Articles

How to Choose the Best POS in Qatar (Complete 2025 Business Guide)

How to Choose the Best POS in Qatar

There’s a moment every growing business in Qatar reaches when collecting payments becomes messy.

Not because you don’t have customers. But because your POS system wasn’t built for how you actually operate today.

You’re delivering to clients, not just ringing up in-store.

You’re accepting payments at events, pop-ups, or doorsteps, not just behind a counter.

You’ve got customers tapping phones, scanning wallets, and asking about Apple Pay. Meanwhile, your finance team is still chasing down paper slips and end-of-day reports.

This is where choosing the right POS system becomes a make-or-break decision. And it’s why more local businesses—especially in retail, F&B, logistics, and service sectors, are quietly switching to Advanced POS device like SADAD plus.

This guide walks you through how to choose the best POS for your business in Qatar—not just based on features or price but based on how you actually work. You’ll learn:

Whether you’re launching your first store, managing daily sales across branches, or collecting payments on the move—this article will show you how to pick a POS system that doesn’t just process payments… but powers your growth.

Walk into almost any shop, café, or service counter in Doha today, and you’ll see it: two or three POS machines sitting side by side. Some are linked to local banks. One may be completely offline because “the internet was down last week and no one fixed it.”

Ask the manager which system they actually rely on, and you’ll usually get a sigh… followed by a workaround.

That’s the silent truth behind many POS setups in Qatar: they weren’t chosen. They were bundled, inherited, or rushed—often installed without matching the real needs of the business.

The way customers pay in 2025 and beyond isn’t the same as it was even three years ago.

But here’s what’s wild: many POS systems in use today weren’t built for any of this.

They assume you’ll be:

That doesn’t reflect reality for most growing businesses in Qatar.

One retail owner in Al Wakrah told us how he had to keep a second POS terminal “just in case” the primary one went offline mid-transaction.

A catering company used to send invoices manually, then follow up with a bank transfer request. The result? Unpaid orders and lost weekends chasing receipts.

A perfume seller at the weekend Souq used to say, “Cash only,” until a competitor set up with SoftPOS and started scooping up tap-to-pay customers.

In each case, the issue wasn’t price. It was fit.

The wrong POS system can limit growth, frustrate customers, and slow down your team.

The right one?

It disappears into the background—letting you sell, serve, and scale.

Because your next move—whether you’re opening a new location, adding delivery, or growing staff—will depend on whether your POS system is built to keep up.

And as you’ll see in the following sections, not all POS systems in Qatar are equal. Some are stuck in the past. Others are trying to be everything to everyone. But there’s a new generation—like SADAD SoftPOS—designed specifically for where local businesses are going.

Let’s break down how to choose what’s right for you.

The biggest mistake we see: People start comparing POS systems before they’ve even defined how their business actually runs.

They look at features. They chase offers. Some even pick based on what their neighbor’s store uses—without asking the most important question first:

“What do I need this POS to do for me, every single day?”

That’s not a tech question. It’s an operational one.

If you run a boutique in Lusail, your day looks nothing like a shawarma shop in Al Sadd, or a home cleaning business in Al Rayyan.

Let’s break that down:

