Articles

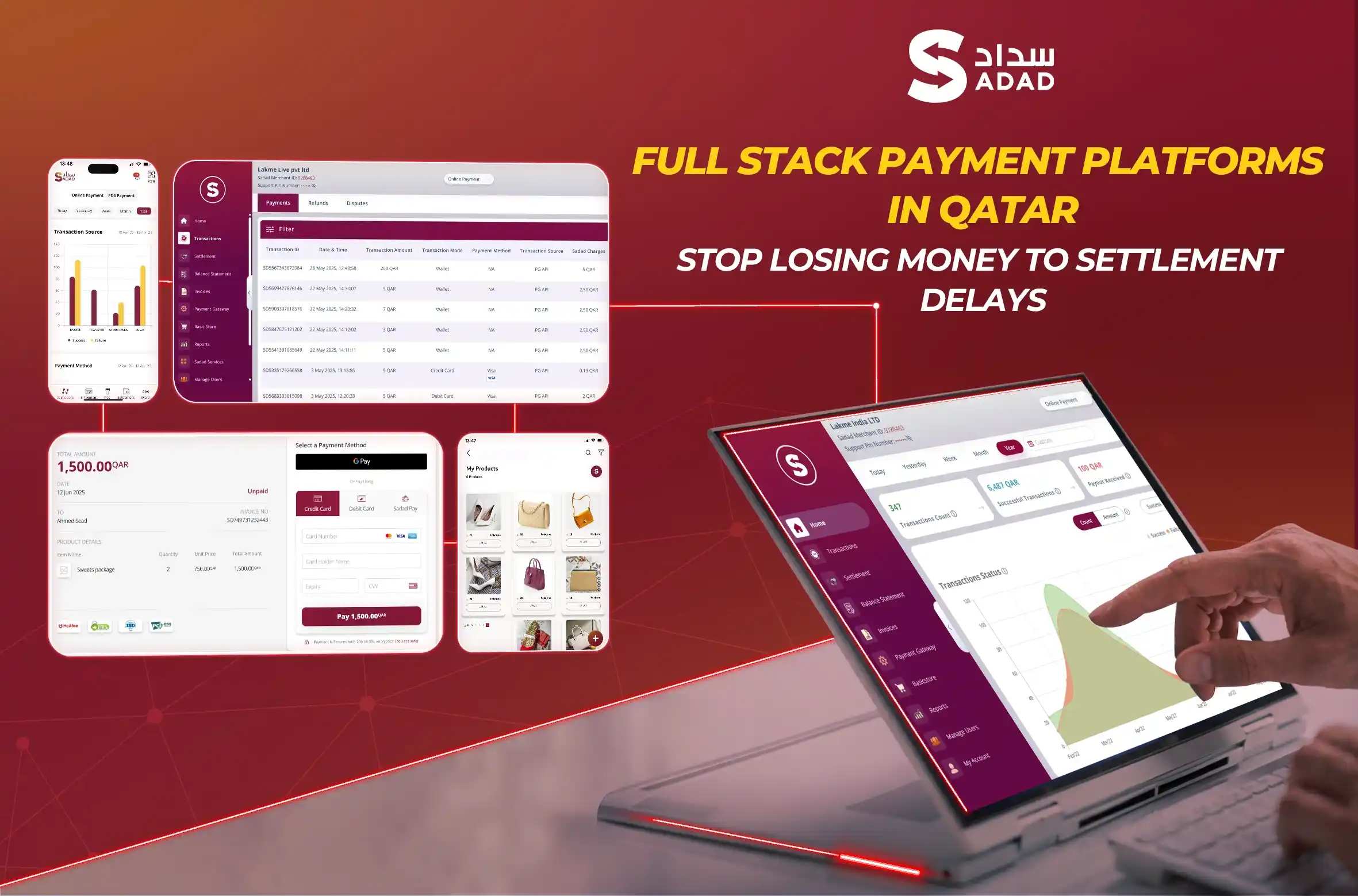

Full Stack Payment Platforms in Qatar: Stop Losing Money to Settlement Delays

If you’re running a business in Qatar, you’ve probably felt the pain of cobbling together multiple payment vendors just to accept payments from your customers.

I’ve spoken with dozens of Qatar business owners, and the story is almost always the same: one vendor for online payments, another for in-store POS, a third for invoicing, and maybe a fourth for reconciliation. Then you’re spending hours every week trying to make sense of it all while waiting 5-7 days for your money to hit your account.

According to McKinsey, businesses in the GCC region lose an average of 15-20% of revenue to payment friction—cart abandonment, failed transactions, and operational inefficiencies.

