Articles

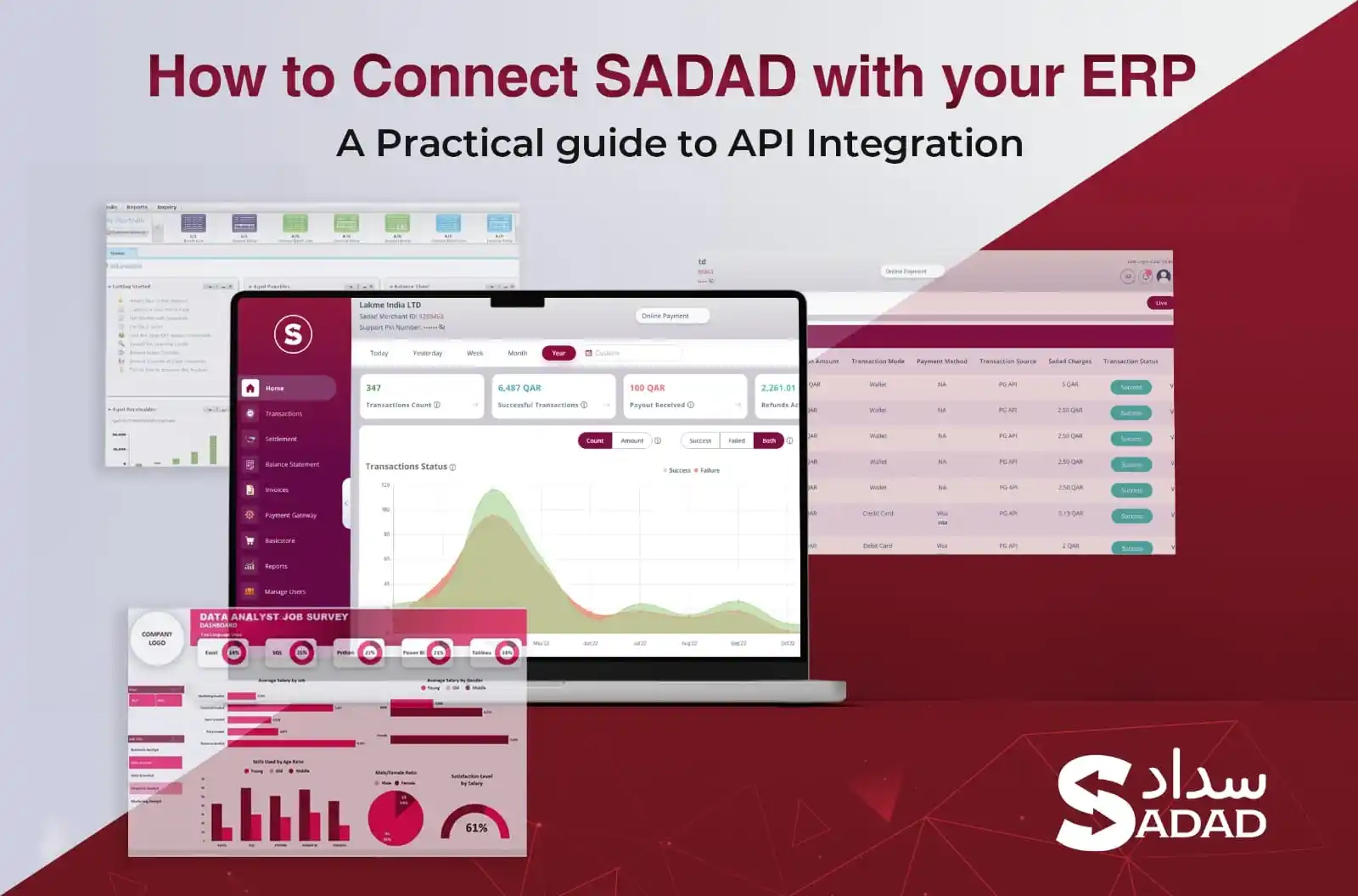

ERP API Integration in Qatar: The Fastest Way to Automate Payments with SADAD

If you’re managing payments, invoices, or sales data across multiple systems in Qatar and you’re still syncing manually, chasing spreadsheets, or reconciling settlements by hand, you’re already behind.