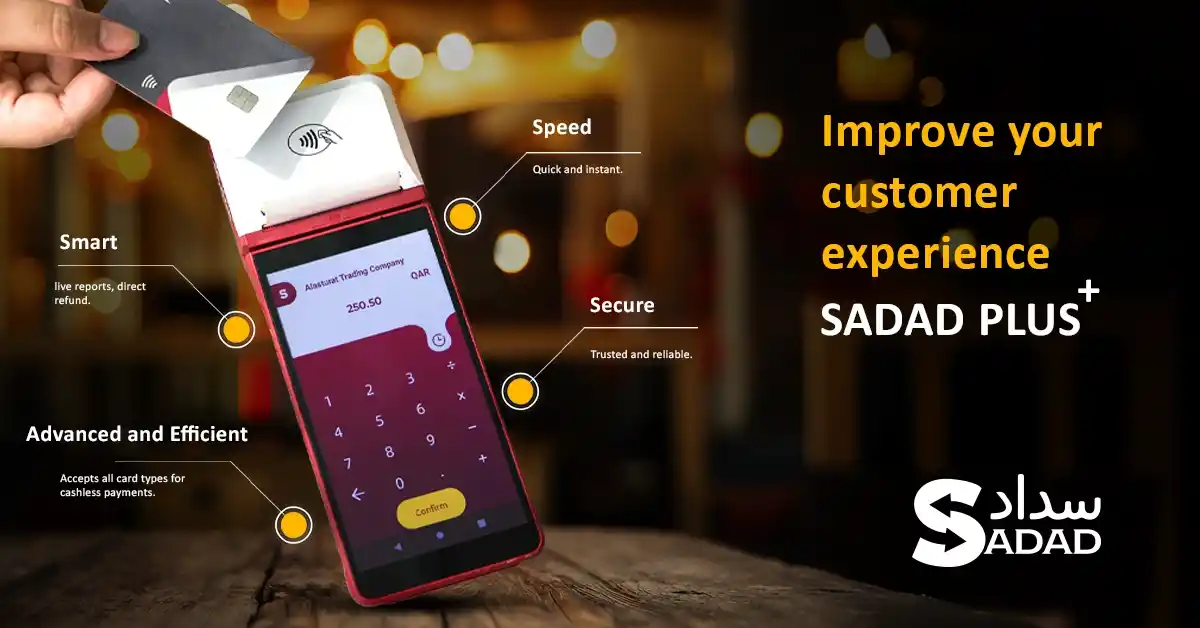

This is why SADAD built SADAD PLUS for the real mix of business models we see in Qatar. It’s not a POS made for global templates—it’s shaped by real conversations with Qatari merchants, event sellers, delivery drivers, and startup founders.

Where do most of your transactions happen?

How many people on your team need to collect payments?

What’s your peak volume like?

Once you’ve answered these, you can filter out 80% of the POS systems on the market—because they simply won’t be designed to fit your workflow.

Here’s the harsh truth: Some small businesses in Qatar adjust their operations to fit their POS limitations.

The smart ones do the opposite. They choose a POS that wraps around how they already win customers.

That’s why the next section matters.

We’re about to break down the types of POS systems available in Qatar today—what they offer, what they miss, and where SADAD SoftPOS fits in the mix.

Let’s get practical.

POS isn’t just a category anymore—it’s a spectrum. And in Qatar, that spectrum includes everything from bank-issued terminals to phone-based systems like SADAD SoftPOS.

The challenge? Most businesses don’t realize they’re choosing a category first—and only then a product. If you get the category wrong, no amount of features will save you.

So let’s break it down.

These are the machines you’ve seen everywhere for the last 10+ years. They’re usually provided by a bank or an acquiring partner and come with a simple keypad, a small screen, and a thermal printer.

Pros:

What You Don’t Hear About:

These machines work if you’re running one branch, with one cashier, and nothing ever moves. But for mobile businesses or fast-growing teams, they’re a bottleneck.

These are systems like Vend, Shopify POS, or regional platforms. They run on tablets or touch screens and usually come bundled with barcode scanners, cash drawers, and printers.

Pros:

The Reality on the Ground:

For high-end boutiques or restaurants, this might make sense. But if you’re operating in a fast, mobile, or low-margin environment, it’s too much system for too little gain.

These are the newer, Android-based POS devices offered by a few providers in Qatar. Think of them as mini-tablets with built-in card readers.

Pros:

But…

This is a step in the right direction. But it still keeps your payments locked inside a device you don’t already own.

