Articles

Invoice Management Software That Helps You Get Paid Without Chasing

If you run a small business in Qatar, invoices are not paperwork. They are your cash flow. And when invoices are slow, unclear, or forgotten, money slows down with them.

Here’s the problem I see again and again. Business owners rely on Word files, Excel sheets, or WhatsApp messages to manage invoices. It works at first. Then clients increase, payments overlap, and suddenly no one is sure what’s been paid and what hasn’t. The result is late payments, awkward follow-ups, and unnecessary stress.

This is not just a feeling. A study by the U.S. Small Business Administration shows that poor cash flow management is one of the main reasons small businesses struggle to survive, with late payments playing a significant role.

That’s where invoice management software changes the game. Instead of chasing payments, you manage everything from one place. You create invoices, send them instantly, track payments in real time, and stay in control of your business finances.

In Qatar, this matters even more. Clients expect fast, simple payment options. Business owners need tools that work without complex setup or accounting knowledge.

In the following sections, we’ll break down what invoice management software really does, why it matters for Qatar’s small businesses, and how a local solution like SADAD fits naturally into how business is done here.

Most people think invoice management software is just about sending invoices. It’s not. It’s about staying in control of your money.

Let’s get specific.

Invoice management software is a digital system that lets you create, send, track, and organize all your invoices from one place. But if that definition doesn’t move you, this will:

It’s what separates business owners who know what’s coming in – and when – from those hoping the client “just sends the payment soon.”

Manual invoicing seems harmless when you’re starting out. You send a PDF, log it in Excel, and move on.

But fast forward 6 months. You’re working with 15 clients. One didn’t pay. Another says they paid. You can’t remember if that follow-up was sent. Now you’re spending two hours checking messages, screenshots, and files just to figure out who owes what.

That’s not admin work. That’s a slow leak in your cash flow.

And it’s everywhere.

Now think about this in a Qatar context—a home-based business selling custom cakes. A cleaning company is juggling multiple clients—a fitness trainer charges per session. Every day a payment is delayed is a day your business stalls. And that kind of pressure builds quickly.

Most invoice software is built for other markets. Markets where everyone pays with PayPal or Stripe and gets invoices via email.

In Qatar, your client might prefer SMS. Or WhatsApp. Or an invoice in Arabic. They want to pay by Mada card or bank transfer in riyals, not dollars. And they expect it to be fast, simple, and mobile.

Here’s the problem: global tools don’t offer that. They expect you to fit into their systems. But as a business owner, your job isn’t to educate clients on software. It’s to make it easier for them to pay you — in the way they already understand.

That’s why invoice management isn’t just a tech upgrade. It’s a competitive advantage.

When you know what’s paid, what’s pending, and what’s overdue — in real time — you stop reacting and start running your business with clarity.

That’s what good invoice management software gives you. Not just automation. Not just templates. But full visibility on your money.

In the next section, we’ll break down the everyday problems that slow down payments for small businesses in Qatar — and how smart invoicing systems are solving them head-on.

Let’s skip the theory. If you’ve run a business in Qatar, you already know the problems. Invoices get delayed, forgotten, and ignored. And the moment you stop tracking one, you stop tracking your money.

But here’s what most invoice software misses: the problem isn’t the invoice. It’s everything around it.

Most business owners think that if they just send invoices faster, they’ll get paid faster. But that’s not how clients work.

Clients forget. They ignore the email. They don’t have the right payment method. Or they just delay — because they can.

According to a global survey by Xero, over 48% of small businesses report that late payments are a constant issue, and 30% say they’ve had to delay paying their own staff or suppliers as a result.

This is not a margin issue. It’s a survival issue. And when your system relies on reminders stuck in your head or scribbled in a notebook, you’ve already lost the game.

Now let’s get practical.

You sent five invoices this week. One client pays instantly. Two pay after you follow up twice. One disappears. One swears they paid but can’t find the receipt.

You start digging. Emails. WhatsApp. Screenshots. Then you cross-check Excel. Maybe you’ll figure it out. Perhaps you missed something. Either way, you’ve just burned two hours and added more mental weight to your week.

That’s the part no one talks about. Manual invoicing doesn’t just delay money. It drains your attention — which is the only thing keeping your business alive.

