Articles

The Cloud-Based Payment Solutions Qatar’s Small Businesses Actually Use

Most business owners don’t think about their payment system until it becomes the reason they’re not getting paid.

Maybe your point-of-sale device goes down. Maybe your client needs to pay remotely but can’t. Maybe you’re waiting for a bank transfer that never lands. Either way, the result is the same: a delayed payment, a frustrated customer, and a disrupted cash flow.

That’s the hidden tax of traditional payment systems. Slow. Rigid. Built around hardware that fails and processes that lag.

Now imagine the opposite.

A client finishes their purchase, you send a secure payment link by SMS or WhatsApp, and they pay instantly from anywhere. No setup, no hardware, no delays.

That’s what a cloud-based payment solution makes possible.

In this article, we’re not just explaining what cloud payment systems are. We’re showing why they matter, how they change your business operations, and what to look for — especially if you’re running a business in Qatar.

And yes, we’ll show you how platforms like SADAD are leading the charge locally with tools built for your exact needs.

Let’s clear something up.

“Cloud-based” isn’t just a buzzword. It’s not a tech trend. It’s not about hosting something “on the internet.” It’s a structural shift in how businesses move money—and how quickly they get paid.

Traditional payment systems rely on hardware. Think physical tools, local servers, maintenance contracts, and software updates that require IT support.

They work — until they don’t.

You lose power. A cable disconnects. A terminal freezes. You’re left staring at the machine while your customer stares at you.

Now compare that to cloud-based systems. Everything – from processing to reporting – happens securely over the internet, using remote servers maintained by enterprise-grade infrastructure providers like Microsoft Azure.

You access it through a dashboard. Your customer pays through a link. The system updates itself. And it all works whether you’re in a shop, in the field, or at home.

That’s not just technical elegance. It’s operational freedom.

When a customer makes a payment using a cloud-based system, the transaction doesn’t sit on a physical server inside your office. It’s encrypted, transmitted, and validated through a secure cloud gateway — often using tokenization or multi-factor fraud detection.

This process is fast, secure, and scalable. It handles 10 transactions or 10,000 with the same infrastructure.

And you? You don’t need to worry about uptime, compliance, or hardware maintenance. The system handles it all for you.

That’s why, according to a 2023 McKinsey report, 89% of businesses that adopted cloud payment systems reported faster payment cycles, while 67% reported improved customer experience.

Those aren’t small wins. Those are competitive advantages.

Many businesses think they already use cloud payments because they accept online card payments.

But here’s the thing: accepting card payments isn’t the same as managing payments through a cloud-based solution.

A true cloud-based payment system doesn’t just process the transaction. It:

It’s not a plugin. It’s a full-stack payment infrastructure—one that becomes part of how your business runs day to day.

That’s what most content on this topic misses. They focus on features. We’re talking about business systems. Systems that reduce admin, speed up cash flow, and keep you ready to scale without touching another wire.

And now that we’ve defined what cloud-based payment really is, let’s look at the real reasons businesses in Qatar are moving away from traditional systems. Because that shift isn’t random — it’s survival.

If cloud-based payment solutions are growing fast, it’s not because businesses love new technology. It’s because traditional payment systems are quietly working against them.

Let’s break down the real problems small businesses face, especially in Qatar.

Traditional payment systems come with baggage. Physical terminals. Installation fees. Maintenance contracts. Software updates that require technicians or downtime.

What starts as a “one‑time setup” quickly turns into recurring costs and operational friction.

According to Deloitte, businesses using legacy payment infrastructure incur up to 30% higher operational and maintenance costs than those using cloud‑based systems.

For a small business, that money is not abstract. It’s rent. Salaries. Inventory. Marketing. Every extra cost limits growth.

Traditional payment setups are built for fixed environments. One store. One counter. One device.

But businesses don’t stay fixed.

You add delivery. You sell online. You take phone orders. You start accepting payments remotely. Suddenly, your payment system becomes a bottleneck.

A PwC study found that 45% of SMEs struggle to scale their payment operations when expanding to new channels or locations.

This is where many businesses slow down, not because demand is low, but because their infrastructure cannot keep up.

This is the most dangerous problem, because it’s invisible.

One payment comes through a POS machine. Another through a bank transfer. Another through a manual invoice. Records live in different places. Reconciliation becomes guesswork.

You think you’re doing fine, until you realize cash flow is unpredictable.

A report by JPMorgan showed that poor payment visibility is one of the top reasons small businesses experience cash flow stress, even when sales are healthy.

When you can’t see payments in one place, you can’t manage them. And when you can’t manage them, you can’t plan.

