Articles

Best Payment Processor for Small Business in Qatar: The Definitive SADAD Guide

You want to start taking payments. Today. You sell through WhatsApp, Instagram, or a simple site. You need local cards to work. You need a clean checkout. You need a live dashboard that tells you what got paid.

to find the Best Payment Processor

SADAD is the straight path.

This guide gives you a clear plan to go live fast. No website required.

What you’ll get:

Read this if you want a setup that works now and scales with you later.

Best Payment Processor

Before we talk tools, you need a clear picture of how money moves online in Qatar. Once you see the flow, every setup decision gets easier.

One provider can bundle several of these roles. That’s fine. What matters is that the provider speaks Qatar’s rails and gives you clean reporting.

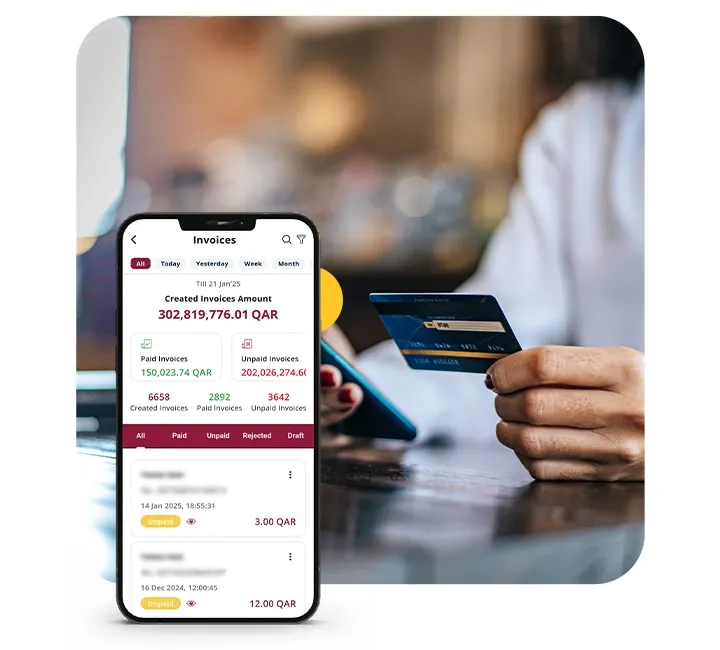

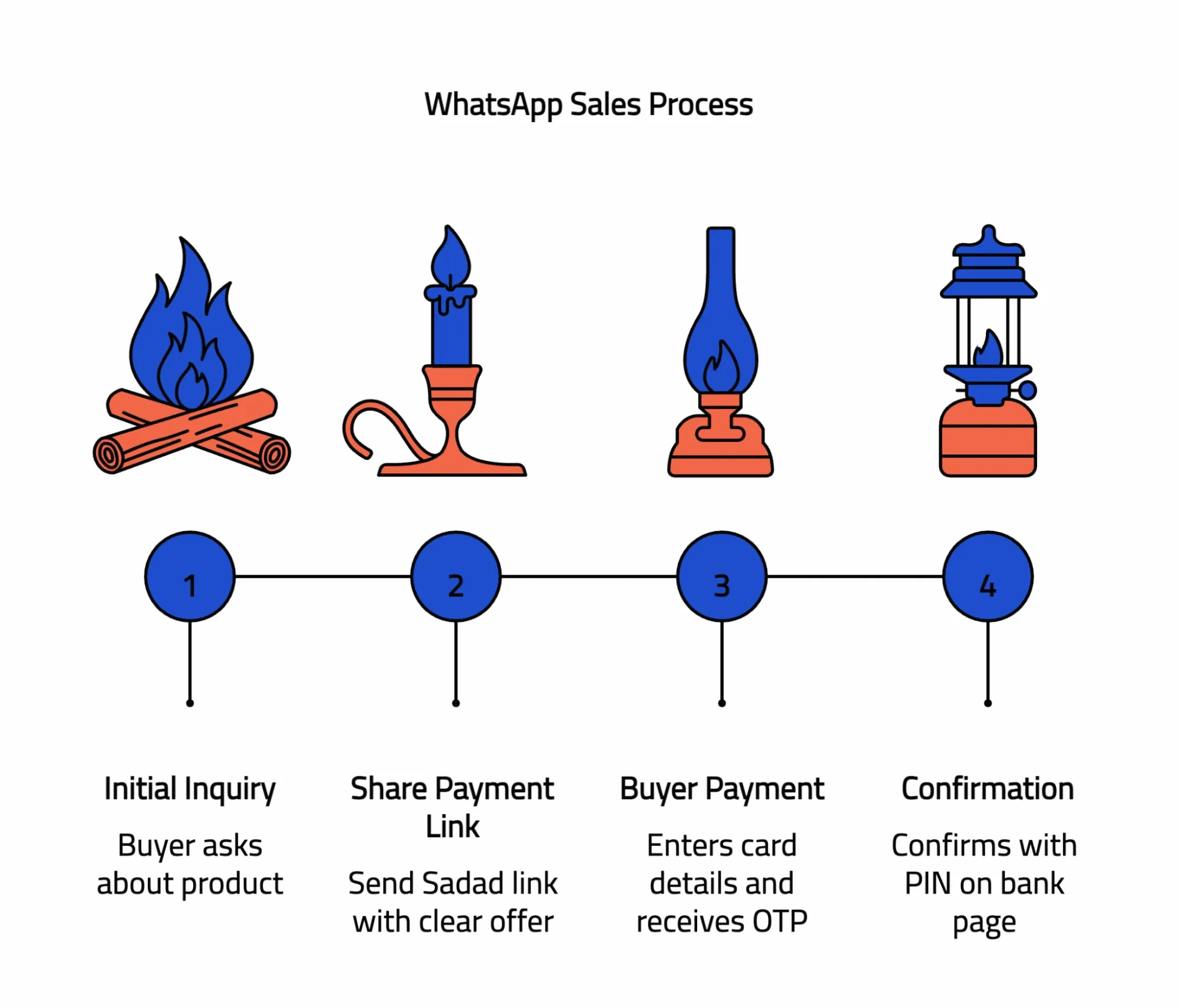

A customer enters card details on your checkout or invoice link. They get a one-time password by SMS. They confirm with their card PIN on the bank page.

You show a clear success state. Your dashboard updates within seconds.

That two-step check – OTP then PIN – is normal in Qatar. It builds trust and lifts approval rates. Plan your copy around it so no one gets confused.

Every online card payment carries network costs. Two big pieces drive most of it:

Your effective rate depends on card type, channel, and your mix of domestic vs international. Don’t guess. Ask for a blended estimate based on your last 30 days of sales or a realistic forecast if you’re new.

This part covers what every business needs to get right: the funnel that drives conversion, the checkout choices that cut drop-off, the basics of risk, and the signals that lift bank acceptance. Read this section first. Then jump to the playbooks that match how you sell.

Every payment passes three gates: checkout completion, risk checks, bank acceptance.

Conversion happens only when all three say yes.

