Articles

How Invoice Software for Service Business Cuts Delays and Gets You Paid Faster

Imagine this: You’ve just finished a job. The customer is happy. You send them the invoice manually. Then… nothing.

No reply.

No payment.

I have no idea if they even saw it.

So now you’re stuck following up. Again. And again. Meanwhile, your cash flow is gasping for air — and your business is bleeding time just to get what it’s already earned.

That’s the invisible tax most service businesses in Qatar are paying. They’re using makeshift tools — such as Excel sheets, text messages, and verbal agreements — to run a process that’s critical to their survival.

Here’s the truth: If you’re still sending invoices manually and chasing payments yourself, you’re leaving money on the table every single week.

But there’s a better way.

In the next few minutes, you’ll see how local tools like SADAD invoicing are changing the game — making invoice software for service businesses instant, automated, and tailored for service-based businesses in Qatar.

No apps. No websites. Just clean, professional invoices sent in seconds — and paid just as fast.

Let’s break it down.

You don’t need to look far to see it happening.

Take Mohammed, who runs a mobile air conditioning repair service in Al Rayyan. His phone never stops ringing during the summer. But by the end of the month? He’s still chasing down payments.

Some customers forgot. Some claim they didn’t receive the invoice. Some say they’ll pay “next Thursday” — and never do.

His invoices are scattered across a mess of Excel sheets, and sticky notes. And every unpaid job is a quiet hit to his growth.

Here’s what most business owners in Qatar don’t realize: Your invoicing system isn’t just admin — it’s a profit lever.

When it’s broken, you feel it:

Every time you send an invoice and “wait to get paid,” you’re at the mercy of memory and good intentions. And if you’re managing more than 10 clients a month? That memory will fail.

Instead of focusing on bookings, service quality, or growing your customer base, you’re playing part-time accountant — writing messages like: “Just checking in to see if the invoice was received…”

Now multiply that by 20 clients. That’s hours lost — every month.

Let’s be honest: Sending an invoice as plain text or an unformatted PDF screams “part-time gig” — even if you run a legit, licensed business.

In contrast, sending a branded, one-click invoice via WhatsApp, SMS or email completely changes the game. It sets the tone. It builds trust. It gets you paid.

If I asked you right now:

Would you know?

Most service businesses don’t. They’re flying blind.

The problem isn’t you. It’s the outdated tools you’re trying to force-fit into a business that needs structure and clarity.

you may read :

However, the good news is that solving this doesn’t require a complete accounting system or a tech team—just the right tool, designed for how service businesses actually work.

In the next section, we’ll break down exactly what that tool needs to do — and why most software out there misses the mark in Qatar.

Most invoice tools look sleek in screenshots. However, try using them as a service provider in Qatar, and they quickly fall apart.

Too many options. Too much setup. And not a single feature that truly understands how your business operates.

So let’s flip the script. If you’re a technician, or small business owner running a service-based operation, here’s what your invoice software must deliver.

You’re not Shopify. You’re not running a product catalog or checkout page.

So why are so many platforms pushing you to build one?

Real talk: Fatima runs a home-based massage business in Lusail. She doesn’t have a website. She takes bookings via WhatsApp. Before SADAD, she had to send her bank IBAN and hope people followed through.

Now, she taps a button, sends a payment link via SMS, and gets paid before the appointment even starts.

Try explaining to an international SaaS platform that your client wants an invoice in Arabic, paid via a Qatari debit card, settled within two days.

Good luck with that.

SADAD, on the other hand, was designed specifically for this region — featuring bilingual invoices, QCB-compliant formats, and settlement timelines that align with local expectations.

No one’s checking email hourly.

Your client might see WhatsApp or Instagram DMs ten times before they touch their inbox.

Good invoice software meets them there.

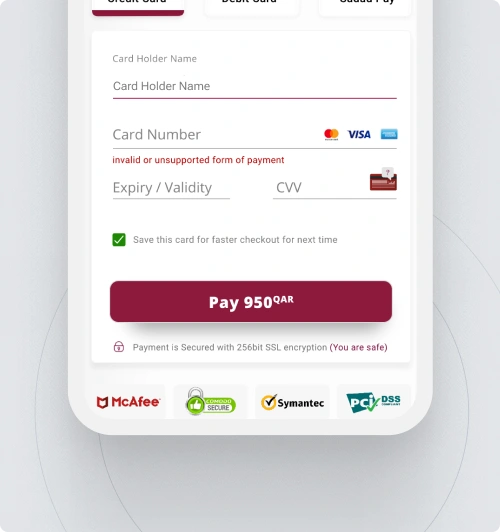

With SADAD, you can share the payment link:

No friction. No excuses.