Here’s the perspective most articles miss.

Small businesses don’t fail because customers don’t want to pay. They fail because the business lacks control over when and how payments occur.

Traditional systems take that control away. They lock it into hardware, fragmented tools, and outdated processes.

That’s why cloud-based payment solutions are not a trend. They are a correction.

And once you understand that, the benefits of cloud payments stop sounding technical and start sounding practical. That’s exactly what we’ll unpack next.

If the last section was about what’s broken, this one is about the fix. And no, it’s not a fancy dashboard or slick UI. It’s something much more valuable: leverage.

Because when you remove the constraints of hardware and manual processing, you get more than just convenience — you unlock business clarity, operational speed, and the ability to grow without chaos.

Let’s talk about what that looks like.

Business doesn’t grow in perfect lines. One month, you’re closing two clients a week. Next month, it’s ten. With traditional systems, scaling means new devices, new accounts, and usually, new headaches.

Cloud-based payment platforms scale instantly. You add users. You add channels. You move from in-store to online to on-site payments without needing to restructure your entire setup.

That’s not just nice to have. It’s the difference between saying yes to growth and hitting pause while your infrastructure catches up.

According to Statista, the global cloud payments market is projected to reach $15 billion by 2026 — a 200% increase from 2020. That kind of growth doesn’t come from convenience. It comes from necessity.

Here’s the usual paradox: the smaller your business, the more vulnerable your payments. But setting up proper security? Expensive. Complicated. Not your core skillset.

Cloud payment providers solve this by doing the heavy lifting for you. They encrypt transactions end-to-end. They tokenize customer data. They handle fraud detection using the same infrastructure as top banks.

This matters in Qatar, where the QCB (Qatar Central Bank) mandates strict compliance for all digital payment providers. A good cloud-based system doesn’t just keep you protected — it keeps you compliant by default.

You don’t need to know how security protocols work. You need to know they work. And with a proper system, they do.

The modern customer expects to pay however they want — on desktop, mobile, by link, QR code, card, or wallet. If your system doesn’t support that? You’re the friction.

Cloud-based solutions break down those barriers. Whether you’re sending an invoice via WhatsApp or accepting payments in-store, everything flows through the same system. Unified. Instant. Trackable.

No more silos. No more guesswork.

According to Salesforce’s State of the Connected Customer report, 76% of consumers expect consistent interactions across departments and platforms.

That includes payments. Especially payments.

Here’s what the SaaS world already knows: when something is easy, people do it faster.

The same applies to getting paid.

When your client gets a branded link by SMS, clicks it, and pays in seconds without needing to register or call, the likelihood of instant payment skyrockets. That’s not a theory. That’s behavioral momentum.

And when payments are made quickly, cash flow becomes more predictable. When cash flow is predictable, everything else — hiring, marketing, growth — becomes possible.

In short, cloud payments help your customers pay faster, so you can build faster.

Next, we’re going hyper-local: why this all matters specifically for businesses in Qatar — from payment culture to regulation to consumer expectations. Because what works globally only works locally when it’s built for the ground you’re standing on.

Let’s go there.

If you’re running a business in Qatar, this isn’t just about “keeping up with digital trends.” It’s about keeping up with your customers — who have already gone digital — and staying aligned with a regulatory environment that’s moving faster than most Gulf markets.

Let’s unpack why Qatar isn’t just ready for cloud payments. It’s demanding them.

Qatar’s population is one of the most digitally connected in the world. Mobile penetration is over 150%, and internet usage is above 99%, according to the latest DataReportal 2023 snapshot.

That means your customers already live in the cloud. The only question is whether your payment system does too.

Still using only physical tools and paper invoices? You’re not just behind — you’re creating unnecessary friction in a market where everyone’s expecting tap, link, pay, done.

E-commerce sales in Qatar are expected to cross $5 billion by 2025, growing at 16.7% CAGR, according to Statista. And over 70% of those transactions are mobile-driven.

What that tells you is simple: mobile-first isn’t a trend here. It’s the baseline.

If your payment system can’t support mobile-friendly checkout, instant link-based payments, and cross-channel reconciliation, you’re leaking conversions and annoying the very people trying to pay you.

Cloud systems close that gap by giving your business instant access across devices without extra hardware, apps, or complexity.

Qatar Central Bank has introduced stricter compliance standards for payment providers, particularly regarding data security, e-invoicing, and payment transparency.

Traditional setups require heavy compliance audits, on-premise data protection, and manual tracking. Cloud-based payment providers, on the other hand, bake these requirements into their systems by default.