Read more from McKinsey :

The 2025 McKinsey Global Payments Report: Competing systems, contested outcomes

In Qatar, where the Central Bank of Qatar is actively pushing toward a cashless economy as part of Qatar National Vision 2030, the gap between consumer expectations and business capabilities is widening rapidly.

The solution isn’t adding another vendor to the mix. It’s finding a full stack payment platform that can handle everything under one roof—preferably one that actually understands Qatar’s regulatory environment and has direct integration with NAPS (the National ATM & Payment Network).

Since 2018, Qatar has had its first independent payment solutions company then it linked directly to NAPS integration: SADAD.

Whether you choose SADAD or another platform, understanding what “full stack” means is critical to making the right decision.

Before we dive deep, here’s what you’ll learn:

When I first started researching payment platforms for businesses in Qatar, I noticed everyone was talking about “payment gateways” as if they were the complete solution. But here’s the thing: a payment gateway is just one piece of the puzzle.

Most businesses in Qatar I’ve spoken with use 4-5 vendors. Each has its own dashboard, settlement schedule, API, and support team. Your finance team is spending 6-10 hours every week just trying to reconcile transactions across these systems. You’re waiting 5-7 business days to receive your funds.

One retail business owner in Doha told me, “We were literally logging into four different platforms every morning just to see how much money we made yesterday. And even then, the numbers didn’t match until we spent hours cross-referencing everything.”

A true full stack payment platform handles everything in one integrated ecosystem:

Think of it as the difference between buying individual car parts and getting a fully assembled vehicle with a warranty and a service team.

Qatar isn’t just talking about going cashless—it’s actually happening. The Qatar Central Bank has been actively promoting the adoption of digital payments. QPay, Qatar’s national mobile wallet, has seen massive growth. E-commerce in Qatar grew by 42% in 2023 alone, according to Visa’s MENA e-commerce report.

But here’s what really matters from a business perspective: instant access to your money. When you’re operating on tight margins or managing inventory that requires frequent restocking, waiting 5-7 days for settlements isn’t just inconvenient—it’s actively hurting your business.

A Boston Consulting Group study found that reducing settlement times from 7 days to instant settlement improved working capital efficiency by 35% for SMEs in the GCC. That’s real money you could be using to grow your business.

From my conversations with business owners and finance leaders in Qatar, I’ve identified seven capabilities that separate real full stack platforms from vendors just calling themselves that.

A true full stack platform needs to support:

A Qatar retailer using SADAD’s full suite can accept online payments on its website, send invoices to corporate clients, and process in-store card payments—all on the same dashboard with the same settlement schedule.

Smart payment routing is the platform’s ability to automatically select the best path for each transaction based on cost, success rate, geography, and currency. For Qatar businesses, this means local transactions going through NAPS (lower cost, higher success rate) and international transactions routed appropriately.

According to Stripe’s payment optimization research, smart routing can increase authorization rates by 2-5%. On 10,000 monthly transactions, that’s 200-500 additional successful payments.

According to the GCC E-commerce Fraud Report 2023, online fraud attempts in MENA increased by 18% year over year. The average fraud loss for businesses without proper prevention systems was 1.2% of revenue.

A full stack platform should include real-time fraud scoring, 3D Secure 2.0 compliance, customizable risk rules, and an understanding of Qatar-specific fraud patterns.

With a proper full stack platform, business owners open one dashboard on their phone and see everything instantly: today’s revenue across all channels, transaction breakdown by payment method, settlement status, and real-time performance across all locations.

As one CFO of a multi-location retail chain told me, “The Smart Performance Dashboard gives me real-time visibility into all our locations. I can check revenue from my phone while I’m traveling. That’s powerful for decision-making.”

From my experience working with development teams, documentation quality makes or breaks integration projects. I’ve seen integrations take 2-3 months with poorly documented APIs and 1-2 weeks with well-documented ones.

SADAD provides comprehensive API documentation, GitHub resources, and technical support during integration. Their fast, easy registration process lets you start testing within days, not weeks.

This is non-negotiable. Operating as a payment service provider in Qatar requires proper licensing from the Qatar Central Bank. When you work with an unlicensed platform, you’re putting your business at risk.

SADAD, as Qatar’s first independent Qatari payment solutions company, holds official QCB licensing. This isn’t an add-on—it’s built into the platform’s DNA from day one.

Platforms with direct QCB licensing have faster regulatory approvals, lower risk of compliance issues, direct relationships with Qatar banks, and better support for QCB reporting requirements.

This is one of those technical details that has massive practical impact—especially on your cash flow and costs.

