Articles

Types of Payment Gateways Explained, Hosted, API, QR & More

Not all payment gateways are created equal.

Some are easy to set up but limit what you can do. Others give you full control, but only if you have a developer. And in Qatar, where mobile payments and VAT compliance are non-negotiable, picking the right type of gateway matters more than ever.

If you’re a business owner or manager trying to figure out how to accept online payments (without breaking your tech stack or budget), this guide is for you.

We’ll break down the four main types of payment gateways, show you the pros and cons of each, and explain why SADAD’s local gateway is becoming the go-to choice for businesses across Qatar.

Not all payment gateways work the same, and choosing the wrong one could lead to slower payments, more friction, and compliance issues.

Here’s a quick breakdown of the five main types of payment gateways used by businesses in Qatar:

If you’re running a business in Qatar, you don’t just need a way to collect payments. You need a solution that’s fast, compliant with local VAT and e-invoicing laws, and built for how people actually pay today.

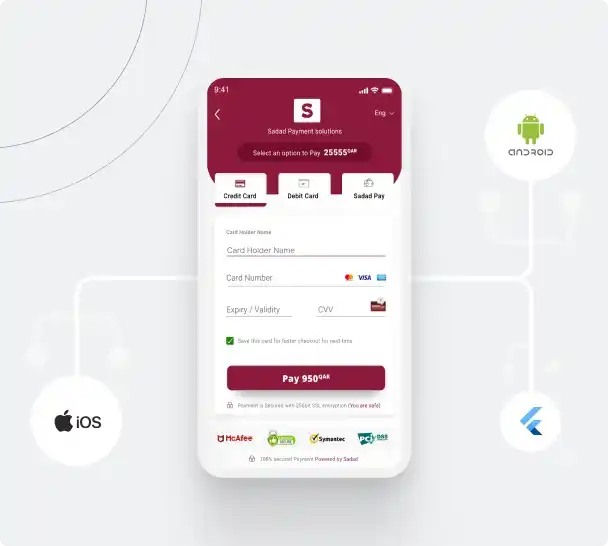

SADAD is the only local gateway designed for Qatari businesses:

If you want to reduce payment delays and streamline your collections, SADAD is the gateway built for the way Qatar does business.

Let’s start with the basics.

Think of a payment gateway like the card machine at a store, but online.

It’s the invisible layer that connects your website, app, or payment form to the banks and systems that move money. When a customer enters their card details, the gateway steps in. It encrypts the data, checks if the funds exist, gets approval from the customer’s bank, and confirms the payment. All in a few seconds.

You don’t see any of that. But it’s happening behind every “Pay Now” button on the internet.

And in Qatar, it’s happening a lot.

According to the Qatar Central Bank, e-commerce and card payments reached QAR 16.1 billion in a single month, March 2025.

That makes the gateway you choose more than just a tech decision. It directly affects:

Some gateways are plug-and-play tools. Simple but limited. Others are more like toolkits. Powerful but hard to set up without a developer. Then there are smart hybrids like SADAD that give you the best of both worlds: easy for you, seamless for your customers, and fully tailored to Qatar’s regulations.

In the next section, we’ll look at why your choice of gateway has a bigger impact than most business owners realize.

Imagine this: a customer is ready to pay. They open your checkout page… and nothing loads. Or worse, the payment fails midway through. They close the tab, and you lose the sale.

That’s the risk of using the wrong payment gateway.

Your gateway isn’t just another tool in your tech stack. It sits at the point where intention turns into revenue. And if it’s slow, confusing, or unreliable, you’re leaving money on the table.

Now let’s tie that to the local reality.

Qatar’s economy is going digital at full speed. In March 2025 alone, the Qatar Central Bank reported over QAR 16.1 billion in e-commerce and card payments processed (source). That number isn’t just impressive, it’s a wake-up call. The way people pay has changed, and your business needs to keep up.

Here’s where the type of payment gateway matters most:

This is where SADAD stands out. Unlike generic, international platforms, it’s built for how people pay in Qatar. It’s designed around local banks, local payment methods, and local tax rules. And because it’s made for the region, you don’t need to fight with integrations or worry about missing key features.