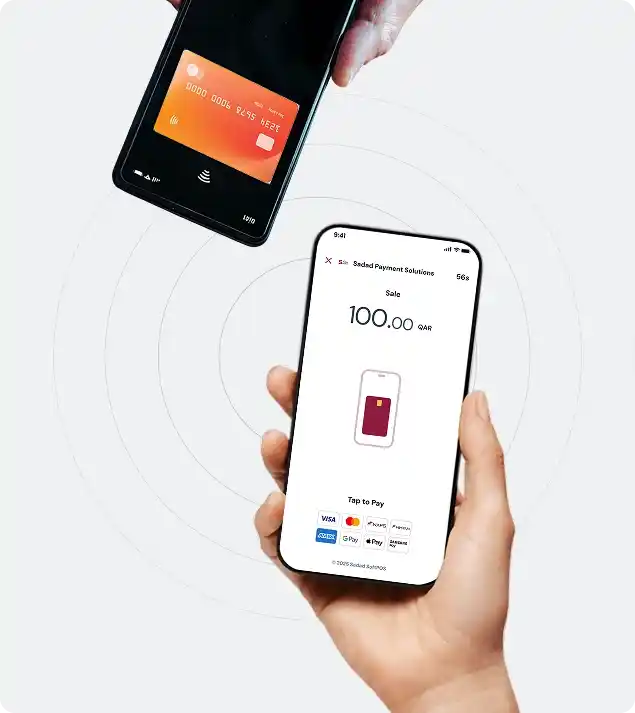

This is where things shift. With SADAD SoftPOS, your Android phone becomes the POS. No dongles. No machines. Just a secure, tap-to-pay app that runs on the phone your staff already uses.

Here’s what this looks like in real life:

SADAD SoftPOS changes how businesses think about payments: it’s not where the terminal is—it’s where you are.

We’ll go deeper into what makes SADAD SoftPOS special in the next section. But the takeaway here is this:

You’re not just choosing a device. You’re choosing how your business will operate.

And in a fast-moving, mobile-first economy like Qatar’s, flexibility is no longer a nice-to-have. It’s survival.

By this point, you’ve seen that not all POS systems in Qatar are created equal. But what really separates an innovative, scalable system from a frustrating one?

Not the logo. Not the marketing. Definitely not the discount someone offered you over WhatsApp.

The right POS should solve problems before they appear. It should make payments feel invisible. And it should wrap itself around your business—not force you to operate like someone else’s template.

Let’s dig into what actually matters.

If your POS only tells you what happened at the end of the day, you’re reacting, not running.

You need a system that gives:

This isn’t just about dashboards. It’s about knowing, at any moment, whether your business is healthy or leaking.

With SADAD plus, every transaction is visible in real time through the merchant dashboard. No waiting, no syncing, no “let me check with the accountant.”

Your customer wants to tap their phone. Or use Apple Pay. Or pay through their NAPS-enabled card. Your POS needs to say yes—instantly and securely.

Any delay, incompatibility, or “sorry, we don’t take that” kills momentum (and trust).

Your POS should accept:

SADAD plus supports all primary payment methods—including NAPS, which is essential for Qatari customers—and doesn’t require any additional hardware.

If it takes a training session and a manual to make a sale, the system is broken.

We’ve seen store owners lose two days just teaching staff how to use a bulky POS terminal—or worse, rely on one person because “only he knows how it works.”

A good POS should:

SADAD’s SoftPOS is app-based. Your staff already knows how to use their phone—now they just use it to get paid.

This is the part most people skip—until something goes wrong.

Qatar’s payment ecosystem is evolving fast. If your POS isn’t PCI-compliant or locally licensed, you’re one data leak or audit away from a nightmare.

You need:

SADAD is a licensed, Qatari fintech provider. Its infrastructure is built with security-first architecture, and its support team is here—not across three time zones.

Maybe you’re just starting. One phone. One team member. One location. But if your POS can’t grow with you, you’ll be forced to start over later.