The most innovative companies in Qatar aren’t just digitizing; they’re transforming. They’re integrating.

They’re using APIs to connect SADAD’s payment systems directly into their ERP platforms, automating finance, unlocking real-time data, and removing the bottlenecks that slow down accounting, operations, and decision-making.

And here’s the part most people miss: this isn’t a future-state scenario. It’s already happening. In retail chains, logistics firms, clinics, and ecommerce stores across Doha, businesses are syncing SADAD with ERPs such as Odoo, SAP, Dynamics, and Oracle and watching their payment data flow in cleanly, instantly, and error-free.

This guide is your blueprint.

You’ll learn:

If you want to stop relying on Excel, if your finance team is spending days on reconciliations, or if you’re tired of systems that don’t talk to each other, this is the article for you.

Let’s get into it.

A few years ago, if your systems didn’t talk to each other, it was annoying. Today, it’s expensive.

Finance teams across Qatar are under pressure for faster reconciliations, cleaner audit trails, and better visibility across sales channels. But most businesses still operate in fragments: payment gateways here, ERP systems there, manual syncs in between.

And those gaps? They bleed time, money, and clarity.

Qatar’s Vision 2030 isn’t just a headline; it’s a real shift in how businesses are expected to operate. The Ministry of Commerce and Industry and QCB are pushing harder on digital compliance, audit readiness, and data accuracy.

Whether you’re a logistics company managing driver payouts, a restaurant chain syncing sales across multiple branches, or a clinic matching patient invoices to payments, integration is no longer a technical preference. It’s operational hygiene.

YOU NEED TO READ: Digitalization, ownership reform propel investment boom

Since 2021, SADAD has worked with thousands of businesses across Qatar. We’ve seen the shift firsthand:

These are real businesses, losing hours every week, not because their teams are slow, but because their tools are disconnected.

The solution isn’t more tools. It’s making your current tools talk to each other.

A few years ago, API integration was something only enterprise IT teams talked about. Today, even mid-sized businesses in Doha are integrating SADAD with Odoo, Microsoft Dynamics, and QuickBooks.

Why?

Because the logic is simple:

Every delayed reconciliation, every mismatched transaction, every Excel file being emailed back and forth… It’s all a symptom of non-integration.

And in 2025 and beyond, the businesses that eliminate that friction are the ones that move faster, serve better, and scale cleaner.

Let’s get one thing straight: API integration isn’t some futuristic concept or enterprise buzzword.

It’s just a more innovative way to make your systems talk to each other without you having to lift a finger.

If your team is copying data from one screen to another, payment amounts, invoice numbers, customer info, you don’t have an automation problem. You have a lack-of-integration problem.

An API (Application Programming Interface) is like a universal translator between software systems.

Imagine this:

An API is that translator. It allows systems to request data, send instructions, and receive responses in real time. No exporting files. No email attachments. No delays.

Here’s what that looks like in the real world:

Let’s compare the two.

Manual syncing means:

It’s fragile, time-consuming, and always one error away from chaos.

API integration, on the other hand:

It doesn’t just save time. It removes the possibility of inconsistency.

One of SADAD’s retail clients runs high-volume branches on Thursdays and Fridays. Before integration, they’d manually pull payment data and upload it to their ERP on Sunday.

What used to take two days and three people now takes zero minutes. Every transaction is automatically synced hourly, straight into the ERP. By the time the finance team arrives on Sunday, everything is already closed.

No delay. No errors. No reconciling.

