Articles

Built in Qatar. Trusted by Business. This Is Why SADAD Wins

You don’t need five tools to get paid in Qatar. You just need one that works.

SADAD is a complete payment platform licensed by the Qatar Central Bank. It connects directly to the national payment network QPay, NAPS, routes payments through the Mastercard Gateway, has a principal membership with visa, AMEX and Mastercard, and is hosted on Microsoft Azure. It’s secure, fast, and purpose-built for businesses in Qatar.

With SADAD, you can accept payments online, in-store, via QR code, or via direct links. You’ll settle faster, receive more transactions, and finally get local support that answers on the first try.

Whether you’re a small shop or a large chain, the rest of this guide shows you exactly how and why SADAD fits.

Businesses in Qatar move fast. But their payment systems often don’t.

Many merchants still juggle separate tools for POS, online checkout, QR payments, and reconciliation. Each one has its own rules, fees, and support team. That slows down daily operations and delays settlements.

Worse, many providers route payments through foreign gateways. This causes payment failures and longer payout times. For high-volume merchants, it also means higher costs and weaker control over fraud and chargebacks.

At the same time, customer expectations in Qatar are rising. Nine out of ten small businesses already accept cards, and mobile payments are growing fast. With the introduction of national systems like Fawran and the Qatar Mobile Payment System (QMPS), buyers expect instant, cashless options at checkout, whether in a shop, on a website, or via a payment link.

The challenge isn’t finding tools. It’s connecting the right ones, at the correct cost, with local trust and direct rails.

That’s precisely where SADAD comes in.

SADAD is a licensed, end-to-end payments platform built in Qatar for Qatari merchants. It gives businesses one place to accept, track, and reconcile payments online, in person, on mobile devices, or via link.

You don’t need to manage separate providers for POS, checkout, and wallet. SADAD does it all, and it’s built to handle local complexity at scale.

Here’s what you can do with it:

This full-stack approach simplifies your operations. You get faster settlement, fewer failed transactions, and real-time visibility over your revenue.

More importantly, SADAD is local. It’s licensed by the Qatar Central Bank, directly connected to NAPS, QPay, has a principal membership with visa, mastercard, and american express, and absolutely compliant with both PCI-DSS and ISO 27001.

For businesses in Qatar, that means better control, local support, and a platform designed for how your customers actually pay.

You can explore the complete feature set here:

In the next section, we’ll break down how SADAD’s local infrastructure gives your business a real edge.

We’ll now explore how SADAD’s local infrastructure can significantly benefit your business.

When payments stay inside Qatar, your business moves faster.

The Qatar Central Bank licenses SADAD. That gives it the legal green light to operate and settle payments. But licensing is just the beginning.

SADAD connects directly to NAPS, the national payment switch. This means your card payments don’t need to leave the country.

You avoid foreign acquirers. You skip the global hops. You cut the risk.

With direct NAPS routing, you get:

That’s a significant upgrade from global providers who route everything through external rails. SADAD gives you local power, without the tradeoffs.

And it’s secure.

SADAD holds PCI-DSS certification. That protects all cardholder data. It also meets ISO 27001 standards for information security. That’s the gold standard for managing risk.

Your customers stay protected. Your operations remain in control.

With SADAD, every payment lands faster, with less stress and more visibility.

Next, we’ll show you what this looks like in action across online, offline, and mobile flows.

SADAD gives you everything in one place. No extra vendors. No fragmented tools.