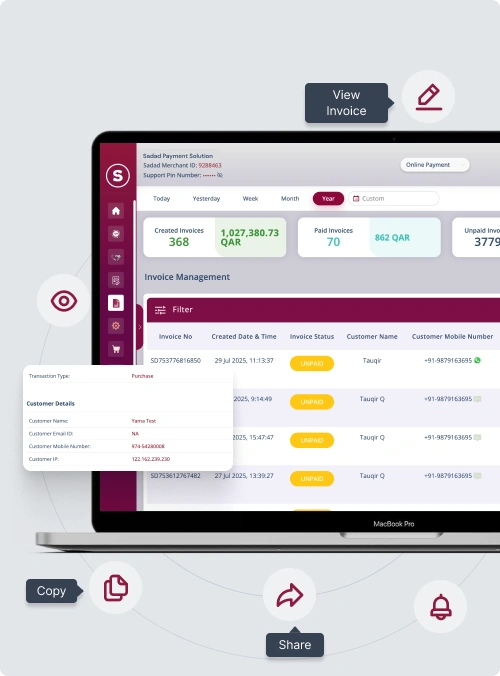

You shouldn’t need to guess if someone has paid.

Ali, who runs a small pest control team, used to mark invoices as paid “whenever the bank SMS came in.” Now, he sees it live in his dashboard — marked paid, pending, or failed — and gets notified instantly.

That’s not a feature. That’s peace of mind.

If your software doesn’t remind clients – politely, automatically, and on time – then it’s just another to-do on your plate.

With SADAD:

You’re free to focus on service, not spreadsheets.

Invoice software should feel like a helpful assistant — not another system to learn.

And in the next section, we’ll show you how the SADAD invoicing system is delivering precisely that for thousands of service businesses across Qatar — with no setup fees, no tech headaches, and no more chasing payments.

When you’re running a service business, getting paid shouldn’t feel like another job. But for most freelancers, contractors, and small teams in Qatar, that’s precisely what it is.

That’s where SADAD Invoice Payment Links come in — not as another software to learn, but as a shortcut to getting paid faster, with less effort.

Let’s look at how.

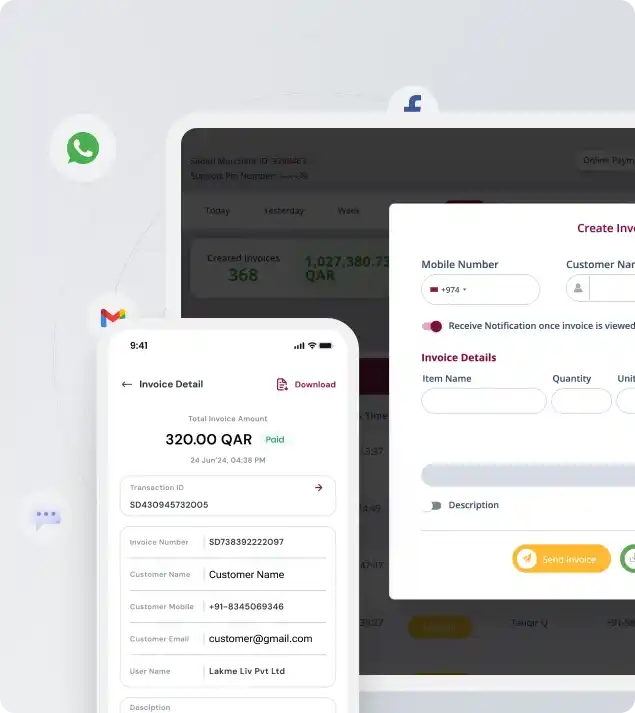

Ahmed owns a small car detailing service in Wakra. His entire booking flow is on WhatsApp. No app, no website, just referrals and hustle.

Before SADAD, his “invoices” were just messages with bank details. He logs into SADAD’s dashboard, enters the client’s name and amount, and sends a branded payment link by SMS. It works instantly. The customer taps, pays by card, and it’s done — with real-time confirmation.

No tech setup. No delays. No excuses.