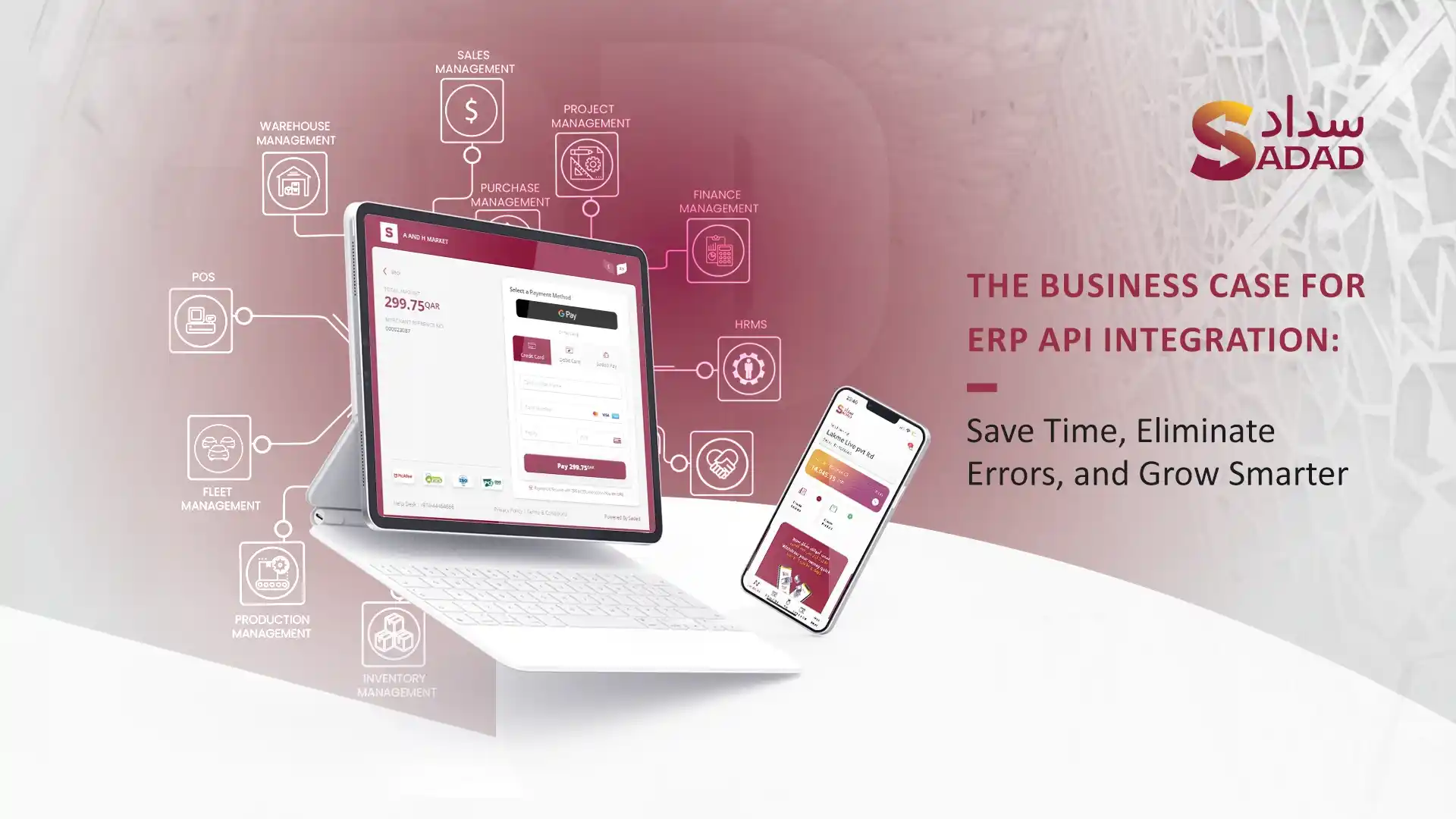

If your ERP is where your business lives, sales, finance, inventory, and procurement, then integration is what makes it breathe.

ERP systems like SAP, Odoo, Oracle, or Microsoft Dynamics are designed to be the backbone of your operations. They’re where you track what’s sold, what’s owed, what’s stocked, and what’s coming next.

But here’s what no one tells you: your ERP is only as good as the data flowing into it.

And without integration? That data usually arrives late, is incomplete, or is wrong.

When you integrate your ERP with your payment systems like SADAD, you stop managing your business in silos. Suddenly, your data moves with you.

Let’s say a customer pays through a SADAD invoice or a POS device:

Now multiply that by 50 payments a day, across four branches, with three payment methods. That’s why ERP integration matters.