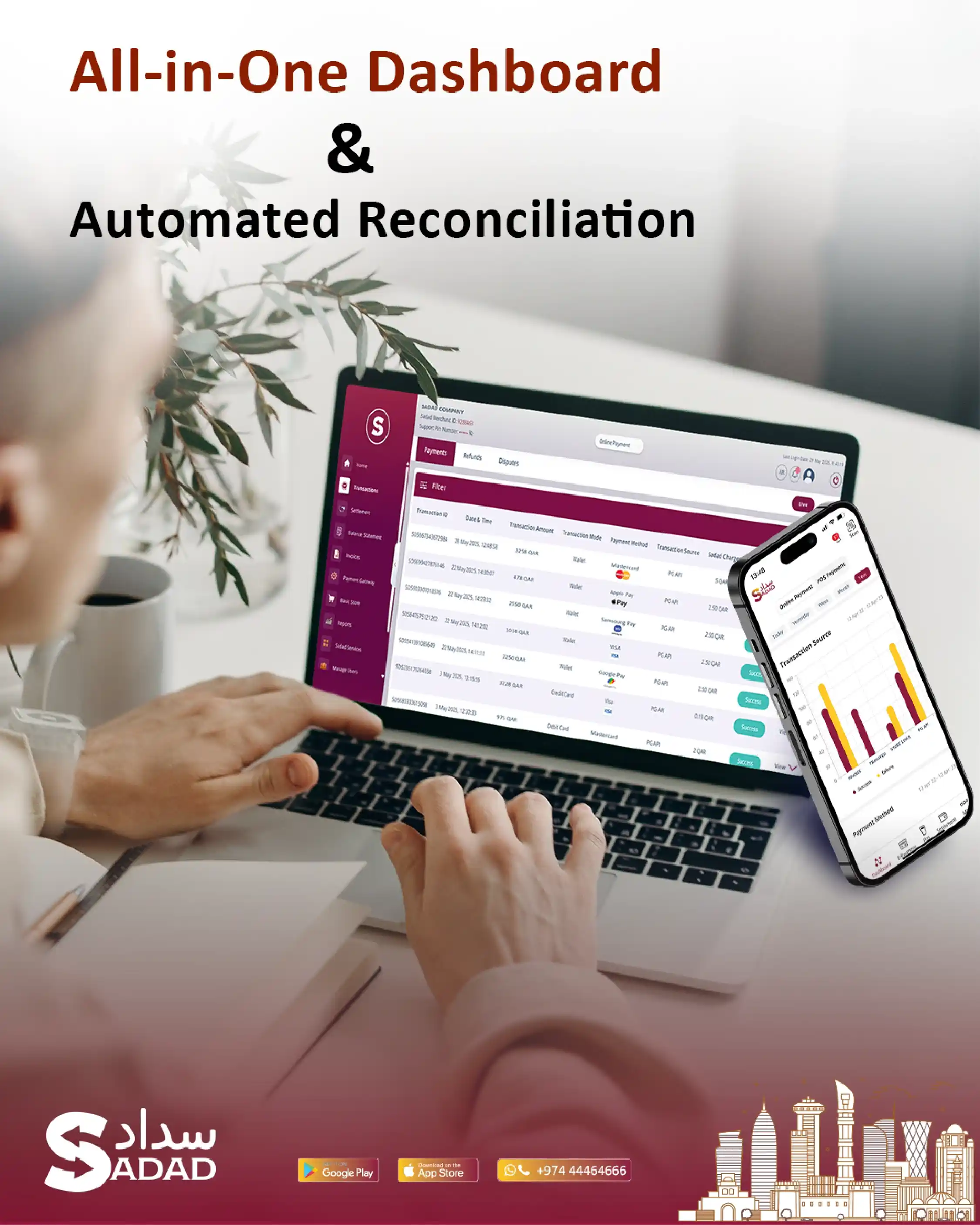

You can accept payments in-store, online, via QR code, or via a link. Then you track and reconcile every transaction in a single dashboard.

Here’s how the stack breaks down.

You get modern point-of-sale devices that connect to the SADAD system out of the box. For smaller setups, you can also turn your phone into a terminal with SoftPOS, no hardware required.

All POS activity syncs to your main dashboard, so you don’t have to chase down reports.

Use a hosted checkout, a custom iframe, or a full API integration to accept payments on your website or app.

SADAD supports all major card types, including Mastercard, Visa, and Meeza. You can also offer QR code-based payments that comply with QCB guidelines.

Want a simple option? Just send a link. SADAD lets you generate payment links for one-time or recurring charges, ideal for service businesses, freelancers, and deliveries.

Every payment, whether online or offline, feeds into one real-time dashboard: SADAD Cloud.

You can:

This isn’t just convenient. It’s critical when you’re managing volume, teams, or cash flow.

In the next section, we’ll look at what makes SADAD’s checkout experience better and how it helps you close more sales.

Speed matters. So does reliability.