Here’s the kicker. You finally decide to upgrade and choose a fancy global invoicing tool. And then the real problem starts.

Suddenly, you’re the one educating your client and translating your own software.

That’s the opposite of what invoice management is supposed to do.

You don’t need more features. You need alignment.

A system that works the way you work, tracks everything without extra effort, and helps your client pay without friction. That’s what solves the invoice problem. Not a dashboard full of buttons — just a tool that speaks your business language.

And that’s exactly where we’re headed next: what real invoice management software should do — especially in a place like Qatar.

Let’s be blunt: most software bloats the feature list, adds four dashboards too many, and leaves you feeling like you need an accounting degree to send a receipt.

That’s not invoice management. That’s complexity with a price tag.

If you’re a business owner in Qatar, here’s what your software should really do — not what it claims, but what actually moves money.

This isn’t a “nice to have.” This is the difference between running a business and surviving one.

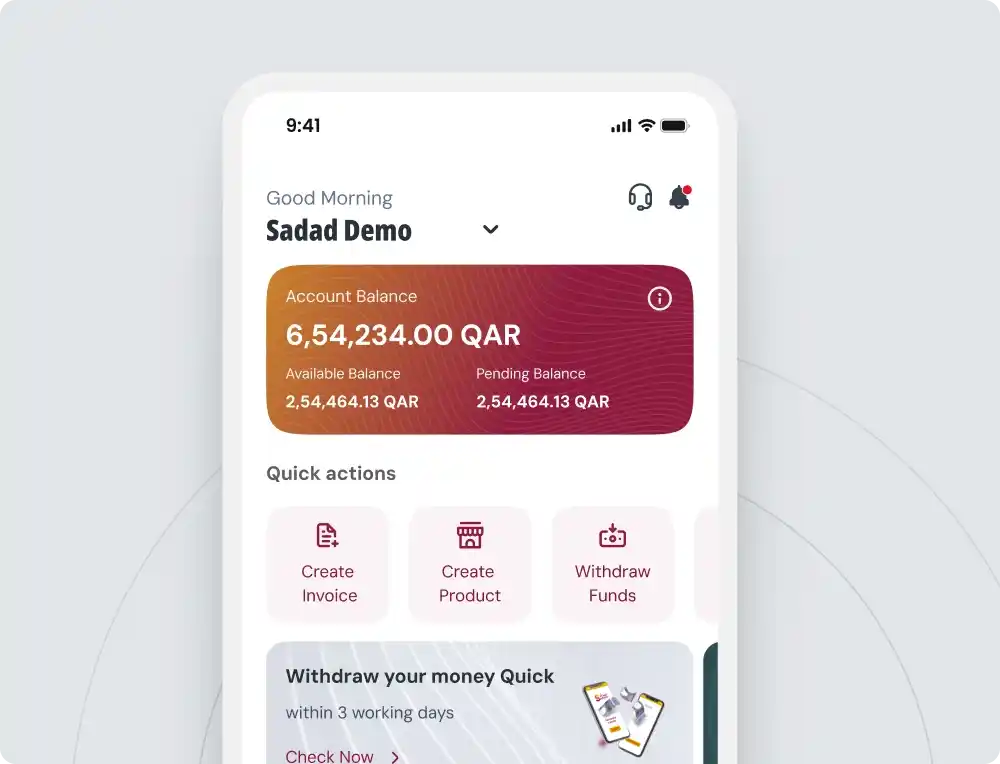

A sound system lets you see what’s paid, unpaid, and overdue in seconds. No digging through messages. No searching your inbox. One dashboard. Real numbers.

It should show you cash flow at a glance. Who owes what. What’s coming in? What’s late? If your current system can’t do that, you’re not managing invoices — you’re firefighting.

When a client pays, you should know — instantly.

According to a 2023 survey by PYMNTS, 70% of SMBs say real-time payment updates reduce the time they spend managing their finances each week.

This is not a gimmick. It’s how modern businesses stay lean and sane. You finish a job, send an invoice, and as soon as payment is made, your dashboard updates. No refreshing. No guesswork.

If you’ve ever delayed sending a follow-up because it felt awkward — welcome to the club.

Late payments are often not malicious. People forget. They get distracted. You send the reminder late, and they pay even later. Days stack up.