Ask:

SADAD plus is built to scale. Add new devices. Add team logins. Sync with SADAD’s API for ERP integration. You’re covered from Day 1 to Day 10000.

Wi-Fi drops. Mobile data lags. If your POS goes down when your internet connection does, your revenue is at risk.

Look for:

SADAD plus is optimized for mobile data environments in Qatar. It works as smoothly on 4G as it does on Wi-Fi—because it’s designed for local conditions, not just global benchmarks.

In the next section, we’ll zoom in.

You’ve seen what a great POS should do. Now we’ll show you why SADAD plus delivers on every point—without the hardware, delays, or cost traps.

Let’s take a step back.

So far, you’ve seen the chaos that traditional POS systems can create.

You’ve seen what real business workflows actually look like in Qatar. You’ve seen what really matters in a POS system.

Now it’s time to show you how SADAD SoftPOS checks every single box, without asking you to buy a single cable, printer, or machine.

This isn’t a pitch. It’s a lens into how businesses across Qatar are quietly replacing outdated POS setups with a tool that fits in their pocket, goes live in minutes, and puts them back in control.

You already carry your phone. With SADAD SoftPOS, that’s all you need.

As long as your Android phone has NFC enabled, you can:

No card reader. No separate device.

This isn’t just convenient. It’s liberating—especially for mobile teams, new businesses, or anyone trying to operate lean.

Every transaction processed through SADAD SoftPOS is:

Whether you’re a delivery driver collecting on-site or a vendor at Souq Waqif selling perfume to tourists, the second a payment goes through, you see it in real time.

One vendor we spoke to said they no longer close with a calculator. They close with confidence.

SADAD isn’t a global tool forced into local standards. It’s a Qatari-built, QCB-regulated system that works natively with:

We’ve seen businesses burned by using imported POS apps that don’t accept Qatari debit cards or crash during Arabic name entry. With SADAD, you’re running native.

Use cases where SADAD SoftPOS shines:

This flexibility changes how you operate. A cable or countertop no longer limits you.

One food truck operator in Doha told us, “We used to have to turn customers away if our old terminal failed. Now, we just use our phones and keep serving.”

Getting started is simple:

One merchant got fully operational in under 37 minutes—with zero tech experience.

SADAD SoftPOS isn’t just modern. It’s an innovative business:

Whether you’re a single store or scaling across five cities, your POS infrastructure scales with a few clicks—not a logistics order.

In the next section, we’ll zoom out again and talk about the bigger picture: how to choose a POS that won’t limit you later—and how to compare total cost, flexibility, and support across systems.