If a customer’s card fails or the checkout feels slow, they leave. SADAD is designed to keep them in the flow and get your business paid.

SADAD processes payments through the Mastercard Gateway. That means global-grade infrastructure, tuned for local cards.

Cards from QNB, CBQ, Dukhan, and other banks are routed smartly. The system retries failed attempts and catches routing errors in real time.

This raises your approval rate. You recover sales that would be lost with other gateways.

The checkout loads quickly. It supports Arabic and English. It securely stores past users’ information, making repeat purchases smoother.

You can embed the payment form, redirect to SADAD-hosted pages, or build your own with the API.

All options are mobile‑first. That means fewer drop‑offs and a cleaner experience on phones.

SADAD includes real‑time fraud detection and transaction scoring. You don’t have to set rules. The system adapts based on risk signals and device fingerprints.

Suspicious activity gets flagged. Legitimate customers pass through fast. This lowers your chargeback rate and increases your clean sales.

When payments feel local, fast, and frictionless, people complete them. SADAD combines global tech with local rails to make that happen.

In the next section, we’ll break down how SADAD keeps everything running with uptime that matches the best in the region.

Payments never stop. Your system shouldn’t either.

That’s why SADAD runs on Microsoft Azure. It’s the first cloud-native payment provider in Qatar to do so. Every transaction, report, or webhook call is backed by enterprise-grade cloud resilience.

SADAD is designed for peak traffic. Whether you’re processing 10 payments or 10,000, the system holds up.

No queueing. No timeouts. No slowdowns during sales spikes or seasonal events.

The cloud setup also means updates roll out fast. You always run on the latest tech without downtime.

Use a POS in-store, a mobile link in WhatsApp, and a web checkout all at once. SADAD syncs everything in real time.

The merchant dashboard gives you a live feed. You can monitor failed transactions, track settlements, and resolve issues before customers even ask.

What if your POS crashes? What if your network fails?

SADAD’s cloud backbone gives you built-in redundancy. You can switch devices or channels while keeping customers charged.

That’s how enterprise systems should work. And now, every business in Qatar can access that same infrastructure.

In the next section, we’ll show how businesses of all sizes use SADAD, from home-based sellers to multi-location brands.

SADAD works for more than one kind of business. It adapts to a range of workflows, from solo sellers to large chains.

Below are four common cases. Each shows how the system fits into daily operations in Qatar.

Selling on Instagram or WhatsApp? You don’t need a website. With SADAD, you can send payment links directly to customers.

You also get a mobile dashboard to track transactions and issue refunds. No paperwork. No hardware. No bank visits.

This helps freelancers, tutors, bakers, and service providers get started fast and stay compliant.

Run a café, clinic, or salon? SADAD gives you a smart POS, SoftPOS, and a cloud dashboard in one bundle.

You can train staff in minutes, assign roles, and reconcile daily cash flow without spreadsheets. The system works across branches and tracks everything in real time.

Refunds, receipts, and reports are all in your control.

Need to track sales from many locations or couriers? SADAD links your online gateway, in-store terminals, and driver tools into one view.

You can compare branches, audit transactions, and spot issues early. The cloud-based setup keeps everything in sync.

This helps restaurants, pharmacies, fashion chains, and logistics brands run lean without juggling systems.

For larger entities, SADAD offers direct NAPS routing, SLAs, and integration support. The system handles high-volume payments, tracks complex settlements, and integrates with accounting tools.

You also get security controls and advanced fraud monitoring by default.

Need a custom flow or bank-grade reporting? The SADAD team will scope it with you.

Next up, we’ll walk through how developers can take this stack live from first test to full production.

