; you’re playing a slower one.

You’re giving up speed, visibility, and control. You’re inviting errors, friction, and risk. And you’re forcing customers to adapt to your system rather than adapting to theirs.

That’s not a strategy. That’s inertia.

The shift to digital payments isn’t a trend in Qatar; it’s the new baseline. Whether you’re a one-person service or a multi-location brand, cash is the slowest, riskiest part of your operation. Cut it out, and everything gets faster.

With SADAD, reducing cash handling doesn’t require new hires, fancy apps, or a long setup. It takes one dashboard, one decision, and one move toward payments that just work.

Start now, and let your business spend less time counting money and more time making it. Explore SADAD’s digital payment tools and take the first step today.

read more about: From POS to Pay Links: What Payment Solutions Actually Mean in Qatar

read more about: From POS to Pay Links: What Payment Solutions Actually Mean in Qatar

Articles

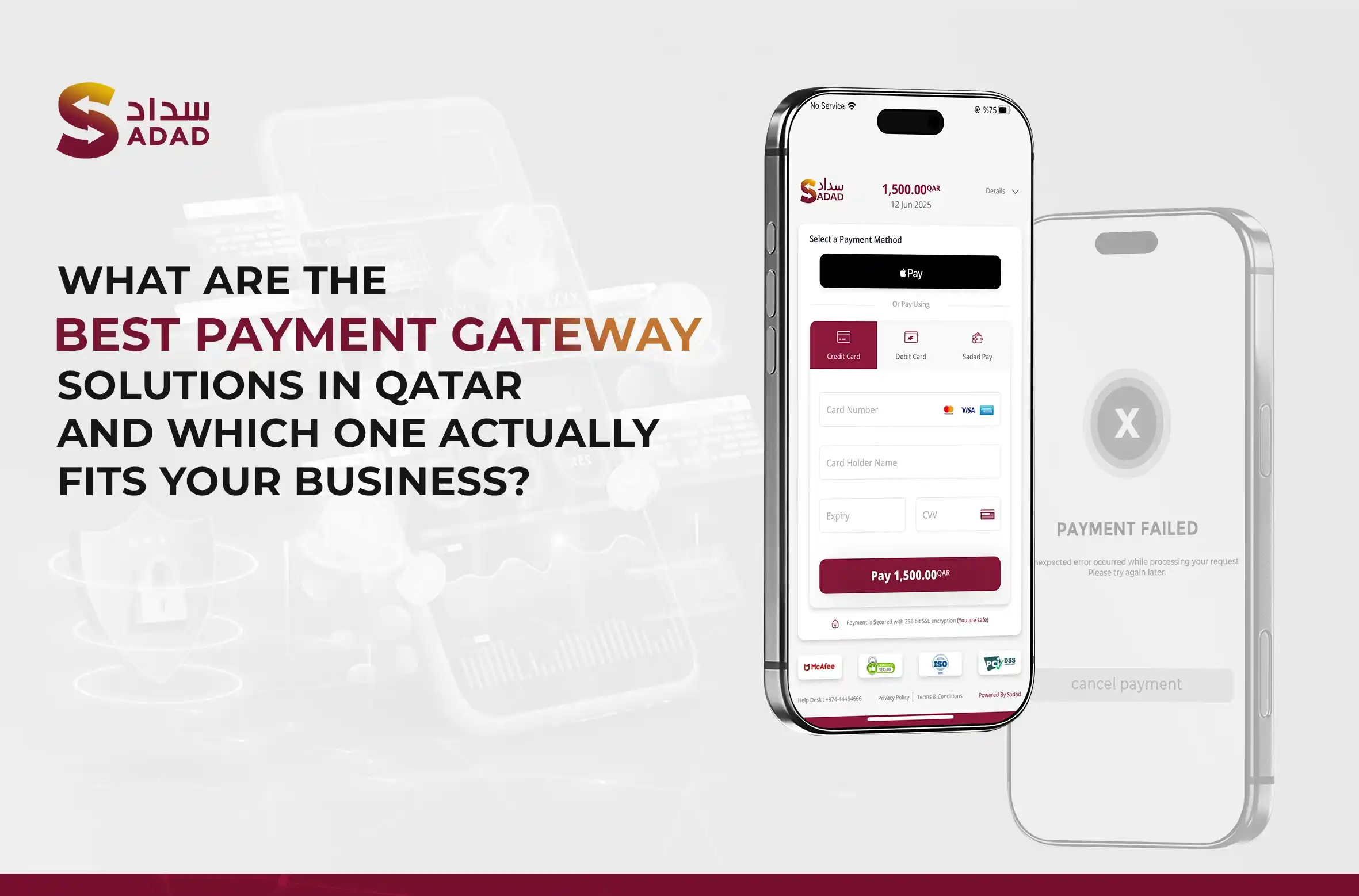

What Are the Best Payment Gateway Solutions in Qatar? A Full Comparison for Business Owners

What Are the Best Payment Gateway Solutions in Qatar, And Which One Actually Fits Your Business? Most businesses in Qatar don't have a payment problem. They have a payment frustration....