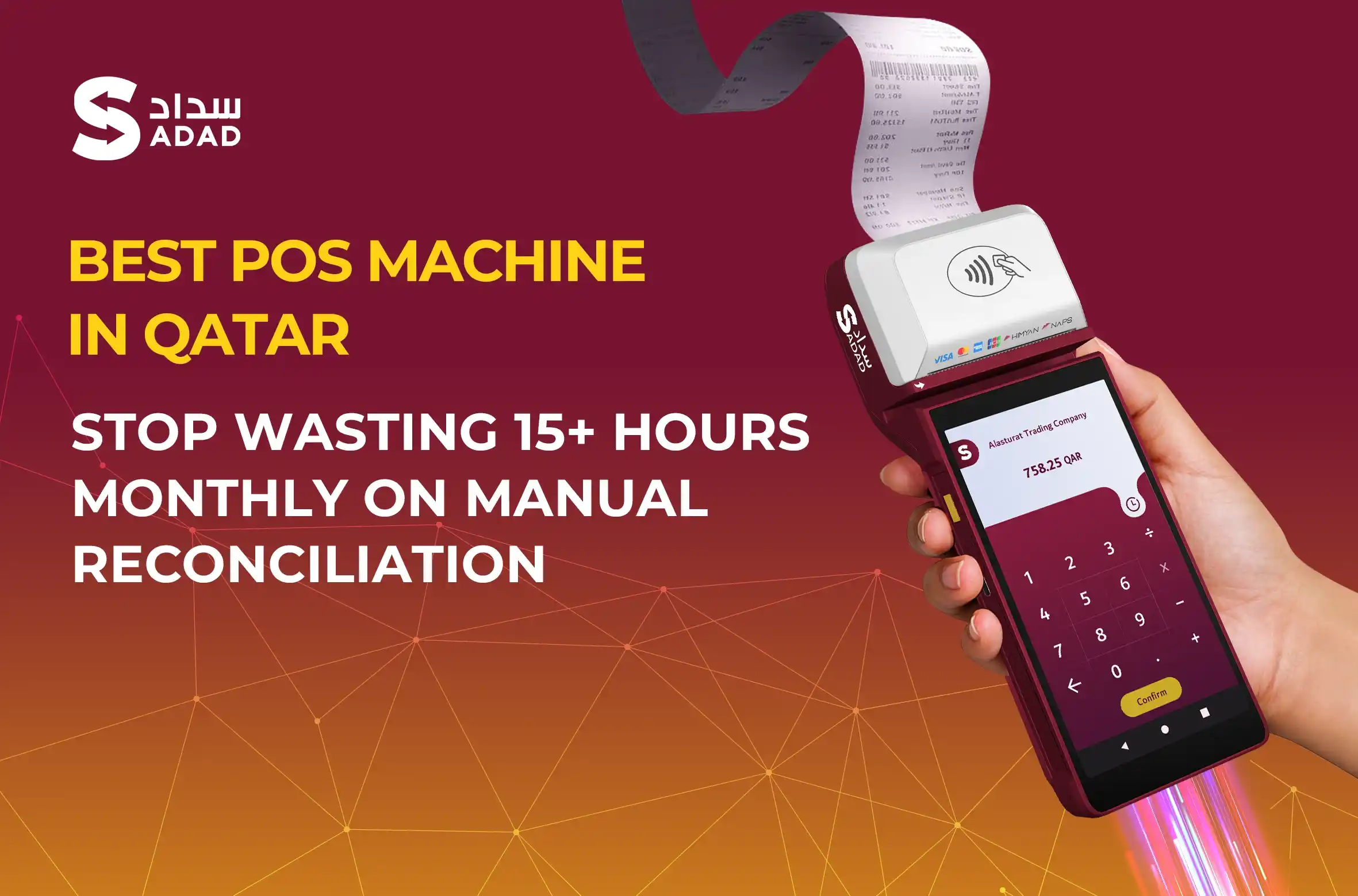

Choosing a POS system isn’t just about what it does today. It’s about how it behaves six months in—when something breaks, when your team grows, or when you open a second branch and realize… your setup can’t scale.

We’ve seen this pattern too many times: A business picks a system because it’s cheap up front.

Then they lose hours each month chasing support. Or pay more over time through add-ons, hidden fees, or painful hardware upgrades.

If you want peace of mind, look beyond the sticker price.

Here’s how it usually breaks down:

| POS Type | Upfront Cost (QAR) | Monthly Cost (QAR) | Hidden Costs |

| Traditional Bank POS | Often free | 50–150 | Printer paper, device rental, downtime |

| Cloud POS w/ Hardware | 3,000–15,000+ | 200–800 | Hardware repairs, training, and add-on fees |

| Mobile POS Terminals | 1,200–2,500/device | 100–300 | Charging docks, replacements, accessories |

| SADAD SoftPOS | Depends | ~transaction fee only for what you use | No hardware, no logistics, no repairs |

One delivery startup we worked with replaced five rented terminals with five staff phones using SADAD SoftPOS. They saved over 3,000 QAR in the first quarter alone—without sacrificing speed or payment acceptance.

A failed POS transaction doesn’t just lose a sale. It can trigger refunds, negative reviews, and compliance risks.