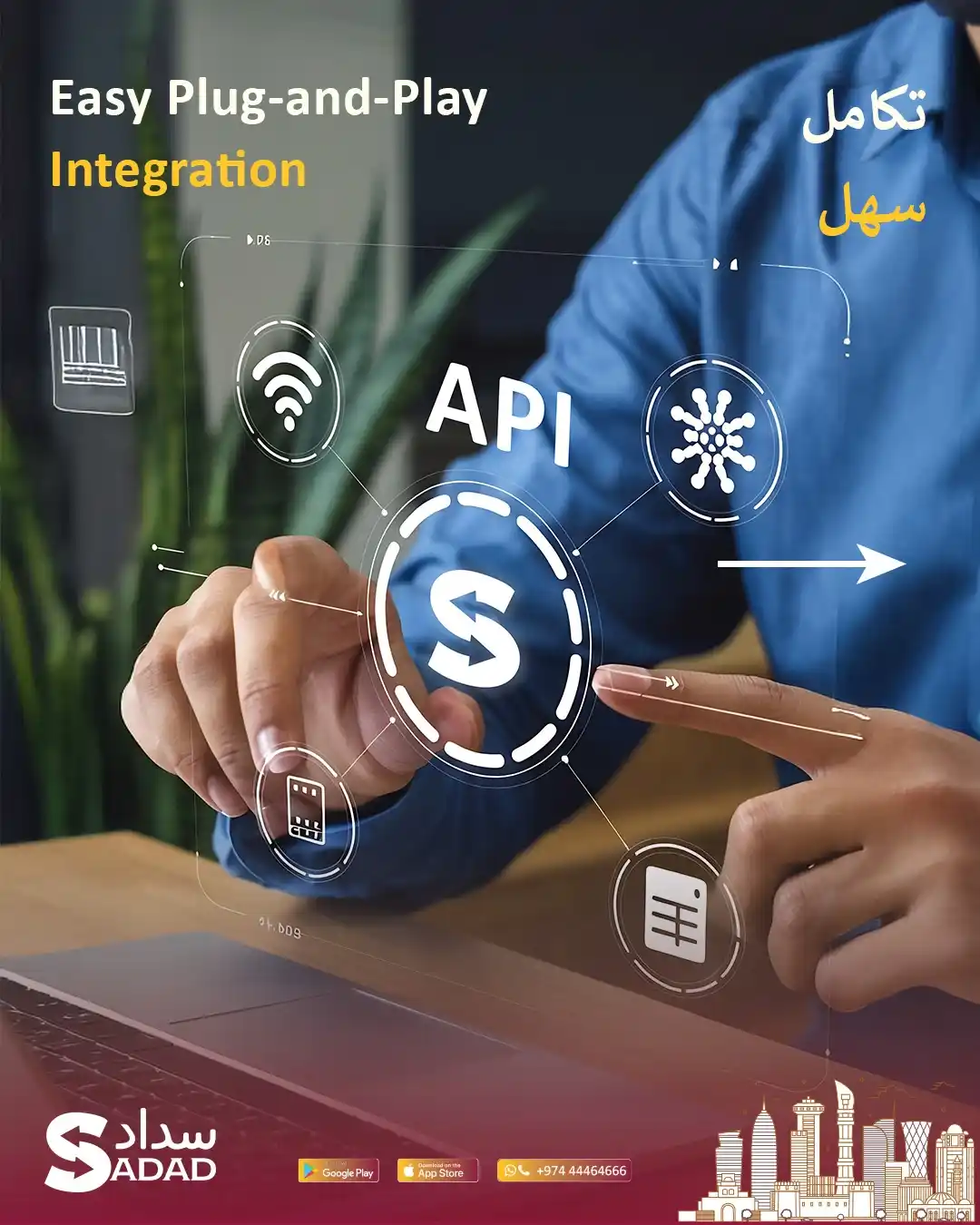

You don’t need weeks to integrate SADAD. You can start testing in minutes.

SADAD gives your team full access to developer docs, sample payloads, sandbox keys, and real-time support during setup.

The setup is simple. You create an account, generate your test credentials, and start sending simulated transactions. You can build with:

You can also test refunds, retries, and 3D Secure flows before going live.

Once ready, you move to production with a separate key, no code changes required.

You can use SADAD in custom apps, web platforms, marketplaces, or CMS tools. It supports subscription logic, saved cards, and instant refunds.

SADAD also works with most payment orchestration layers. If you’re running a multi-country gateway setup, you can add it as your local provider in Qatar.

The system supports:

All endpoints are secured with authentication headers and TLS encryption. The system complies with PCI-DSS and ISO 27001 by default.

Your dev team doesn’t need to manage compliance; SADAD handles it behind the scenes.

You focus on your product. SADAD takes care of payments.

Next, we’ll look at how SADAD handles security, fraud, and risk to keep you protected at every step.