Your software should handle that for you. Automatically. You set the rules — “remind after 3 days,” “follow up after 7,” “alert me if it’s still unpaid after 10.” The system takes care of the rest.

That’s not just automation. That’s protecting your time and your relationships.

Let’s be clear: you shouldn’t need a website to send a professional invoice. Or a setup call. Or an “onboarding session.”

Good invoice software works from day one. You log in, send a payment link, and you’re done.

And if it can’t run on your phone — while you’re on-site, in the car, or between meetings — it’s not built for small business. It’s built for accountants. You’re not an accountant. You’re running a business.

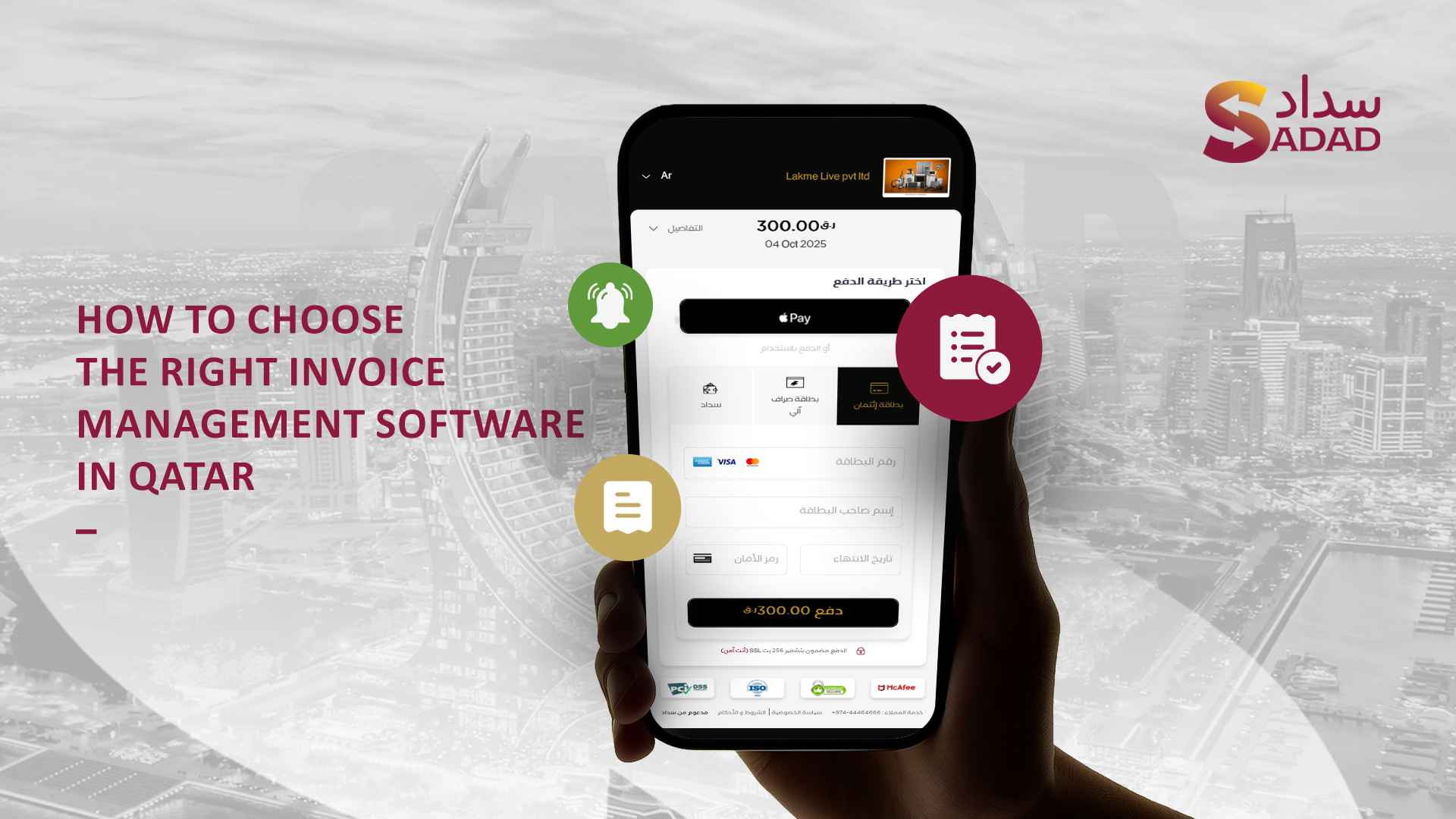

Qatari clients don’t want to sign into foreign platforms or figure out how to pay in USD.