Ask yourself:

SADAD provides local support, built for the Qatari market. No timezone gaps. No script readers. Just people who know your context and solve real issues fast.

Maybe you’re running a single booth at a mall today.

But what if you win a government contract next month? What if you open a second kiosk at Villaggio? What if you start accepting payments on behalf of partners or subcontractors?

Can your POS system handle:

With SADAD POS, you can add team members instantly, issue logins, and monitor sales performance per staff or device—all from your merchant dashboard.

If your business is trying to reduce waste, eliminate paper, or cut unnecessary shipping, POS hardware is a hidden cost.

Every terminal you avoid is:

SADAD POS helps modern businesses in Qatar go greener by going fully digital—from tap-to-pay to receiptless reporting.

Bottom line: Choosing a POS system is like choosing a business partner: it’s not about who looks good on Day 1. It’s about who can grow with you, adapt to your needs, and never leave you hanging.

Up next: “Mistakes to Avoid When Choosing Your POS in Qatar”, a rapid-fire section based on all the silent pain points we’ve seen firsthand.

If you’ve ever seen a cashier reboot a terminal during a lunch rush… If you’ve watched a delivery guy call his manager because the POS “won’t read the card”… If you’ve had to explain to a customer why your payment link expired, and they need to send a bank transfer instead…

Then you already know: the wrong POS decision shows up fast—and costs you daily.

Below are the most common (and costly) mistakes businesses in Qatar make when choosing their POS system. Ignore them, and you’ll pay in refunds, frustration, and lost growth.

It’s tempting. A bank offers a free POS terminal. A vendor gives you a “limited-time discount.”

But you’re not buying a machine. You’re buying:

And cheap hardware won’t give you any of those.

One home services startup in Doha got four free terminals from different banks—none of which supported mobile wallet payments or worked reliably on-site. They now use SADAD POS and haven’t touched a plastic terminal since.

A POS system is like electricity. You don’t notice it when it works. But when it doesn’t—you feel it immediately.

If your support line goes unanswered or your only option is email, your business suffers in real time.

Ask before you sign:

SADAD’s support team operates in-country, understands the local context, and resolves most issues same-day. That’s not a feature, it’s survival.

Too many POS systems are designed for software engineers—not cashiers, delivery teams, or sales assistants.

If your team finds it clunky, slow, or complicated—they’ll avoid it, break it, or forget to use it.

What you want:

SADAD POS works like any simple app. One of our merchants onboarded two new hires during a weekend pop-up—no training, no confusion.

Your business won’t stay the same size forever. But many POS systems assume it will.

We’ve seen businesses:

With SADAD POS, adding users or devices is instant. No new hardware. No new contracts. Just log in and go.

Your customer doesn’t care which POS you use. But they do care if:

Every second of friction is a risk of losing that customer forever.

SoftPOS lets you serve your customers where they are, how they want to pay—with zero friction, zero hardware, and complete confidence.

Choosing the wrong POS traps you. Choosing the right one frees you.

If you’ve read this far, you’re already ahead of most business owners who rush into a POS decision based on price, pressure, or convenience.

Now let’s make it concrete.

Here’s a step-by-step checklist built from what honest merchants in Qatar actually go through—designed to help you filter out the noise and pick a POS that works from day one.

Print it, save it, share it with your ops manager. This is the checklist we wish most teams would use before signing that POS contract.

Ask yourself:

If you’re mobile, multi-staff, or flexible—SADAD POS wins on setup speed and scalability.

Mark what matters most to your business:

The more boxes you tick here, the less traditional POS systems will fit, and the more SADAD POS becomes the obvious solution.

A POS system isn’t a one-time cost—it’s a daily partner. And if it adds friction, it’s costing you more than you think.

Before committing, test how the POS performs:

Run this test with SADAD SoftPOS. You’ll find it takes less time to activate than to finish reading this checklist.