SADAD doesn’t treat security as an extra feature. It’s part of the foundation.

Every transaction runs through systems that meet global security standards while remaining compliant with Qatar’s financial laws.

SADAD is entirely PCI-DSS compliant. That means cardholder data is protected at every step, from entry to settlement.

It’s also ISO 27001 certified. This global standard covers data privacy, access control, encryption, and disaster recovery. You don’t need to manage those risks yourself. SADAD does it for you.

The platform runs intelligent fraud filters behind the scenes. It flags risky behavior, blocks suspicious cards, and tracks device fingerprints.

You don’t need to write rules or toggle switches. SADAD learns as it processes. That means fewer chargebacks, lower fraud rates, and more clean sales.

Not every employee needs access to everything. With SADAD, you can assign roles across your finance, operations, and support teams. Each user gets a secure login and limited access.

You can monitor changes, control permissions, and lock down your data all from one place.

Security isn’t just about compliance. It’s about control. And with SADAD, it’s built in from the start.

Next, we’ll cover support and how SADAD keeps your team moving even when issues arise.

Most payment providers in Qatar offer support. Few deliver when it counts.

SADAD keeps things simple. You speak to a real team based here in Qatar who understands your setup, your tools, and your urgency.

Whether it’s 2 p.m. or 2 a.m., you can reach SADAD’s support team. No chatbots. No tickets that vanish. Just a team trained to solve real issues fast.

They help with:

And they don’t disappear after setup. You get help before, during, and after launch.

The team doesn’t just speak Arabic. They say your business. They understand local banks, card issues, peak sales seasons, and QCB rules.

They’ve supported everything from cafés and clinics to marketplaces and ministries.

That makes a difference when something breaks, and you don’t have time to explain everything twice.

You can reach support by phone, email, or inside the SADAD dashboard. You also get access to setup guides, testing tools, and real-time error logs.

Support isn’t just a number to call. It’s a system built around your team.

In the next section, we’ll highlight the proof behind the claims, licenses, partnerships, and product milestones that show SADAD is built to last.

Claims mean little without evidence. SADAD has the track record to prove it.

The Qatar Central Bank licenses SADAD to operate as a payment service provider. This license confirms that it meets all legal and financial requirements to process payments in the country.

SADAD was also one of the first fintechs to gain direct access to NAPS. This is a significant shift. It means merchants can settle locally without the need for foreign intermediaries.

In 2025, Mastercard partnered with SADAD to boost digital payments in Qatar. The partnership includes access to Mastercard’s global gateway infrastructure. This improves payment approval rates and reduces fraud.

SADAD also runs entirely on Microsoft Azure. That gives the platform cloud-grade reliability and scalability with data residency in Qatar.

Security isn’t a checkbox. SADAD is PCI-DSS and ISO 27001 certified. That means your data—and your customers’ data—stays protected whether you process 50 payments a week or 50,000.

SADAD combines international-grade infrastructure with full local compliance.

In the next section, we’ll compare it to other options on the market so you can choose what best fits your business.

Not all payment gateways are built the same. Especially in Qatar.

Here’s how SADAD stacks up against the common alternatives: bank-based gateways and international PSPs.

Banks like QNB, CBQ, and Dukhan offer merchant services. These include POS devices and basic online payment pages. While they’re trusted, they often lack:

You also have to juggle tools. POS from one provider. Online payments from another. Reconciliation becomes manual.

SADAD brings it all together in one place with the same local licensing.

Platforms like Stripe or Checkout.com offer modern APIs and global reach. But they route payments through offshore acquirers. That leads to:

Also, many don’t support QCB-mandated features like NAPS routing or QR compliance.

SADAD is built with Qatar in mind. It speaks the language, supports the rails, and understands your local customers.