Most micro-businesses start informally, often with just a phone number, a notebook, and perhaps an Excel sheet.

But as soon as you send a clean, secure payment link with your brand name and invoice breakdown, something shifts — in your business and in your client’s mind.

It’s not just about collecting payments. It’s about signaling that you’re running a serious operation, even if you’re a team of one.

Whether you’re a digital consultant in Doha or a private Arabic tutor serving clients across borders, SADAD supports multi-currency payments with high success rates.

You don’t need to think about how they’ll pay. You just send the link, and let SADAD handle the rest — credit card, debit, or wallet.

Even better: You get your settlement within two days. No middlemen. No hidden steps.

Let’s say you’re a personal trainer offering four sessions per month. You shouldn’t have to send a new invoice every week.

SADAD lets you automate recurring payments — with just one setup, the system handles it.

Your client gets a polite reminder before each charge. You get paid without having to ask for it.

That’s not just efficient. That’s how you scale.

You’re probably not sitting in an office with two screens.

You’re jumping between calls, locations, or service visits.

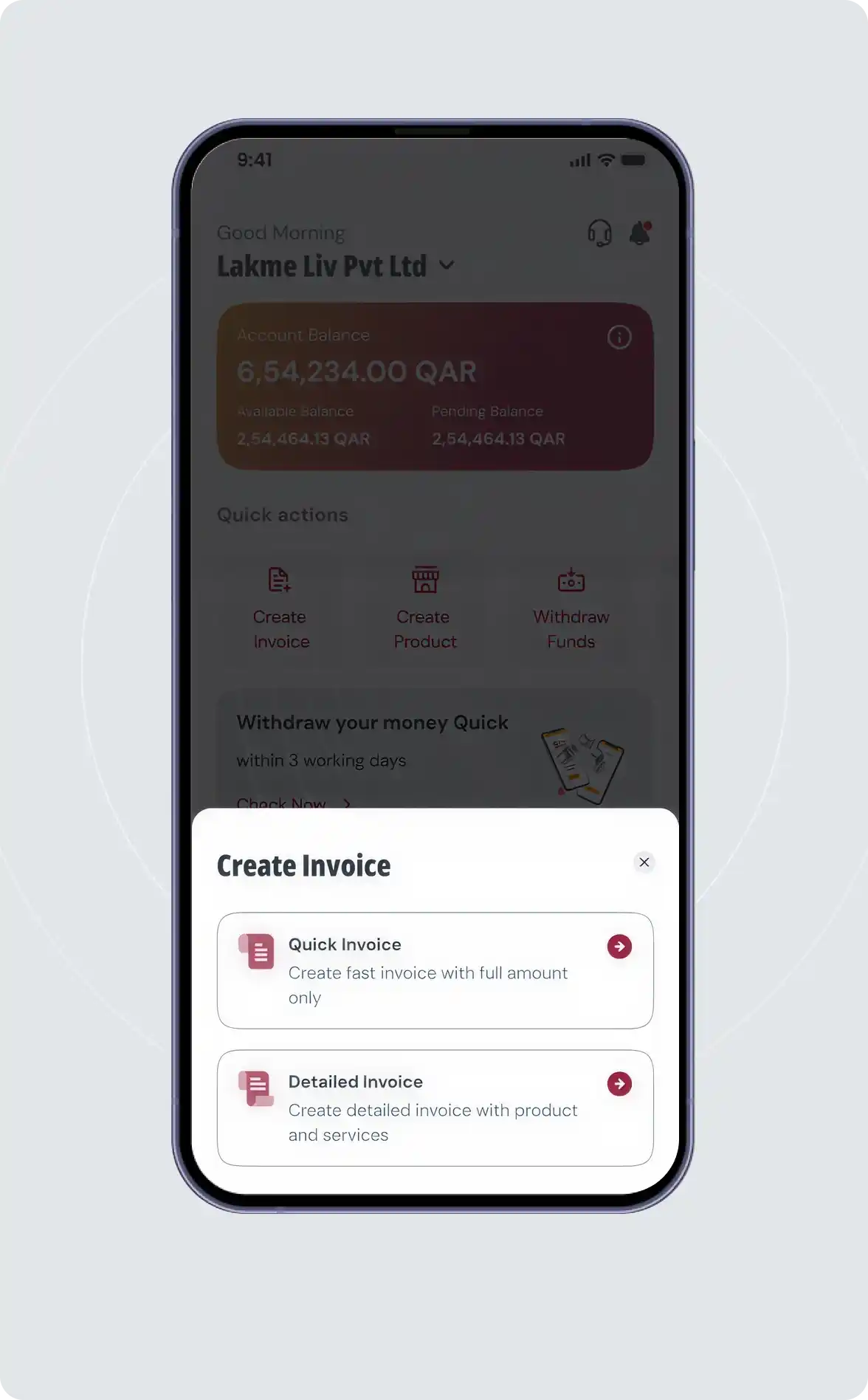

From the SADAD dashboard, you can:

It’s your back-office — without the overhead.