If you’re doing business in Qatar, the local option isn’t just convenient, it’s strategic. You don’t have to worry about hidden fees, international transfer delays, or misaligned tax systems. A local gateway like SADAD is designed around the way payments actually work in the country.

In the next section, we’ll show how each type plays out in practice, and why hybrid gateways like SADAD are becoming the default choice for growing businesses in the region.

Not all payment gateways are created equal.

Some are quick to set up but come with limits. Others offer advanced features but require developer help. To choose the right one, you need to understand the main types and where they fit in your business journey.

Let’s break them down clearly.

These take your customer off your website to complete the payment on a third-party page. Think PayPal or Stripe Checkout.

Pros:

Cons:

Best for: Freelancers, small online stores, and anyone who wants speed over customization.

With this setup, the customer enters their payment details directly on your website. You then pass that data securely to the gateway provider.

Pros:

Cons:

Best for: Larger e-commerce platforms or tech-savvy teams who want a polished, integrated experience.

These give you total flexibility by connecting directly to the gateway provider through APIs. You design the entire checkout flow and trigger transactions from within your app or system.

Pros:

Cons:

Best for: Fintech companies, marketplaces, or businesses with custom software needs.

These are built for specific markets, in this case, Qatar. They often combine the simplicity of hosted gateways with the benefits of deep local integration.

Pros:

Cons:

Best for: Any business operating in Qatar, from solo entrepreneurs to large enterprises, looking for something fast, compliant, and easy to use.

So what does this mean for you?

This is where we see the most traction. SADAD wasn’t built for global scale. It was built for local precision.