SADAD gives you:

You don’t trade convenience for compliance. You get both.

| Feature | SADAD | Bank Gateways | Global PSPs |

| QCB Licensed | ✅ Yes | ✅ Yes | ❌ No (typically) |

| Direct NAPS Access | ✅ Yes | ✅ Yes | ❌ No |

| Unified POS + Online Gateway | ✅ Yes | ❌ Separate tools | ✅ Yes |

| 24/7 Local Support | ✅ Yes | ❌ Limited to business hours | ❌ Offshore teams |

| Real-Time Dashboard | ✅ SADAD Cloud | ❌ Often missing | ✅ Yes |

| Advanced Developer Tools | ✅ API & SDKs | ❌ Very limited | ✅ Yes |

| PCI & ISO Certified | ✅ Security Certified | ❌ Varies | ✅ Yes |

| Support for QR & Wallets | ✅ Yes | ❌ Not standard | ❌ Rare |

In the next section, we’ll show what it takes to go live and how to start accepting payments with SADAD in days, not weeks.

You don’t need a long setup cycle. You don’t need training manuals. SADAD makes it easy to get started quickly.

Visit panel.sadad.qa and register your business. You’ll need:

You can choose your setup: in-store, online, or both.

Once your documents are verified, SADAD activates your account. Most businesses go live in under 60 minutes..

If you ordered POS devices, they’ll be delivered and configured on-site. If you’re going online, you get test credentials and access to the developer dashboard.

You’ll also get access to the merchant portal to monitor all activity.

Once live, you can:

You get one system for all channels—no need to check five dashboards.

Need help during setup?

SADAD’s support team is available 24/7 to guide you.

Next, we’ll look at pricing and how to calculate the real cost of getting paid.

You’re not just paying for a payment gateway. You’re investing in smoother operations, faster cash flow, and fewer lost sales.

Here’s how to think about SADAD’s pricing and what makes it worth it.

SADAD keeps pricing clear. You pay based on transaction volume, channel (POS or online), and settlement method.

You can choose from:

You’ll also see rates for:

To get exact pricing, check the official pricing page or contact the team for a quote.

Because SADAD uses direct NAPS routing, you avoid foreign acquiring costs. That means better rates on local cards and faster settlements to your account.

You also reduce operational costs:

When you look beyond the rate, SADAD delivers strong ROI across your business.

When evaluating payment providers in Qatar, compare:

| Factor | Why It Matters |

| Approval rates | Higher approvals mean more completed sales |

| Settlement speed | Faster payouts mean better cash flow |

| Downtime risk | Downtime equals lost revenue |

| Support speed | Faster help keeps operations smooth |

| Fraud handling | Fewer chargebacks protect your margins |

SADAD performs across every one of these.

Next, we’ll answer the most common questions businesses ask before switching from timelines to tools to transition steps.

Still thinking it through? Below are the questions most businesses ask before they switch to SADAD.

Most businesses activate in 60 minutes faster if you don’t need POS hardware.

All you need is a valid CR, QID, and a local bank account. You apply online via panel.sadad.qa.

Not always.

If you use payment links or SoftPOS, no integration is needed. If you want to accept payments on your website or app, your developer can use SADAD’s ready-made API or iframe.

SADAD supports Visa, Mastercard, Meeza, and other cards issued in Qatar. It also supports QR and mobile wallet payments via the SADAD consumer app.

More local options are coming as NAPS evolves.

If your current POS is QCB-approved and unlocked, you can use it. But SADAD recommends its smart devices for full feature access and support.

Ask the team to confirm based on your setup.

For local cards, SADAD settles to your bank through NAPS. You get funds faster, with fewer delays.

You can track each settlement in the SADAD Cloud dashboard.

SADAD offers 24/7 local support. You can reach them by phone, email, or chat, whether you’re reporting a failed payment or setting up a new branch.

They respond fast. No ticket chases—no long waits.

SADAD is more than a payment provider. It’s a full-stack system built for businesses in Qatar. You get speed, compliance, and real local support without juggling tools or chasing your money.

If you’re tired of slow settlements, broken integrations, or generic platforms that don’t understand the Qatari market, now’s the time to move.

You can get started in three ways:

Your customers are ready to pay. Let SADAD help you get paid faster, cleaner, and with complete control.