NAPS (National ATM & Payment Network) is Qatar’s national payment infrastructure—the backbone that connects banks, merchants, and payment processors. Think of it like a highway system. You can take the direct highway (NAPS) or you can go through multiple toll roads with various intermediaries.

SADAD has been the first and only independent Qatari company that provides payment solutions (not bank-owned) with direct NAPS integration. This technical achievement creates real business advantages:

With direct NAPS: Transaction processes. Money in your account (same day, often within 24 hours). Through intermediaries: Transaction processes. Multiple intermediaries → 5 -7 days later

Instant access to working capital. A business generating QAR 200,000 in weekly revenue has QAR 600,000-1,000,000 tied up in settlement delays with traditional platforms. With direct NAPS integration, that’s QAR 0 locked.

Every intermediary takes a cut. Typical cost with intermediaries: 2.2% platform fee + 0.4% global processor + 0.3% local bank + 1.2% currency conversion = 4.1% total

Direct NAPS integration cost: 2.2% platform fee + 0% middlemen + 0% conversion = 2.2% total

Savings: 2.1% per transaction

On QAR 2,000,000 annual volume: Intermediaries cost QAR 82,000 in fees. Direct NAPS costs QAR 40,000. Annual savings: QAR 42,000

When local Qatar cards are processed via direct NAPS integration, authorization rates are typically 2-5% higher than those for routing through international processors. On 10,000 monthly transactions at QAR 200 average, a 3% improvement = 300 additional successful payments = QAR 60,000 additional monthly revenue.

QPay adoption is exploding in Qatar. To accept QPay, you need to integrate with NAPS. Platforms with direct NAPS integration offer native QPay support. One e-commerce retailer told me their cart abandonment dropped 23% after they added QPay.

You can’t just pick the platform with the slickest marketing. Your payment infrastructure needs to match your specific business model. Here’s the framework I use when advising businesses.

Pull your data from the last 3-6 months and analyze:

This tells you what features you actually need. If 80% of your customers pay with QPay, you absolutely need native QPay support.

Most businesses underestimate total cost by 40-60%. Here’s the real breakdown:

Direct platform costs:

Hidden operational costs:

Example calculation (10,000 monthly transactions, QAR 200 average):

International platform:

Qatar-licensed platform (SADAD):

Difference: QAR 269,940 saved annually

This is your compliance and market-fit checklist:

Challenge: Using an international gateway – 5-day settlement delays, high cart abandonment, 6+ hours weekly on reconciliation

Solution: Switched to SADAD Payment Gateway with QPay integration

Results:

Challenge: Different POS systems across 5 locations, no unified reporting, 7-day settlement delays

Solution: Full SADAD ecosystem – Traditional POS + Payment Gateway + Smart Dashboard

Results:

Challenge: Manual invoicing, clients slow to pay (45 days average), no payment tracking

Solution: SADAD Invoice system

Results:

Total cost of ownership varies but typically includes: transaction fees (1.8-2.5% + fixed), monthly platform fees, integration costs, and opportunity costs. Qatar-licensed platforms with direct NAPS integration typically cost 30-40% less than international platforms when you calculate total cost, including settlement delays and reconciliation time.

Simple integrations (Invoice, Soft POS): immediately. E-commerce (Payment Gateway API), Complete omnichannel, max 1 week. SADAD’s comprehensive documentation and 24/7 support typically enable faster implementations than platforms with poor documentation.

Yes, with proper planning. Three approaches: Parallel Running (zero downtime, 2-3 months), Phased by Channel (minimal downtime, 2-4 months), or Big Bang Migration (planned downtime, 4-8 weeks). SADAD’s 24/7 support team is available during migration to minimize risk.

Direct NAPS integration means: instant settlements (vs. 2-7 days), lower costs (no intermediary fees), better authorization rates (2-5% higher), native QPay support, and more reliable processing. For a business doing QAR 2M annually, this can mean QAR 40,000+ in savings plus significant working capital improvements.

The question isn’t whether to adopt a full stack payment platform—Qatar’s digital transformation makes that inevitable. The question is: Will you choose a platform that truly understands Qatar’s market, operates with Qatar Central Bank’s official licensing, settles your payments instantly, and integrates directly with NAPS?

For Qatar businesses committed to operational excellence, the comparison is clear:

Since 2018, SADAD has been empowering Qatar-based businesses with payment infrastructure that not only processes transactions but also drives growth, improves cash flow, saves time, and enables better decision-making through real-time data.

Ready to Modernize Your Payment Infrastructure?

Whether you’re launching your first e-commerce store, managing multiple retail locations, or sending invoices to corporate clients, SADAD has a solution built for your Qatar business needs.