Your job is to tighten all three. Treat them as one system, not separate projects.

Short forms win. So does clarity.

If you sell by link or invoice, the same rules apply: clear amount, tight description, one clean pay action, success state that’s impossible to miss.

The goal is not zero fraud. The goal is low fraud with high acceptance.

When you need stronger checks, use step-up prompts only where risk is real, not on every transaction.

Issuing banks say yes or no based on data quality and account status. Give them clean signals.

Cards are your base. Local rails matter.

VAT and invoicing rules change by jurisdiction. Build habits that scale.

What this section gives you: a mental model for payments that matches how Qatar actually works. Next, we’ll apply a scoring lens to SADAD so you can make fast, confident decisions about setup, plugins, and day-one execution.

This is the decision lens. When a small team asks for the best processor, I score five things that move cash to your account with the least friction.

Time to first payment: strong. Create a link or invoice from the dashboard and collect a real payment the same day. No site required.

Local acceptance: strong. Built for Qatar’s checkout reality. The copy and flow expect OTP by SMS and PIN on the bank page.

Sell without a website: strong. Links and invoices are shared cleanly on WhatsApp and email. Status updates in real time with simple reminders.

Plugins and API: strong. Native path for WooCommerce, a documented route for Shopify, and a developer hub with APIs, SDKs, and webhooks.

Reporting, refunds, and controls: strong. Live transactions, quick refunds, clean exports. Finance gets the data it needs without manual cleanup.

Next, you’ll see SADAD at a glance: the specific actions you can launch this week and the problems each one solves.

You want outcomes, not a feature catalog. Here is what you can turn on now and what each piece does for your revenue.