Articles

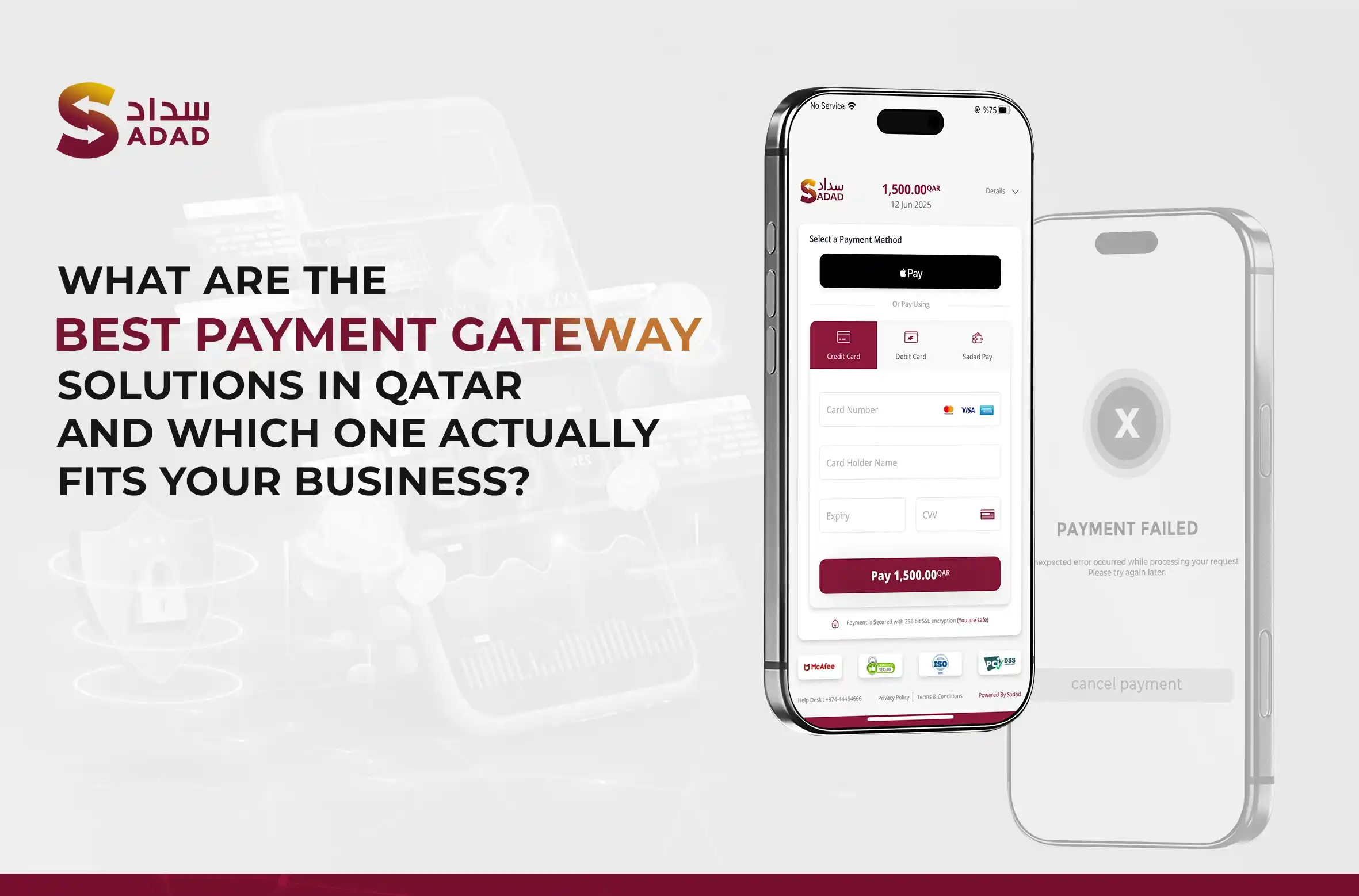

What Are the Best Payment Gateway Solutions in Qatar? A Full Comparison for Business Owners

What Are the Best Payment Gateway Solutions in Qatar, And Which One Actually Fits Your Business? Most businesses in Qatar don't have a payment problem. They have a payment frustration....

Read more

Articles

The Future of Payments in Qatar: 5 Shifts That Will Change How Your Business Gets Paid

The Future of Payments in Qatar: What Every Business Needs to Know In July 2025, Qatari businesses processed $4.4 billion in digital transactions, totaling 51.7 million individual payments. SAMENA Daily...