Explore SADAD solutions:

Learn more about building payment infrastructure that grows with your business at SADAD.qa

The future of payments in Qatar is instant, integrated, and intelligent. For Qatar businesses serious about operational excellence:

Since 2018, SADAD has been Qatar’s payment innovation partner – empowering businesses with Qatar Central Bank-licensed payment infrastructure, direct NAPS integration, and instant settlements.

The future is here. Are you ready?

Articles

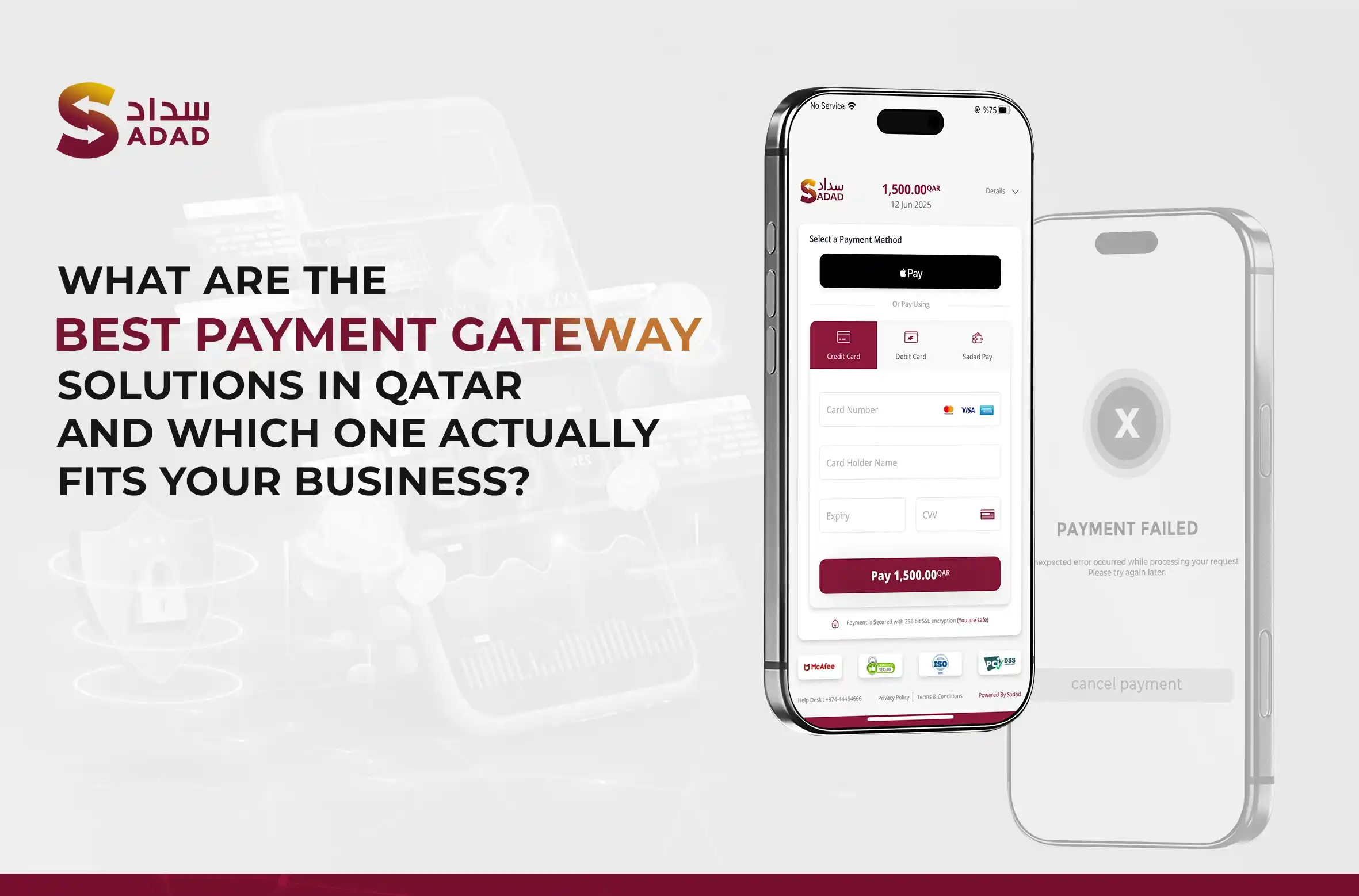

What Are the Best Payment Gateway Solutions in Qatar? A Full Comparison for Business Owners

What Are the Best Payment Gateway Solutions in Qatar, And Which One Actually Fits Your Business? Most businesses in Qatar don't have a payment problem. They have a payment frustration....