SADAD Invoice Payment Links aren’t built for software teams or accounting firms. They’re built for people like you — service providers who need simple, reliable, Arabic-first tools that just work.

Next, let’s see how real businesses are using them to reduce late payments and grow faster without changing how they work.

You don’t need a CRM. You don’t need an ERP. You need your money – in your account – on time.

And that’s precisely what SADAD Invoice Payment Links are helping business owners do across Qatar.

Let’s walk through what that looks like in real life.

Fatima runs a home-based beauty salon. Her days are packed with appointments — hair, makeup, and facials — often booked at the last minute over WhatsApp.

However, collecting payments was always a mess.

“Sometimes clients would say, ‘I’ll transfer later’ — and I didn’t want to chase them after they’d left.”

Then she discovered SADAD’s quick invoice option:

No more awkward payment reminders. No more ‘forgotten’ transfers. She sends the invoice before the session ends — and leaves with the payment confirmed.

Omar works independently in his own small company and travels across Doha for home repair and installation jobs. He doesn’t have time to open laptops or send manual follow-ups.

With SADAD:

“One client delayed payment for 4 days. SADAD kept reminding them automatically — I didn’t have to say a word. Payment came through before the weekend.”

The result: Omar’s late payments dropped by over 82% in the first month. And he stopped losing weekends chasing money.

Layali Logistics manages deliveries for local flower shops and boutique stores. Before SADAD, they relied on cash-on-delivery, which often led to no-shows and last-minute cancellations.

Switching to prepaid links solved that. Now they:

They no longer send drivers out for unpaid deliveries. The team has fewer disputes, tighter logistics — and more peace of mind.

These aren’t edge cases. They’re real stories from business owners who finally stopped treating invoicing as an afterthought — and started using it as a growth tool.

Next up: you’ll see precisely how easy it is to send your first payment link using SADAD — even if you’ve never touched invoicing software before.

One of the biggest myths about invoicing software?

That you need to “set things up first.”

In reality, you don’t need to be a techie. You don’t need a website. You don’t even need to download an app.