Create a link in the dashboard, add amount and description, hit generate. Share it on WhatsApp, SMS, or email. Track opened, paid, and failed in real time.

Why it matters: you sell without a site, close DMs faster, and prove demand before you invest in a full store.

Build an invoice with line items, tax, and a due date. Each invoice includes a pay button. Send by email or paste the link into WhatsApp. Set reminders for due and overdue.

Why it matters: you stop chasing transfers and turn service work into predictable cash flow.

Use Tarweej to generate a link per product. Drop it in bios, stories, and DMs. Buyers move from discovery to payment without extra steps.

Why it matters: you convert attention into orders with fewer clicks.

Support the QPAY flow for domestic cards. Buyers receive an OTP by SMS and confirm with their card PIN on the bank page. Write a clear copy that sets this expectation and test the return to your success screen.

Why it matters: trust rises, approval rates follow.

Surface Apple Pay on iOS for one-tap checkout. Keep card rails as the default for maximum coverage.

Why it matters: you lift mobile conversion without breaking the base path.

WooCommerce: install the SADAD QA Payment plugin and enable Pay with SADAD. Shopify: follow the merchant guide to add a custom method. Developers: use the API, SDKs, and webhooks to extend flows or add native apps.

Why it matters: you start simple and keep a clean path to scale.

See transactions as they happen. Trigger full or partial refunds from the same screen. Export reports that map to your accounting fields.

Why it matters: finance gets clarity, customers get fast resolutions.

Next section: setup playbooks for links, invoices, WooCommerce, Shopify, and mobile so you can go live step by step.

Pick the setup that matches how you sell. I’ll explain why it works, what to watch, and how to keep a clean path to scale.

Payment links are the fastest way to prove demand. You create a link in the dashboard, share it on WhatsApp or email, and watch the payment land. The buyer sees a clear amount and purpose, then moves through Qatar’s familiar path: OTP by SMS followed by PIN on the bank page. That two-step flow builds trust. It also reduces “I wasn’t sure it went through” messages.

What makes links convert:

When to outgrow links: once you repeat the same offer daily, or you need inventory, taxes, and shipping rules on autopilot. Until then, links are the right speed.

If you sell time, packages, or one-off deliverables, invoices beat bank transfers. Each invoice includes a pay button and tracks status. You keep numbering consistent for accounting, show tax lines, and send reminders automatically. Think of it as your payment page wrapped around a professional document.

How to keep invoicing clean:

Invoices do more than collect money. They reduce back-and-forth, make reconciliation predictable, and let you hand clean exports to finance.

Many small stores in Qatar choose WooCommerce because it is flexible and familiar. The goal is a native payment method that feels like part of your store and respects the local flow. With the SADAD plugin, you keep shoppers in your brand, pass clean order references, and issue refunds from the same admin they already use.

What matters most here:

If you keep those three in shape, you get a checkout that feels first-party and a back office your team understands.

Shopify gives you speed, themes, and a tight admin. Your job is to add a card method that speaks the local rails without disturbing the buying flow. Follow the merchant guide, create the connection, and limit availability to Qatar if you sell locally. Place a live order, read the order timeline, and make sure the payment reference appears where support will look.

Two practical checks:

If both are true, you have a shop that converts on mobile and keeps all the operational signals in one place.

Apps win when the payment feels like part of the product, not a detour. That starts with a server-first approach. Create payments on your backend, never expose keys in the app, and use tokenization for returning buyers. Webhooks carry the truth of paid, failed, and refunded. Treat them as a source of record and make handlers idempotent so repeats never double-charge.

Architecture that scales:

Do this now and you avoid rewrites when volume climbs.

Good setups die when money is unclear. Lock down the basics early. Ask for an effective rate that reflects your mix of domestic and international cards. Write down settlement timing and any reserves. Know the chargeback fee and the dispute window. On day one, run three transactions: a live charge, a full refund, and a partial refund. Export reports and check that columns map to your accounting fields.

What you gain:

This is how you move from idea to working payments without turning your week into a build. Links prove demand. Invoices clean up service work. WooCommerce and Shopify bring structure when you need a store. Custom flows stay safe when the server owns the keys and webhooks tell the truth.

Next, we will map these setups to real scenarios in Qatar and show what to measure in week one.

Small businesses win when payments fit how people actually buy. The examples below show what that looks like with SADAD. Read the one that matches your week. Borrow what works. Keep moving.