In Qatari businesses we’ve worked with, here’s the pattern we keep seeing:

This isn’t a software problem. It’s a data flow problem.

ERP integration with SADAD means:

Everything is synced, logged, and reflected in the ERP where it matters.

One multi-branch medical clinic, used to reconcile patient payments manually every night. Their ERP and SADAD weren’t connected, so front-desk staff exported reports, cross-checked invoices, and manually updated SAP.

Once they integrated with SADAD, the process became instant.

Now, when a patient pays via SADAD invoice, or even via link, the ERP reflects it immediately—no more end-of-day chaos. No more finance errors flagged two weeks later.

Just clean, real-time numbers.

If you’ve ever worked with a payment API that felt like it was built in another country, for another market, with no idea how your operations work, SADAD is the opposite.

This isn’t just an API that “works.” It’s a gateway built for businesses in Qatar, by a team that knows how payment flows here actually look on the ground.

Here’s what’s possible, right out of the box:

All through clean, well-documented REST APIs, built on modern JSON standards.

This means your ERP, website, app, or back-office dashboard can talk to SADAD the same way it speaks to any modern system, without workarounds, delays, or email confirmations.

Every integration engineer we’ve worked with says the same thing: “It just makes sense.”

No black boxes. No outdated XML feeds. Just clean documentation, clear logic, and predictable behavior.

And if something isn’t working, you’re not emailing a global support center in another timezone. You’re talking to a team here in Qatar that answers.

SADAD’s API is secured by design:

This isn’t just about avoiding breaches. It’s about giving your finance team, compliance officer, and CTO the peace of mind they need to scale confidently.

A local SaaS company in Qatar integrated SADAD into its invoicing platform. No middleware. No custom gateways. Just direct API calls from their platform to SADAD for payment creation, confirmation, and reconciliation.

Today, they send over 200 invoices per week, every one tracked, matched, and logged without manual effort.

That’s what a local-first API is supposed to do: remove friction, not add layers.

If you’ve ever asked, “What exactly would we gain by integrating SADAD into our ERP?” This is your section.

Because when integration works, it’s not theoretical. It shows up in your daily workflow. It saves hours. It prevents errors. It gives your team space to focus.

These five use cases come straight from field businesses in Qatar that use SADAD’s API to connect directly with systems such as Odoo, SAP, Microsoft Dynamics, and QuickBooks.

Let’s walk through them.

Orders come in through an online store. Payments are collected. But the ERP only updates once a week if someone remembers to export the CSV file.

SADAD’s API syncs every successful payment directly to the ERP, instantly updating:

One retailer went from 12 hours per week of reconciliation to 0. They now close out daily sales in real time across three branches.

Multi-branch restaurants use POS devices at each location but manually consolidate reports. Finance gets inconsistent data from each manager, often days late.

POS payments are pushed via API into the company’s ERP, tagged by branch and timestamp—no need to wait for store managers to email reports.

Then he made the smart move to SADAD.

Finance now pulls accurate, same-day revenue and splits by card/cash from one dashboard. Errors dropped. Month-end happens faster.

Drivers collect payments via x SoftPOS, but reconciliation with delivery logs happens in a silo. Matching who paid what, and for which shipment, takes hours.

When payment is received via SADAD, the API sends a confirmation back to the logistics platform, which then syncs with the ERP. Payment status is matched to the delivery ID in real time.

No more back-office reconciliation. The company now tracks revenue and delivery completion in a single place, with full audit logs.

Clinics use traditional ways to collect payment at reception, but billing in the ERP (often SAP or Oracle) isn’t updated immediately. Delays and duplicate entries happen weekly.

SADAD’s API pushes payment confirmation, including service type, amount, and patient reference, into the ERP’s patient billing module.

Front-desk staff stopped manually entering receipts. Finance can now instantly match every service with payment, and refunds flow both ways.

Agencies send dozens of invoices each month. Finance has to mark each as paid in Dynamics or Zoho Books manually.

As soon as a client pays through SADAD (card, bank transfer, or QR code), the ERP marks the invoice as paid. Auto-match. No delays. No chasing.