Your software should:

This is non-negotiable. It’s not a localization feature. It’s what makes your client actually pay you.

Up next, we’ll break down what to look for — and what to avoid — when choosing the right invoice software for your business in Qatar. Then, we’ll show you how SADAD stacks up. But first, you need to know what features are actually worth your time.

By now, you know what good invoice software should do. But let’s get specific. If you’re evaluating tools – or worse, stuck with one that’s slowing you down – this is your checklist.

Not a wishlist. Not what looks nice in a product demo. What actually matters on the ground when you’re running a business in Qatar.

You can’t manage what you can’t see.

Your software needs to show exactly who paid, how much, when, and how — without making you click five times. This isn’t about “reporting.” It’s about visibility.

A 2022 study by Intuit showed that small businesses with real-time financial tracking tools improved cash flow forecasting accuracy by over 75%.

In a business environment where one late payment can stall your operations, that kind of visibility isn’t optional.

This is where most global tools fall flat.

Clients in Qatar aren’t looking to set up PayPal accounts or pay in dollars. They want to pay in riyals using local debit or credit cards, or via bank transfer. Your invoicing tool should support that.

If it doesn’t, you’re forcing your clients to jump through hoops. And every hoop is a chance they’ll bounce.

Let’s be honest: most invoice software was designed for someone sitting behind a desk. But that’s not how most small businesses operate.

You’re in the field. On the move. Meeting clients. Delivering orders. You need to send invoices from your phone. Check payments while you’re waiting for a client. Follow up from a taxi.

Mobile access isn’t a “nice to have” in Qatar. It’s how the work gets done.

It’s amazing how many tools ignore this.

Your team may work in English, but many of your clients prefer Arabic — especially when it comes to payments and official communication.

Invoices, SMS notifications, dashboard labels — your software needs to handle both languages natively. Not just to look professional, but to avoid costly misunderstandings.

Your dashboard should feel like a control center, not an accounting exam.

If you can’t tell in 10 seconds how your business is doing — who paid, who hasn’t, and what’s overdue — your software is failing you.

And no, you shouldn’t need to “generate a report” just to get that information.

Look, automation for the sake of automation is pointless. But when done right?

This is how you reclaim hours of admin every week — and redirect them to growing your business.

Most software gives you tools. What you need is leverage.

In the next section, we’ll break down how SADAD delivers all of the above, built from the ground up for small businesses in Qatar. Not adapted. Not translated. Designed. For you.

You’ve seen the checklist. You know the pain points.

Now here’s the tool that was built around them — not retrofitted after the fact.

SADAD isn’t just another software in the sea of options. It’s a system designed for how small businesses in Qatar actually operate: mobile-first, service-driven, and cash-flow-dependent.

Let’s break down what makes it different.

What is the most significant friction in most invoice systems?

Setup.

With SADAD, you don’t need a website. You don’t need coding. You don’t even need to call anyone.

You log in. You click “Quick Invoice.” You send a payment link through WhatsApp, SMS, or email. Done.

It takes 60 seconds, and you’re fully operational.

Your clients aren’t sitting on email all day. They’re checking WhatsApp. Getting SMS alerts. Scrolling through their phones.

SADAD meets them there. You can send unlimited branded payment links through whatever channel your client prefers — and they pay instantly. No logins. No friction.

This is what modern invoice management looks like. You don’t change client behavior. You integrate into it.

The second your client pays, SADAD tells you.

Every payment status — from pending to paid — is visible in your dashboard. Automatically updated. Easy to read. Always on.

And if a payment fails? SADAD retries it — automatically — until it goes through.

SADAD doesn’t assume you’re in the US or UK. It’s built for Qatar.

That last point isn’t a side note. As of 2024, more regional governments are pushing toward e-invoicing mandates. SADAD is already a certified e-invoice provider — which means you’re not just getting paid faster. You’re staying ahead of compliance issues before they happen.