“If I had to double my payment volume next month, could this POS handle it—without new hardware, contracts, or delays?”

If the answer isn’t a confident yes, it’s the wrong system.

Pro Tip: Want to try SoftPOS before committing?

Just download the SADAD SoftPOS app, register, and walk through the setup. No contracts, no paperwork. It’ll tell you more in five minutes than any sales pitch could.

You’ve seen what to look for. You’ve walked through the decision process. But there’s always a final set of questions that come up—especially when you’re close to choosing.

Below are the most common, unfiltered questions we hear from business owners in Qatar about POS, hardware terminals, and POS integration.

| Feature | SADAD SoftPOS | Traditional POS Terminal | Cloud POS + Hardware |

| Setup Time | Minutes (Download + Register) | Days or weeks | Usually requires delivery + install |

| Hardware Cost | None | limited | 3,000–15,000+ QAR |

| Payment Methods | All cards + wallets + NAPS | Often limited | Depends on the provider |

| Portability | Smartphone-based (anywhere) | Fixed location | Some mobile options are available |

| Language / Interface | Arabic + English | Often English-only | Varies |

| Support | Local team | Depends on bank/vendor | Varies by provider |

| Scalability | Add users instantly | New hardware required | May require system reconfig |

| Eco-friendly / Paperless | 100% paperless, no waste | Prints paper receipts | Mixed |

| Reconciliation & Reporting | Real-time dashboard | End-of-day batch or manual | Good if synced |

Q: Do I need a separate terminal to accept payments with SoftPOS?

A: No. Your NFC-enabled Android smartphone becomes your terminal—no hardware needed.

Q: Is SADAD POS secure and compliant?

A: Yes. It’s PCI-DSS compliant, QCB-regulated, and uses full encryption + secure PIN entry.

Q: Can I accept Apple Pay, Google Pay, and NAPS with SADAD POS?

A: Absolutely. SADAD POS supports tap-to-pay with all major cards and wallets, including Qatar’s NAPS cards.

Q: What if I don’t have stable Wi-Fi?

A: SADAD POS works reliably over 4G and mobile data. It’s designed for on-the-go businesses.

Q: Is there a limit to the number of users or staff I can onboard?

A: No. You can add multiple devices or team logins based on your business needs—no new hardware required.

Q: How do I get started with SADAD POS?

A: Simple:

You don’t need a flashy POS. You need a reliable one. One that adapts to how your business actually runs, not how a brochure says it should.

Whether you’re managing one store or five, selling behind a counter or at the customer’s doorstep, your payment system should give you speed, clarity, and control. Not cables. No delays. Not headaches.

And in Qatar today, that means looking beyond outdated hardware. That means skipping the bureaucracy. That means asking: Can I run my business from my phone? If the answer is yes… then so should your POS.

Try SADAD POS for yourself. No sales call. No setup team. Just download the app, register, and turn your smartphone into a secure, compliant, ready-to-work terminal.

Because payments shouldn’t slow you down, and now, they don’t have to.