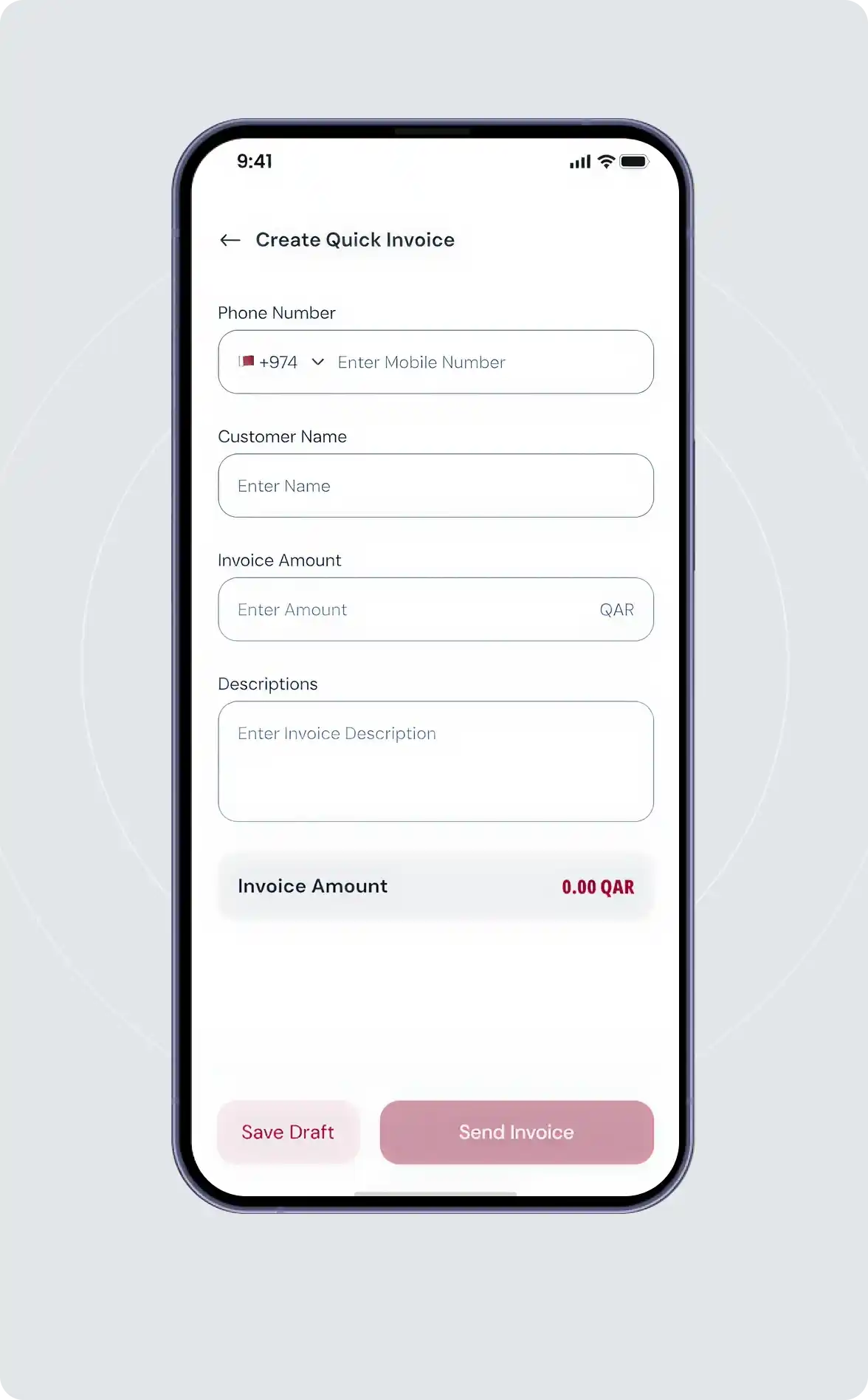

With SADAD Invoice Payment Links, if you can type a name and a number, you’re ready to get paid.

Here’s what it looks like in practice — whether you’re freelancing solo or running a small team.

Pro tip: You can even bookmark it on your phone for one-tap access between jobs

It’s all done on one screen. Takes less than 30 seconds.

With one click, you can send the invoice:

“My clients pay faster on WhatsApp than email — so I just send the invoice there and it works,” says Nada, a Doha-based nutrition coach who moved from manual transfers to payment links in a day.

The moment a client completes payment, you get a confirmation. No need to check the bank. No need to refresh anything.

You’ll know exactly:

If the client’s card fails, SADAD retries automatically. No follow-up from you needed.

That’s it. No setup. No training. No “demo call.”

And if you’re managing recurring services or packages?

SADAD allows you to automate repeat invoices, so you never have to send them manually again.

In the final section, we’ll wrap up this discussion and explain why taking control of your invoicing now could lead to more clients, less stress, and smoother growth in the months ahead.

If you’re still chasing payments through Excel sheets and WhatsApp messages, you’re spending too much time on the wrong things.

SADAD Invoice Payment Links are built for busy service providers in Qatar — no app, no website, no tech headaches.

Quick and professional invoices that your clients can pay in one tap.

Start getting paid faster — without the follow-up.

Try SADAD Invoice Payment Links today. Explore the features

Articles

The Cloud-Based Payment Solutions Qatar’s Small Businesses Actually Use

Cloud-Based Payment Solutions for Businesses That Want to Get Paid Faster Most business owners don’t think about their payment system until it becomes the reason they’re not getting paid. Maybe...

Read more

Articles

Invoice Management Software That Helps You Get Paid Without Chasing

Invoice Management Software: A Complete Guide for Small Businesses in Qatar If you run a small business in Qatar, invoices are not paperwork. They are your cash flow. And when...

Read more

Articles

How to Choose the Best POS in Qatar (Complete 2025 Business Guide)

How to Choose the Best POS in Qatar There’s a moment every growing business in Qatar reaches when collecting payments becomes messy. Not because you don’t have customers. But because...

Read more