Read more

Articles

The Future of Payments in Qatar: 5 Shifts That Will Change How Your Business Gets Paid

The Future of Payments in Qatar: What Every Business Needs to Know In July 2025, Qatari businesses processed $4.4 billion in digital transactions, totaling 51.7 million individual payments. SAMENA Daily...

Read more

Articles

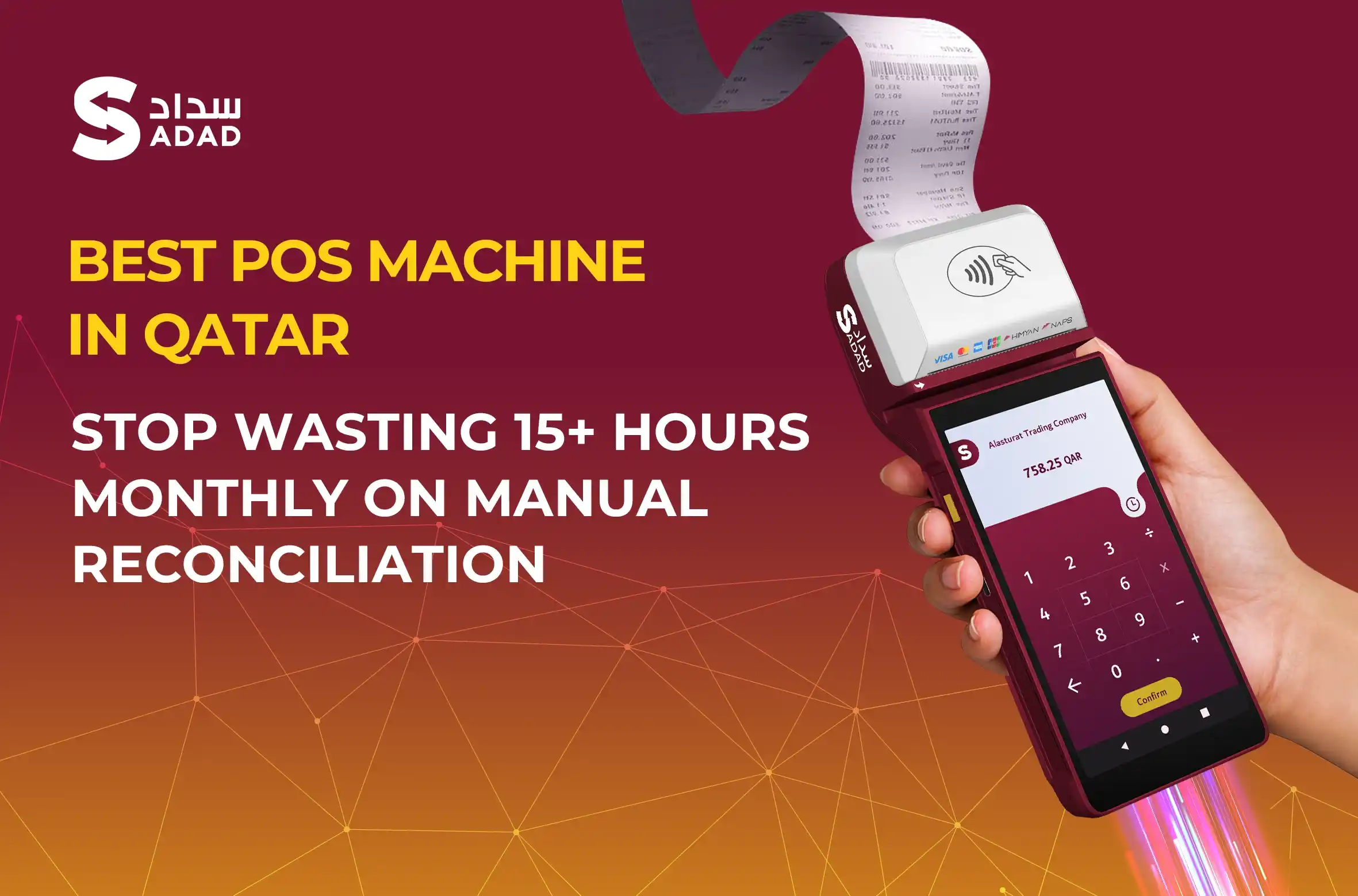

Best POS device in Qatar: Why SADAD Plus Outperforms Bank-Issued Terminals

Best POS device in Qatar: Why SADAD Plus Outperforms Traditional Terminals Last month, a café owner in West Bay showed me his counter. Three different POS machines. One from his...

Read more