This isn’t a niche tool for one sector. SADAD is being used today by:

Every one of them needed a tool that didn’t slow them down. And that’s the pattern you’ll see with SADAD — it’s simple enough to start using now, and powerful enough to grow with you.

Next, we’ll give you a smart checklist to help you compare invoice management software — not just on features, but on fit. Because getting paid shouldn’t be a guessing game. It should be a system.

Here’s the truth about software: most of it looks good on the homepage.

Slick UI. Big claims. Impressive logos. But when the dust settles, and you’re staring at your dashboard trying to send a simple invoice, the only thing that matters is whether the tool actually fits how your business runs.

That’s why feature lists are overrated — and fit is everything.

So here’s a real-world checklist to use before you commit to any invoice software. If it doesn’t check at least 80% of these boxes, it’s probably slowing you down.

If you need to call support, install an app, or “book a demo” just to send your first invoice, walk away.

Small businesses don’t have time for onboarding ceremonies. You should be able to create an invoice in under two minutes — on your own — and send it via any channel your client actually checks.

SADAD gets this right. But test it yourself. If it takes longer than brewing a coffee, it’s too complex.

Nearly 94% of people in Qatar access the internet primarily through mobile (source: DataReportal).

If your invoice system isn’t mobile-first, it’s disconnected from how business actually works here.

You should be able to manage your invoices while walking to a client site, not just from a desk. Especially if you’re in services, events, or fieldwork.

This is the dealbreaker.

Your clients need to pay using what they know. Local debit cards. Mada. Qatari riyals. Anything less — and you’re the reason for the delay, not them.

Many global tools still default to PayPal, Stripe, or bank wires in foreign currency. That’s a nonstarter in Qatar. Your invoicing tool should meet the market — not ask the market to adjust.

Bilingual support isn’t a checkbox for translation. It’s about communication. Clarity. Respect.

If your invoice template looks like it was Google-translated, you’re sending the wrong message. Choose a system where both the interface and the output feel native to your team and your clients.

SADAD lets you switch between Arabic and English without losing formatting, tone, or professionalism.

You might be a one-person show today. But if your invoicing tool caps your growth — or charges extra the moment you add complexity — it’s not a partner. It’s a bottleneck.

Look for systems that support:

In other words, tools that don’t force you to migrate later, just because you scaled.

If you’re checking these boxes, you’re not just buying software. You’re building an infrastructure that helps your business run more smoothly, look more professional, and get paid on time.

In the final section, we’ll bring it all together. You’ll know exactly where to go from here — and why now is the time to fix your invoicing for good.

There’s this idea that invoices are just something you do after the real work is done.

But if you’ve read this far, you already know that’s false.

Invoices are the work. They’re how you get paid. They’re how you stay afloat. And if you’re still managing them manually — or worse, using software that doesn’t fit your business — then you’re losing more than time.

You’re losing money. Visibility. Control.

And it’s not just theory. According to a 2023 GoCardless SMB report, nearly 40% of small business owners say that chasing payments damages customer relationships, and 1 in 3 say it keeps them up at night.

That’s what invoice management software is really about. Not automation for automation’s sake. Not dashboards. Not design.

It’s about freeing you up to run your business — instead of constantly catching up.

If you’re in Qatar, and you want to invoice faster, track smarter, and get paid with less effort, the solution already exists.

SADAD’s invoice management software is built for this exact moment in your business. Simple. Mobile-friendly. Compliant. Localized. And ready when you are.

So the next time you finish a job, send the invoice, and get paid — instantly — you’ll know: this wasn’t luck. This was a better system.

And now, it’s yours to use. Start here

Articles

Invoice Management Software That Helps You Get Paid Without Chasing

Invoice Management Software: A Complete Guide for Small Businesses in Qatar If you run a small business in Qatar, invoices are not paperwork. They are your cash flow. And when...

Read more

Articles

How to Choose the Best POS in Qatar (Complete 2025 Business Guide)

How to Choose the Best POS in Qatar There’s a moment every growing business in Qatar reaches when collecting payments becomes messy. Not because you don’t have customers. But because...