In fact, SADAD became the first cloud payment processor in Qatar to integrate with Microsoft Azure for enterprise-grade security, setting a local benchmark for digital payment infrastructure.

This isn’t a marketing stat. It’s a compliance edge. When regulation increases — and it will — businesses using compliant cloud platforms won’t scramble. They’ll keep operating without missing a beat.

Here’s the part every global solution gets wrong: payment behavior isn’t universal.

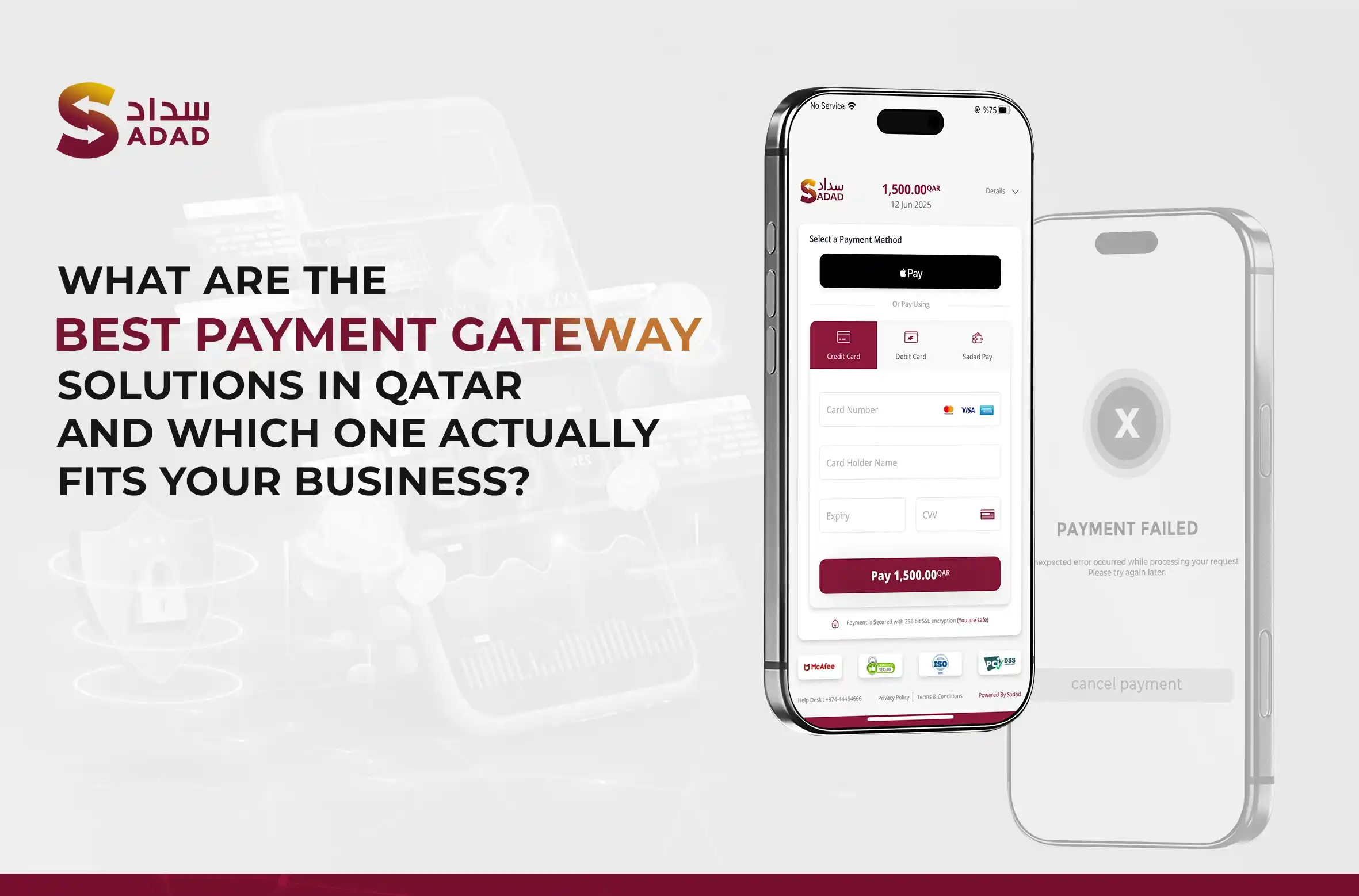

Your client in Doha expects invoices in Arabic and English. They want to pay in QAR via credit card, or local transfer — not USD via Stripe or PayPal. They want receipts instantly, not after a three-day processing cycle.