Read more

Articles

The Future of Payments in Qatar: 5 Shifts That Will Change How Your Business Gets Paid

The Future of Payments in Qatar: What Every Business Needs to Know In July 2025, Qatari businesses processed $4.4 billion in digital transactions, totaling 51.7 million individual payments. SAMENA Daily...

Read more

Articles

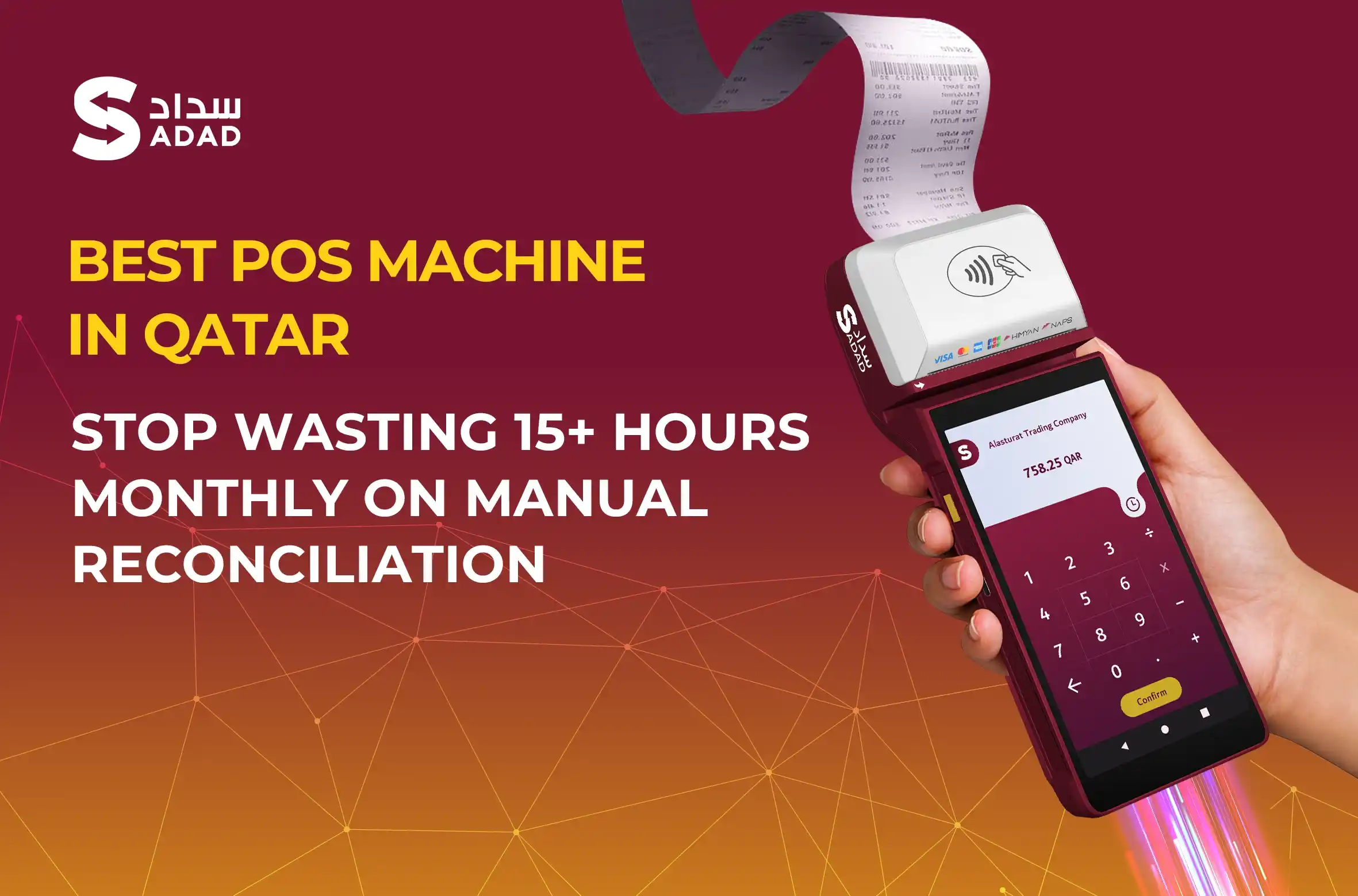

Best POS device in Qatar: Why SADAD Plus Outperforms Bank-Issued Terminals

Best POS device in Qatar: Why SADAD Plus Outperforms Traditional Terminals Last month, a café owner in West Bay showed me his counter. Three different POS machines. One from his...

Read more