Read more

Articles

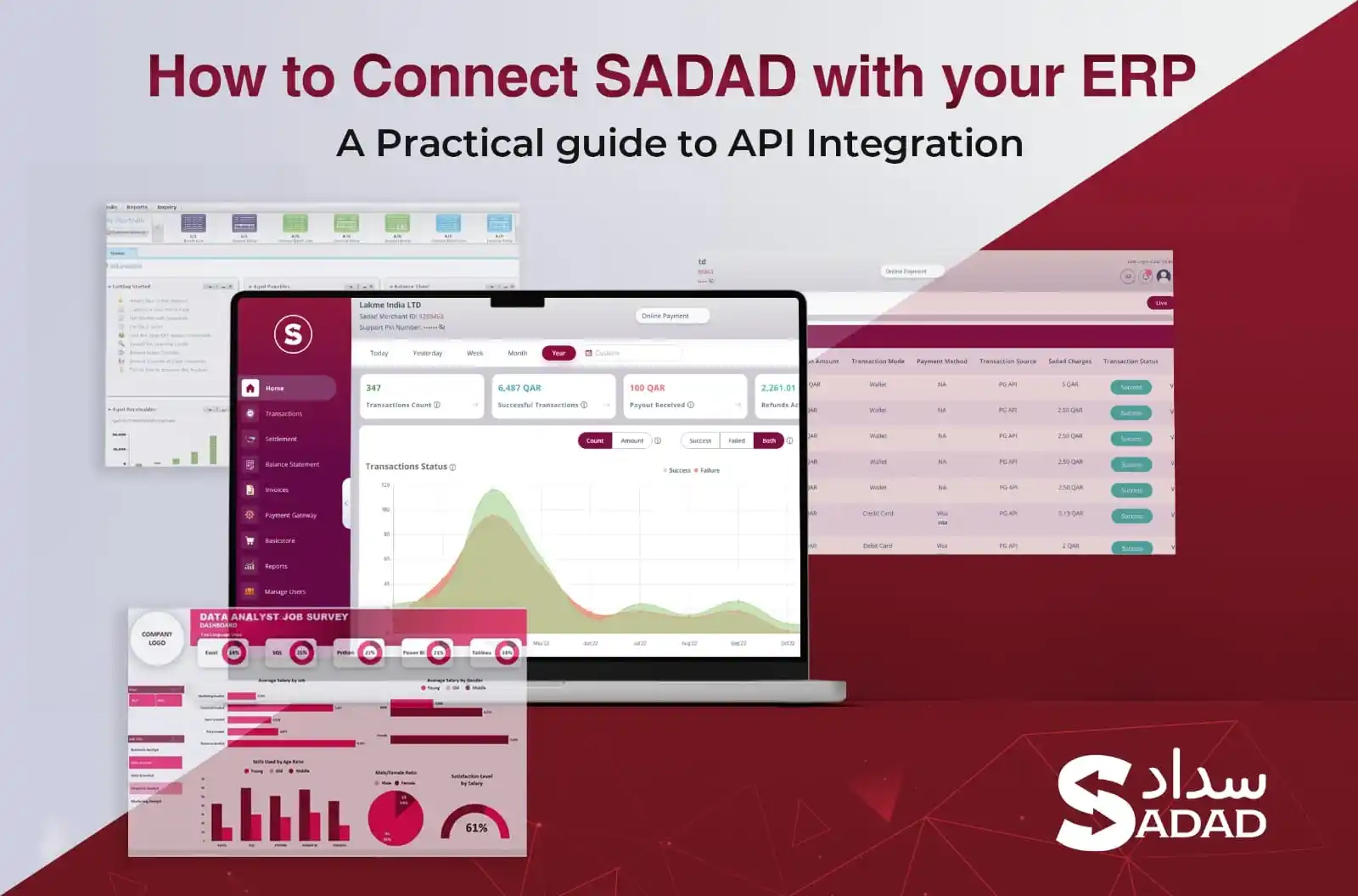

ERP API Integration in Qatar: The Fastest Way to Automate Payments with SADAD

SADAD ERP & API Integration in Qatar: The Masterclass for Scaling Your Finance Operations If you're managing payments, invoices, or sales data across multiple systems in Qatar and you're still...

Read more