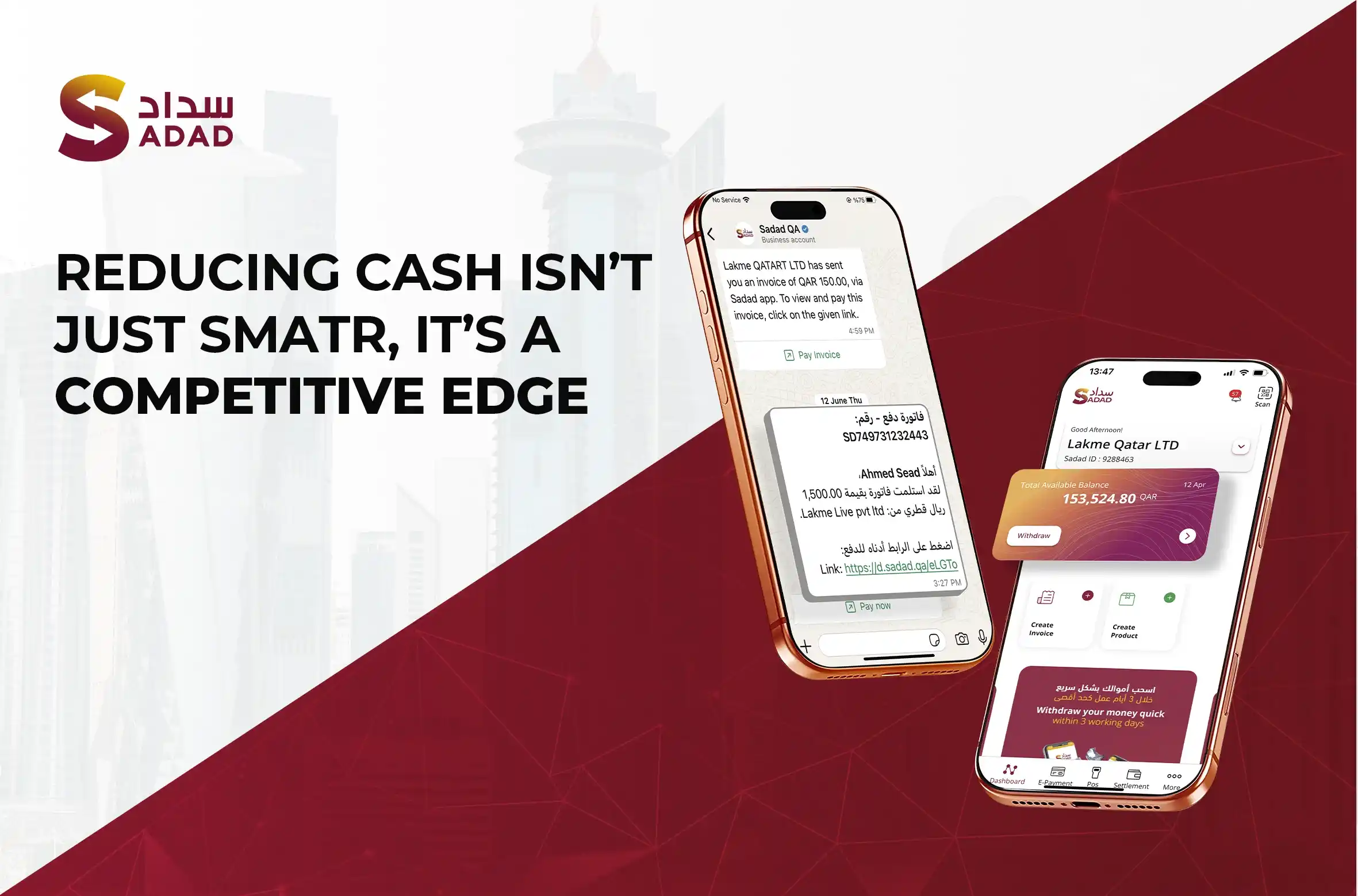

You send a payment link in Arabic by SMS or WhatsApp. Your client pays using a familiar interface. The system generates a full VAT-compliant invoice instantly, in Arabic and English. And if they forget to pay, a polite reminder goes out without you lifting a finger.

We’ve seen this used by:

And because SADAD operates under Qatar’s regulatory framework, the entire flow matches government expectations. You don’t have to read policy documents or figure out tax rules. It’s already built in.

In a market where digital payments reached QR 16.3 billion in July 2025, tools that integrate directly with local payment behaviors are more than a convenience. They’re a competitive edge.

Up next, we’ll explore why hybrid gateways like SADAD, combining the ease of hosted systems with deep local integration, are now the default choice for smart businesses in Qatar.

The old tradeoff used to be clear: hosted gateways were simple but limited. Custom gateways were powerful but expensive.

But in markets like Qatar, a third option has emerged, and it’s changing the game.

Hybrid gateways combine the flexibility of APIs with the simplicity of hosted systems. You get the ease of sending a payment link, but with features deep enough to replace complex invoicing, payment tracking, and tax handling.

Here’s how hybrid design plays out in practice:

It doesn’t feel like a payment gateway. It feels like a complete cashflow system.

And the timing couldn’t be better.

As Qatar Central Bank’s monthly reports show, the shift toward digital payments is accelerating. Businesses that rely on Excel, email attachments, or generic tools are falling behind, not just in speed, but in trust.

Your clients now expect digital-first payments. Your government expects VAT compliance. Hybrid gateways like SADAD solve both.

That’s why they’re not just the future, they’re the new standard.

In the next section, we’ll show you exactly how SADAD works behind the scenes, from sending a payment link to getting paid and staying compliant. Step by step.

So how does SADAD actually work in a real business workflow?

Let’s walk through it step by step, from creating an invoice to receiving payment and staying VAT-compliant, without needing a single line of code or a complex setup.