You start with a conversation. A buyer asks for a price or a size. You answer, then share a SADAD payment link with a clear label and amount. The buyer sees a clean page, enters card details, receives an OTP by SMS, confirms with a PIN on the bank page, and lands on your success screen. No store required. No detours.

Two things drive results here. First, clarity. Name the offer in the link so the buyer recognizes it in one glance. Second, pace. Send the link while the chat is warm and follow with a short reminder if it stalls. Over a week, you’ll see a pattern: links close impulse buys fast and turn DMs into a repeatable sales lane.

What to watch: the share of clicked links that become paid, mobile load time on 4G, and how often buyers ask, “Did it go through?” If that question pops up, add one sentence above the pay button that explains the Qatar flow: OTP by SMS, then PIN on the bank page.

If you sell time or deliverables, invoices do more than collect. They set terms. A SADAD invoice carries line items, tax, and a due date along with a pay button. You send it by email or paste the link in WhatsApp. The system tracks opened and paid so you are not guessing.

This format reduces friction on both sides. Clients see a professional document with everything in one place. You keep numbering consistent for accounting and trigger reminders without chasing. Do one dry run on a small amount so you know the refund path before you ever need it.

The metric that matters is days to payment from send. If it stretches, tighten scope descriptions and use deposits to create commitment. Most service businesses see fewer disputes once invoice references match how finance files work.

Many shops in Qatar use WooCommerce for its control and familiarity. Your goal is a checkout that feels native and respects local rails. With the SADAD plugin enabled, shoppers remain in your brand, orders carry the SADAD reference in the notes, and refunds happen inside the same admin your team already knows.

The make-or-break details live on mobile. Cart to checkout has to hand off instantly. Return from the bank page must land on a clear thank-you view. Exclude checkout and thank-you URLs from caching so nothing gets stuck. When these pieces are in place, you get fewer abandoned sessions and cleaner support work because every order shows the payment reference where staff can find it.

As volume grows, add Apple Pay if your bank supports it. It helps iOS buyers finish faster without changing the base card path.

Shopify gives you speed, themes, and a tidy back office. Your task is to add a card method that speaks Qatar’s flow while keeping the buying experience smooth. Follow the SADAD merchant path to set up a custom method, scope it to Qatar if you sell locally, and place a live test order.

Read the order timeline. You want the SADAD reference recorded where support will look. Then check the two failure points that cost stores the most: a slow handoff to checkout and abandoned flows that stop sending emails after the bank page. Fix those and you preserve both conversion and recovery.

In apps, payments should feel like part of the product. That starts on the server. Create payments on your backend, hold keys out of client code, and use tokenization for returning buyers. Webhooks are your source of truth. Handle paid, failed, and refunded with idempotent logic so retries never double-charge.

Design around the Qatar step. After OTP and PIN on the bank page, return users to the exact screen they expect with a visible success state. Add a gentle retry for soft declines and log the SADAD transaction reference alongside your order ID. When you ship this way, you keep trust high and support simple even as traffic grows.

Pick a few signals and learn fast. Time to first payment from sign-up. Acceptance rate on domestic debit. Link click-to-pay for WhatsApp sales. Refund resolution time. Report accuracy against your accounting fields. If one number looks off, fix that path first. Clean money flows beat new features every time.

Payments aren’t just a button on your site. They are contracts, costs, and timelines that shape cash flow. Before volume arrives, get clear on how money moves through your stack.

Start with pricing you can predict. Every card transaction carries network costs that vary by card type and channel. Your goal is a single effective rate you can plan around. Ask for a number that reflects your actual mix of domestic debit and international cards, not a headline you never see in practice. Then map where fees land. Some providers deduct on each charge. Others net them on settlement. The difference shows up in your bank reconciliation.

Settlement timing matters as much as price. Daily, two-day, or weekly cycles change when you can restock or run ads. Write down cut-off times and holiday rules. If a rolling reserve applies, record the percentage and release schedule so finance isn’t guessing. Pair this with a payout report that lists every charge and refund in each settlement. That report is your source of truth when the bank statement arrives.

Risk is the third leg of the stool. In Qatar, buyers expect to receive an OTP by SMS and confirm with their card PIN on the bank page. Say that on your checkout. Clarity reduces drop-off and disputes. Keep a recognizable statement descriptor so customers see your name on their bank app. When a chargeback happens, treat it like operations, not drama. Know the fee, the evidence window, and the exact path to submit proof. Test refunds on day one so support never stalls.