Articles

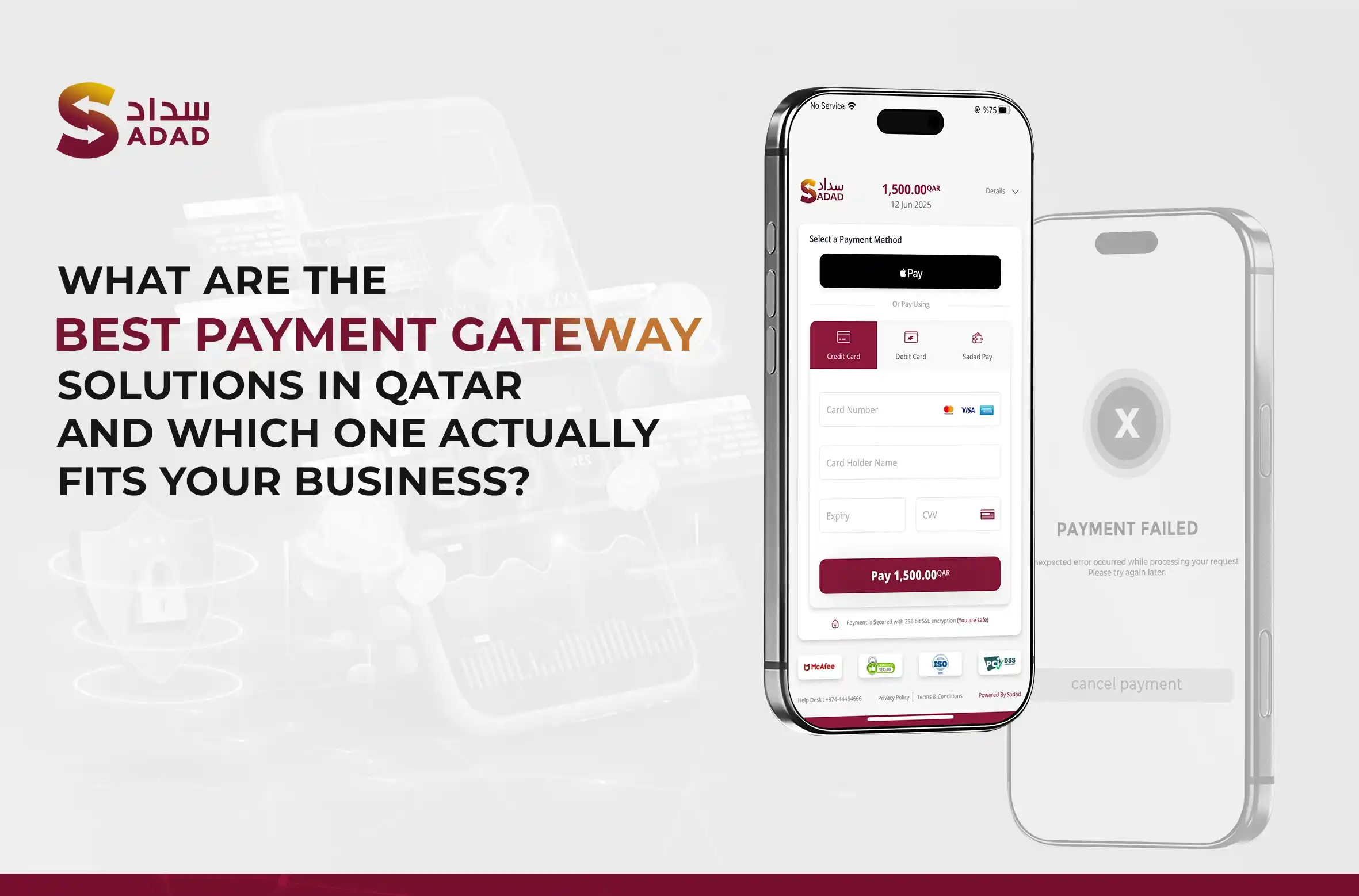

What Are the Best Payment Gateway Solutions in Qatar? A Full Comparison for Business Owners

What Are the Best Payment Gateway Solutions in Qatar, And Which One Actually Fits Your Business? Most businesses in Qatar don't have a payment problem. They have a payment frustration....

Read more

Articles

The Future of Payments in Qatar: 5 Shifts That Will Change How Your Business Gets Paid

The Future of Payments in Qatar: What Every Business Needs to Know In July 2025, Qatari businesses processed $4.4 billion in digital transactions, totaling 51.7 million individual payments. SAMENA Daily...

Read more

Articles

Best POS device in Qatar: Why SADAD Plus Outperforms Bank-Issued Terminals

Best POS device in Qatar: Why SADAD Plus Outperforms Traditional Terminals Last month, a café owner in West Bay showed me his counter. Three different POS machines. One from his...

Read more