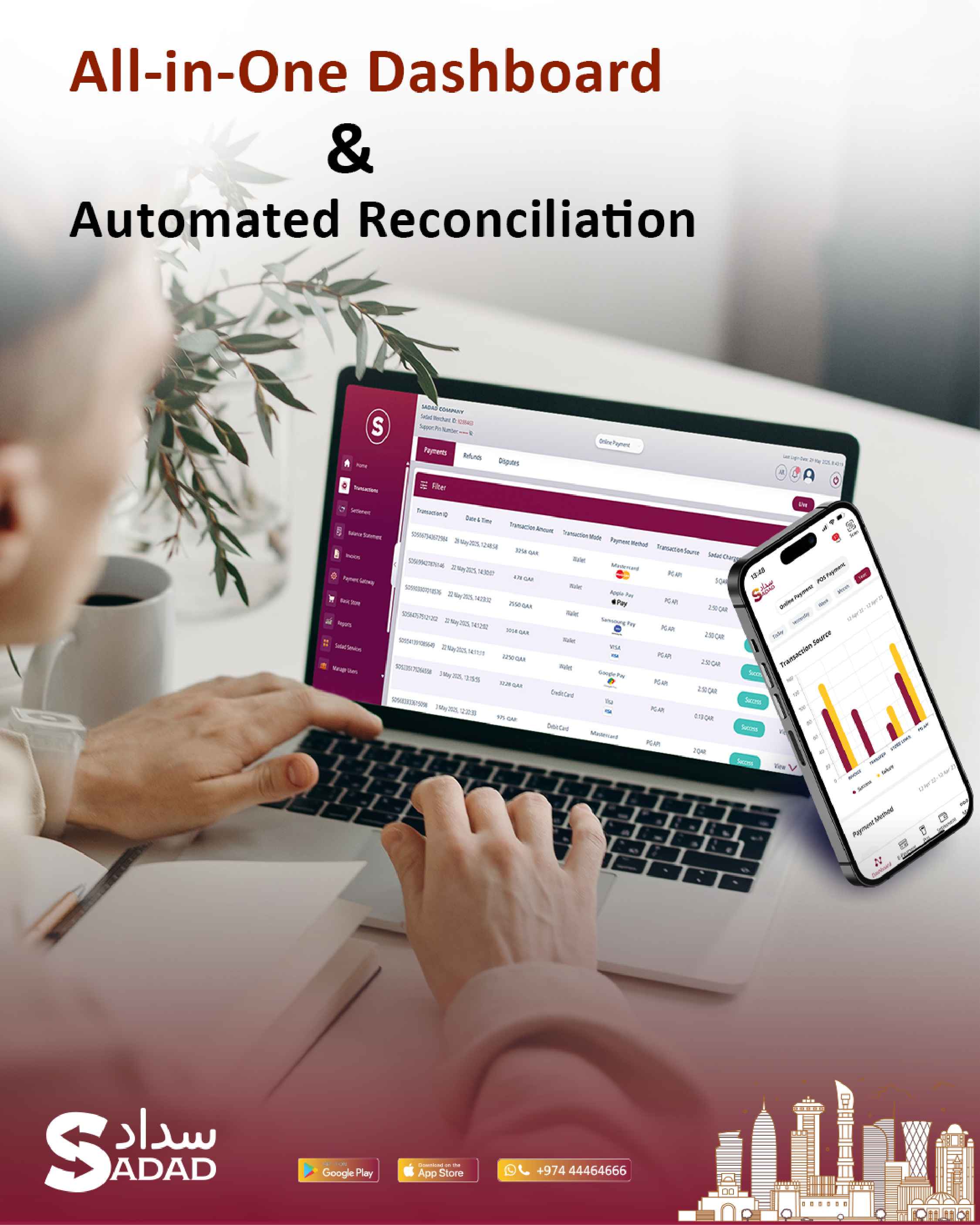

You start by logging into your SADAD dashboard, no downloads, no installations. Just a clean interface that works on desktop or mobile.

You enter the invoice details:

There’s no need to design templates or mess with formatting. The system does it for you.

Every SADAD invoice includes a built-in payment link. You don’t have to create one separately or rely on another tool.

Clients can pay using local methods, including credit cards, debit cards, or direct bank transfer, all inside a familiar interface that supports Arabic and English.

You can send the invoice link by:

There’s no friction. No login required from your client’s side. They click, review, and pay.

This works especially well in Qatar, where WhatsApp is often the default communication channel for business.

As soon as your client makes the payment, you get an instant notification. No need to check your bank account or wait for a receipt.

If they don’t pay by the due date, SADAD sends automatic reminders, politely and on time. You stay professional, and your cash flow stays healthy.