That’s not a “nice to have.” It’s a baseline. If your payment system can’t speak your client’s language — literally and financially — it’s working against you.

SADAD, for example, is built with these local expectations baked in. That’s why businesses in F&B, logistics, education, healthcare, and retail across Qatar are shifting to SADAD’s cloud infrastructure: because it fits how things actually work here.

So if you’re in Qatar and still thinking about cloud payments like they’re optional, here’s the truth: they’re already here. The only question is whether your business is using them to run smarter — or holding itself back.

Next, we’ll dig into the five features every small business should demand before choosing a cloud-based payment system. Because when the stakes are this high, picking the wrong tool is more than a tech mistake — it’s a business risk.

At this point, it’s clear cloud-based payments aren’t a “nice upgrade.” They’re the new standard.

But here’s where most businesses slip.

They look at the interface. They skim a features page. They listen to a sales rep talk about integrations. Then they sign up — and discover, six months later, that the system doesn’t actually work for how they do business.

So let’s flip the script.

Here’s what to demand from a cloud-based payment solution before you put your money, time, or customer experience on the line.

You shouldn’t have to log in to five systems just to know if you got paid.

The right cloud platform gives you a unified dashboard showing every transaction — online, offline, invoice, QR code, mobile link — updated in real time.

According to a KPMG fintech report, businesses with real-time payment tracking reduced invoice-related delays by up to 60% and improved cash flow forecasting accuracy by 40%.

This isn’t about dashboards. It’s about knowing — at any given moment — exactly what’s flowing in and what’s stuck.

If your provider doesn’t give you that kind of visibility, you’re not managing payments. You’re guessing.

Your customers don’t care where or how you accept payment. They care that it works.

Your system should allow:

Not “some.” All of them. Seamlessly.

And here’s the catch: they all need to connect back to one central platform. If your invoice payments live in one system and your store checkout in another, you’re setting yourself up for reconciliation chaos.

Let’s say it out loud: if your cloud solution doesn’t support the Qatari riyal, and the most locally preferred payment flows, it’s not built for Qatar.

Too many tools treat international markets like an afterthought. They force workarounds. They charge FX fees. They slow down settlement times.

The result? Customers hesitate. Transactions bounce. And you look less professional than you actually are.

A solution like SADAD doesn’t just accept QAR — it’s designed around it. That means faster settlements, zero foreign transaction surprises, and compliance with QCB standards out of the box.

Data breaches don’t just affect big tech.

SMBs are now three times more likely to be targeted by cyberattacks than large enterprises, according to Accenture’s Cybercrime report.

If your payment system isn’t keeping you secure, it’s leaving you exposed.

That means end-to-end encryption, tokenized transactions, fraud detection protocols, and automated backups. Not optional. Standard.

Bonus if your provider operates on a Tier-1 infrastructure like Microsoft Azure (which SADAD does), because that means security isn’t patched together — it’s embedded into the very foundation of the system.

This one’s underrated — but critical.

If you need a dev just to get going, you’re already upside down on ROI. Your cloud-based solution should let you:

The tool shouldn’t slow you down. It should disappear — while your business runs smoother in the background.

Coming up next: we’ll show you how SADAD checks all five boxes — and why hundreds of Qatar-based businesses already rely on it to power their payments daily. Because when the stakes are this high, “good enough” isn’t good enough anymore.

Let’s get something straight: not all cloud-based payment solutions are created equal.

Plenty of global providers offer slick dashboards and multi-currency processing. But most of them weren’t built for businesses in Qatar. They were built elsewhere, for markets that work differently. Then they were adapted for you — usually with bugs, delays, and missing features.

SADAD flipped the model.

It was built in Qatar, for Qatar. That means the currency, payment flows, mobile behaviors, and compliance requirements were the starting point—not an afterthought.

Here’s what that looks like in practice.

SADAD lets you create unlimited branded payment links directly from your dashboard.

You send them via SMS, WhatsApp, email — whatever your customer prefers. They pay with one click. No setup, no download, no login.

You don’t need a developer. You don’t even need a website.

It’s designed for the 1-person gym coach in Lusail, the beauty service in Al Sadd, and the home bakery in Wakrah. Business owners who don’t want a tech stack — they want to get paid.

And it works.

The second a customer pays, you see it.

SADAD’s dashboard updates in real time, with full visibility into what’s paid, pending, or overdue. You can send automated reminders, issue refunds, and view detailed reports — all from your mobile.

No more Excel sheets. No more waiting for a bank SMS. Just clarity.