A simple drill closes the loop. Run one live charge, one full refund, and one partial refund. Export a payout report, reconcile it to your bank, and save the steps. That routine is worth more than any feature list because it protects cash and time.

The best setup is the one that matches how you sell today and grows without rework. If you sell through conversations, start with payment links. They turn WhatsApp and email into revenue without a storefront. If you invoice for services, switch bank transfers for SADAD invoices and let reminders do the follow-up. When a catalog appears and orders repeat, WooCommerce gives you a native checkout that fits your brand. Shopify gives you speed and a tight admin. Both keep a clean route to Qatar’s card flow.

Mobile apps sit on a different axis. Here, the payment should feel like part of the product. Create charges on your server, hold keys out of client code, and use tokenization for returning buyers. Webhooks tell you what actually happened. Treat them as the ledger and make handlers idempotent so retries never double-charge.

If two paths fit, take the one that gets you paid this week and layer the rest. Links prove demand. Stores add structure. APIs let you compose when scale arrives.

Do I need a full website to take payments?

No. Payment links and invoices cover day one. They let you sell from DMs, email, and simple landing pages. Build a store when your catalog and logistics need automation.

How does the online card flow work in Qatar?

Buyers enter card details, receive an OTP by SMS, confirm with their PIN on the bank page, then return to your success screen. Tell them this before it happens. Trust goes up and support tickets go down.

Can I offer Apple Pay?

Yes when your bank supports it. Think of Apple Pay as a fast lane for iOS buyers. Keep card rails on by default for coverage across banks and devices.

What if a payment fails?

Treat soft declines as recoverable. Offer a gentle retry and keep a fresh link or invoice ready. Watch failures in the dashboard and follow up while intent is warm.

Can I do subscriptions later?

Yes. Start with invoices or links to validate the offer. When it stabilizes, move recurring charges to the API with tokenization and webhooks so renewals stay accurate.

How do refunds appear?

You issue them in the dashboard or your store admin. They attach to the original transaction, appear in payout exports, and post back to the buyer after the card network processes the reversal.

What should finance receive each month?

A payout report that ties settlements to charges and refunds, invoice exports with numbering and tax lines, and an up-to-date list of disputes with due dates. That package closes books without guesswork.

Before we wrap up.

You will see these terms in dashboards, bank emails, and support threads. Keep this list close. It turns jargon into decisions.

You came here to choose a processor and get paid. SADAD fits the way small businesses in Qatar actually sell. Now make it real. Open your SADAD dashboard at SADAD.qa, create a payment link, share it on WhatsApp or email, and collect a live payment. One action, one receipt, proof you’re set.

Running WooCommerce or Shopify. Turn on the SADAD method, place a small mobile order, and confirm the success page and refund path. Your checkout stays on brand and respects the local OTP plus PIN flow.

If you want a walk-through, book a short session with the team. You’ll connect links, invoices, and your store in one sitting and leave with a verified money path. Head to developer.SADAD.qa for APIs, SDKs, and webhooks. Keep payment creation on the server, use tokenization for returning buyers, and wire up webhooks as your source of truth.

Make your first payment today. Add Apple Pay when your bank supports it. Layer WooCommerce or Shopify when the catalog is ready. The best processor is the one that moves cash now and scales when you do.

start from here

Articles

The Future of Payments in Qatar: 5 Shifts That Will Change How Your Business Gets Paid

The Future of Payments in Qatar: What Every Business Needs to Know In July 2025, Qatari businesses processed $4.4 billion in digital transactions, totaling 51.7 million individual payments. SAMENA Daily...

Read more

Articles

Best POS device in Qatar: Why SADAD Plus Outperforms Bank-Issued Terminals

Best POS device in Qatar: Why SADAD Plus Outperforms Traditional Terminals Last month, a café owner in West Bay showed me his counter. Three different POS machines. One from his...

Read more

Articles

Cloud Payments for Enterprises: The Qatar CFO’s Guide to QCB-Compliant Infrastructure

Cloud Payments for Enterprises: Top Features Every CFO in Qatar Should Care About Last week, I sat across from a CFO managing a 700-employee enterprise in Qatar. His board was...

Read more