Every invoice created and paid through SADAD is stored in your dashboard, fully formatted for Qatar’s VAT regulations.

You can filter by date, download summaries, and export reports whenever needed. During tax season, this saves hours of manual work and reduces the risk of errors.

Let’s say you’re a home repair company. A client asks for plumbing service. You visit, finish the job, and send a SADAD invoice via WhatsApp.

The client clicks the link, pays by card, and you get notified instantly. You didn’t need to design a PDF. You didn’t need to chase them. And the invoice is already stored, ready for end-of-month reports or tax filing.

That’s the difference.

SADAD doesn’t just process payments. It supports your business flow, adapts to how people in Qatar actually communicate, and reduces friction at every step.

Next, we’ll look at how this kind of setup helps you build trust with clients, not just close payments.

In Qatar, trust is everything.

Whether you’re working with a corporate client or an individual, how you send an invoice shapes how professional, and reliable, you look. A messy PDF, a late follow-up, or a missing payment option can make even a great service feel unpolished.

SADAD helps you fix that.

Here’s how every transaction builds more trust with your clients:

Every invoice from SADAD is clean, well-formatted, and includes your business name, logo, and VAT details. That’s not just about looking good, it signals credibility.

When a client sees a proper invoice with a secure payment link, they know you’re serious. You’re not just a side hustle. You’re a real business.

Your clients don’t want to download attachments or open desktop apps. They want to tap a link, pay, and move on.

SADAD makes that happen. It gives them a seamless, mobile-first payment experience in Arabic or English, whatever they prefer.

And because they can choose their payment method (card, bank, etc.), you eliminate excuses and make payment friction-free.

Nothing ruins trust faster than endless “Just checking in on this invoice…” messages.

With SADAD, reminders are built in. If a client forgets to pay, the system follows up politely, without making you look pushy or desperate.

You stay professional. They stay informed. And your payments come in faster, without awkward conversations.

Clients can always see invoice details, payment status, and history. There’s no confusion about what’s due or when. You stay accountable. They stay confident.

In a country where VAT and tax compliance are now non-negotiable, showing your clients you’re doing things by the book builds long-term trust.

SADAD automatically includes VAT breakdowns, due dates, and compliant formatting. You don’t need to explain; the invoice speaks for itself.

Bottom line: Every time you use SADAD, you’re reinforcing the message:

“This business is serious, prepared, and easy to work with.”

Next, we’ll wrap it all up and show why the right payment gateway, especially one designed for Qatar, can transform how you get paid and how your clients see you.

A payment gateway isn’t just a technical tool. It’s how your business asks to get paid. And how your client experiences that process, fast or slow, confusing or clear, manual or instant, shapes their trust in you.

SADAD was built with that in mind.

It’s not a generic payment system with global bells and whistles. It’s a solution made for Qatar, for real businesses that need to send invoices, collect payments, and stay 100% compliant with VAT, without chasing clients or managing spreadsheets.

Let’s recap what makes it work:

This isn’t just about technology. It’s about building a smoother, more trustworthy business.

now we hope you really know

So if you’re still relying on Excel, Word templates, or free tools that make you do all the work, it’s time to upgrade.

Let SADAD handle your invoicing, so you can focus on what really grows your business.

Start using SADAD today and make every invoice one step closer to getting paid.

Articles

Stop Losing Ramadan Sales: A Qatar Payment Checklist That Actually Works

How to Prepare Your Business for Ramadan Payments in Qatar I've watched countless Qatar-based businesses scramble every year when Ramadan arrives, only to realize their payment systems weren't ready for...

Read more

Articles

Web Summit Qatar: From Global Fintech Ideas to Local Merchant Impact

What Attending Web Summit Qatar Reminded Us About Fintech in Qatar There’s a difference between showing up to an event and showing up with a point of view. At SADAD,...

Read more

Articles

Reduce Cash Handling for Businesses Qatar: What Most Owners Get Wrong

How to Reduce Cash Handling for Businesses in Qatar (Without Slowing You Down) Here’s the part no one talks about. Cash is heavy, not just physically but operationally. It wastes...

Read more