This kind of instant tracking isn’t a bonus feature. It’s a core reason businesses using SADAD get paid faster and follow up less.

Let’s talk trust.

SADAD isn’t just compliant with Qatar Central Bank’s e-payment and invoicing standards. It’s built on Microsoft Azure, one of the most secure cloud infrastructures in the world.

That means:

You don’t have to worry about losing data or failing an audit. It’s all handled.

That’s why SADAD became the first cloud payment processor in Qatar to run entirely on Azure infrastructure (Zawya).

It’s more than a headline. It’s the reason institutions, clinics, retail brands, and service providers across the country are switching to SADAD.

Need to onboard new users? Launch recurring billing? Accept payments internationally? SADAD supports it all — from day one.

You can:

And when you’re ready to scale? You’re already on infrastructure that can handle it — no migrations required.

This isn’t theory. These are real use cases from SADAD customers:

What do all of them have in common? They stopped letting payment systems control how they work — and started using one that adapts to how they already work.

In the next section, we’ll give you a practical checklist to evaluate whether any payment system — SADAD or not — is the right fit for your business. Because when you know the right questions to ask, the right solution becomes obvious.

Let’s be real: every payment provider sounds good on paper.

They throw around words like “seamless,” “secure,” and “easy-to-use.” They all have a clean UI, a demo video, and a promise to make payments less painful.

But here’s the truth: most of them weren’t built for your business.

If you run a service-based brand, work remotely, operate without a storefront, or deal with cash flow anxiety every month, your needs aren’t generic. They’re specific. And you don’t need a “solution.” You need a system that fits how you already work.

So here’s how to tell the difference.

Are your clients paying through links? In person? Subscriptions? All three?

If the tool can’t support every real-world way you collect money, it’s a limitation — not a solution.

Look for:

This isn’t “nice to have.” It’s survival. If your system can’t follow the flow of your actual work, you’ll spend more time fixing payments than earning them.

Plenty of tools were built for San Francisco, not Doha.

If your solution requires foreign currency, excludes local payment methods, or delivers invoices only in English, it’s not your solution.

Ask:

SADAD checks all three. Most global providers don’t even check one.

A lot of tools feel “lightweight” — until you grow.

Then, suddenly, you hit invoice limits, paywalls for adding users, or technical restrictions that require a dev team to fix.

You want a system that handles:

Growth shouldn’t require migration. Your infrastructure should already be ready.

If you need onboarding sessions, API keys, or a dedicated support agent just to get started, it’s too complicated.

Your payment tool should:

Because if a tool adds more to your plate instead of removing it, it’s not software — it’s software-shaped stress.

The point of this checklist isn’t to sell you on a provider. It’s to sell you on clarity.

Because when you know exactly what to look for, you don’t get distracted by shiny interfaces or big names. You choose based on fit. Based on function. Based on how well it solves your real-world payment problems.

And when you apply that lens, a tool like SADAD doesn’t feel like a vendor. It feels like infrastructure.

Let’s wrap it all up.

You didn’t start your business to chase invoices, juggle tools, or fight with hardware. But if your payment system isn’t built for how you work, that’s exactly what happens.

Cloud-based payment solutions aren’t just a tech upgrade — they’re a smarter way to run your business. Faster payments. Real-time tracking. Local compliance. Fewer headaches.

And if you’re in Qatar, SADAD isn’t just one of the options. It’s the one built specifically for you.

No setup. No friction. No waiting.

Just payments that work — from your phone, your laptop, or wherever business happens.

Start today with SADAD’s cloud-based payment system and finally take control of how you get paid. Explore SADAD’s Cloud Payment Tools

read more about: Invoice Management Software That Helps You Get Paid Without Chasing

Articles

What Are the Best Payment Gateway Solutions in Qatar? A Full Comparison for Business Owners

What Are the Best Payment Gateway Solutions in Qatar, And Which One Actually Fits Your Business? Most businesses in Qatar don't have a payment problem. They have a payment frustration....

Read more

Articles

The Future of Payments in Qatar: 5 Shifts That Will Change How Your Business Gets Paid

The Future of Payments in Qatar: What Every Business Needs to Know In July 2025, Qatari businesses processed $4.4 billion in digital transactions, totaling 51.7 million individual payments. SAMENA Daily...

Read more

Articles

Best POS device in Qatar: Why SADAD Plus Outperforms Bank-Issued Terminals

Best POS device in Qatar: Why SADAD Plus Outperforms Traditional Terminals Last month, a café owner in West Bay showed me his counter. Three different POS machines. One from his...

Read more