Read more

Articles

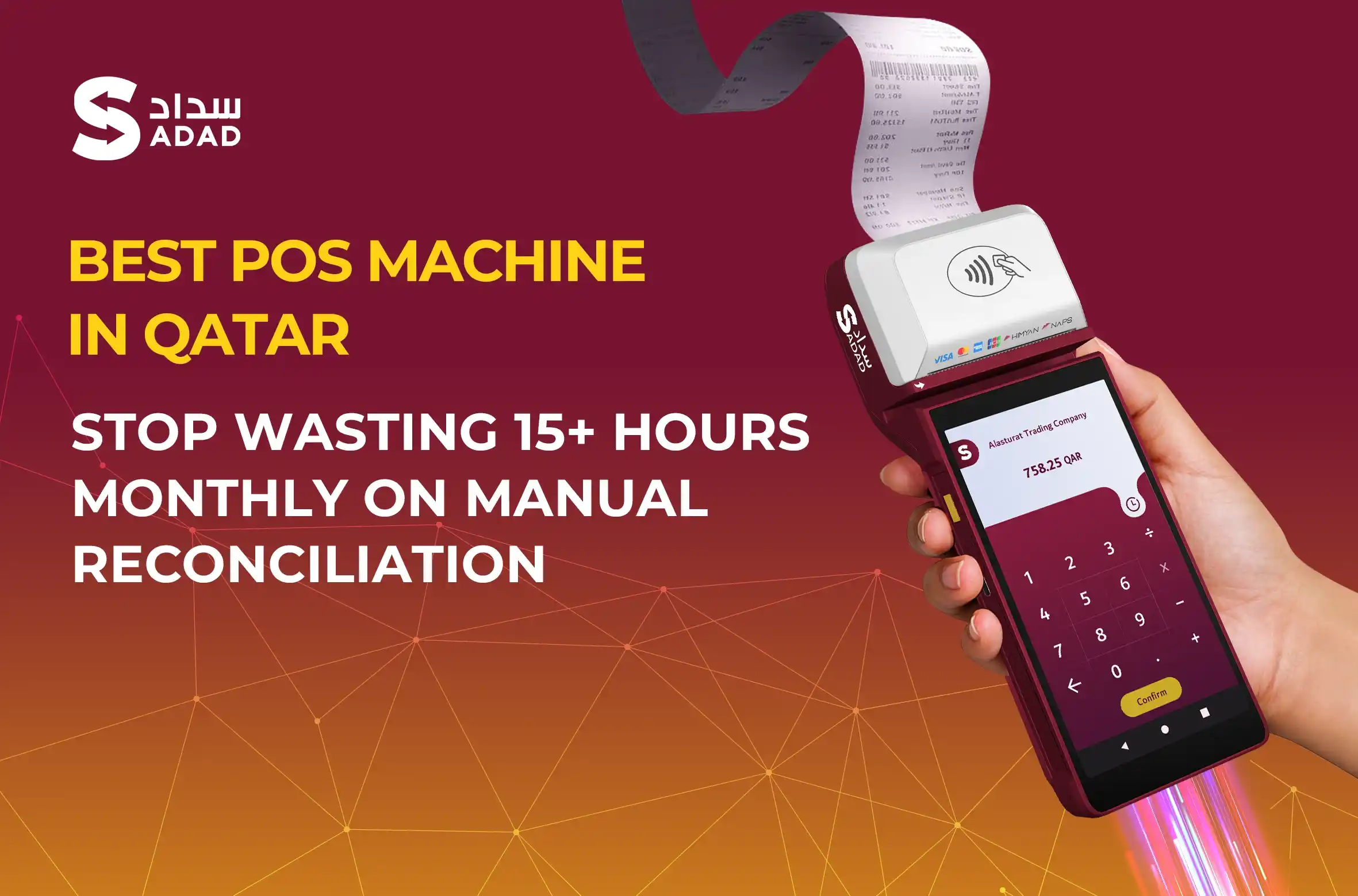

Best POS device in Qatar: Why SADAD Plus Outperforms Bank-Issued Terminals

Best POS device in Qatar: Why SADAD Plus Outperforms Traditional Terminals Last month, a café owner in West Bay showed me his counter. Three different POS machines. One from his...

Read more