Collections improved. Payment tracking became self-updating. And end-of-month no longer involves a shared Excel sheet and three cups of coffee.

These are real problems solved by integration.

And whether you’re running one clinic or a chain of retail stores, the principle is the same: connect your ERP and SADAD via API, and let the systems do what people shouldn’t have to.

Let’s demystify the part most people avoid.

ERP integration sounds complex, but with SADAD, the process is direct, structured, and built to work with the systems businesses in Qatar already use.

Here’s the breakdown.

SADAD’s API is ERP-agnostic.

That means it’s been successfully integrated with:

What matters is that your ERP can handle RESTful API calls or connect via middleware (like Zapier, Make, or direct SDKs). Most modern ERPs can be used either natively or through extension modules.

The best integrations start by answering:

Example: A retail chain in Doha chose to generate invoices in SADAD and push status updates back into Odoo via a webhook. This gave them cleaner tracking and less ERP clutter.

SADAD uses OAuth2 bearer tokens for secure access. Your integration team will:

Authentication is:

This is where the real magic happens.

SADAD can push real-time updates to your ERP using webhooks:

Your ERP just needs to expose an endpoint that can receive and parse this data.

No polling. No lag. Just live transaction data piped directly into your backend.

SADAD offers a complete sandbox environment that mirrors live transactions using fake data. You can:

Once everything works, flip the switch. Your systems go live.

They needed to:

The integration team used a lightweight middleware app that:

It took no time to deploy. Two hours to train the team. And it eliminated a daily 3-hour reconciliation task.

You don’t need to be a developer to understand this.

You just need the right team to build it once, and then your systems run clean forever.

Integration doesn’t have to be a massive IT project. You don’t need six months, a full-stack dev team, or a consulting firm.

You need one focused time and a clear game plan.

Here’s how SADAD clients in Qatar have launched fully working integrations.

Start by answering a few grounded questions:

This is not a tech task, it’s a process-mapping task. You’re defining the handshakes between tools.

Tip: Get finance, ops, and tech in one 30-minute call. Without alignment here, the integration fails later.

Loop in your ERP vendor or internal dev. Ask one question:

Can our ERP consume a REST API and receive webhooks?

If you’re on:

SADAD shares technical documentation from day one,your dev doesn’t have to guess.

SADAD gives you access to a sandbox environment. This lets your team:

You’ll also get your API keys. Keep them secure. Use Postman or any REST client to start sending/receiving data.

Now that the data flow is mapped and the systems are talking:

Most of this is plug-and-play using SADAD’s docs. If you’ve got dev support, it’s smooth.

Run a batch of test transactions from start to finish. Examples:

Don’t skip this. One missed edge case in testing = 20 headaches later.

Once testing is clean:

If something breaks, it’ll break early. SADAD’s team provides support during this stage. You’re not alone.

And just like that, you’re integrated.

No more manual entries. No more weekend reconciliation. Just clean, automated sync between SADAD and your ERP.

You don’t integrate SADAD with your ERP just to check a box.

You do it because disconnected systems cost real money through delays, duplication, manual work, and missed insights.

The businesses that win in Qatar’s new digital economy aren’t working harder. They’re working smarter by connecting the tools they already use and letting data move without friction.

Here’s what we’ve seen, again and again:

And this doesn’t require a transformation initiative or a new platform. It just requires connecting the systems you already use, SADAD, and your ERP, so they can do the heavy lifting together.

Are the companies doing this today? They’re not just integrated. They’re free to grow, to scale, and to focus on what actually moves their business forward.

Articles

Best POS device in Qatar: Why SADAD Plus Outperforms Bank-Issued Terminals

Best POS device in Qatar: Why SADAD Plus Outperforms Traditional Terminals Last month, a café owner in West Bay showed me his counter. Three different POS machines. One from his...

Read more

Articles

Cloud Payments for Enterprises: The Qatar CFO’s Guide to QCB-Compliant Infrastructure

Cloud Payments for Enterprises: Top Features Every CFO in Qatar Should Care About Last week, I sat across from a CFO managing a 700-employee enterprise in Qatar. His board was...

Read more

Articles

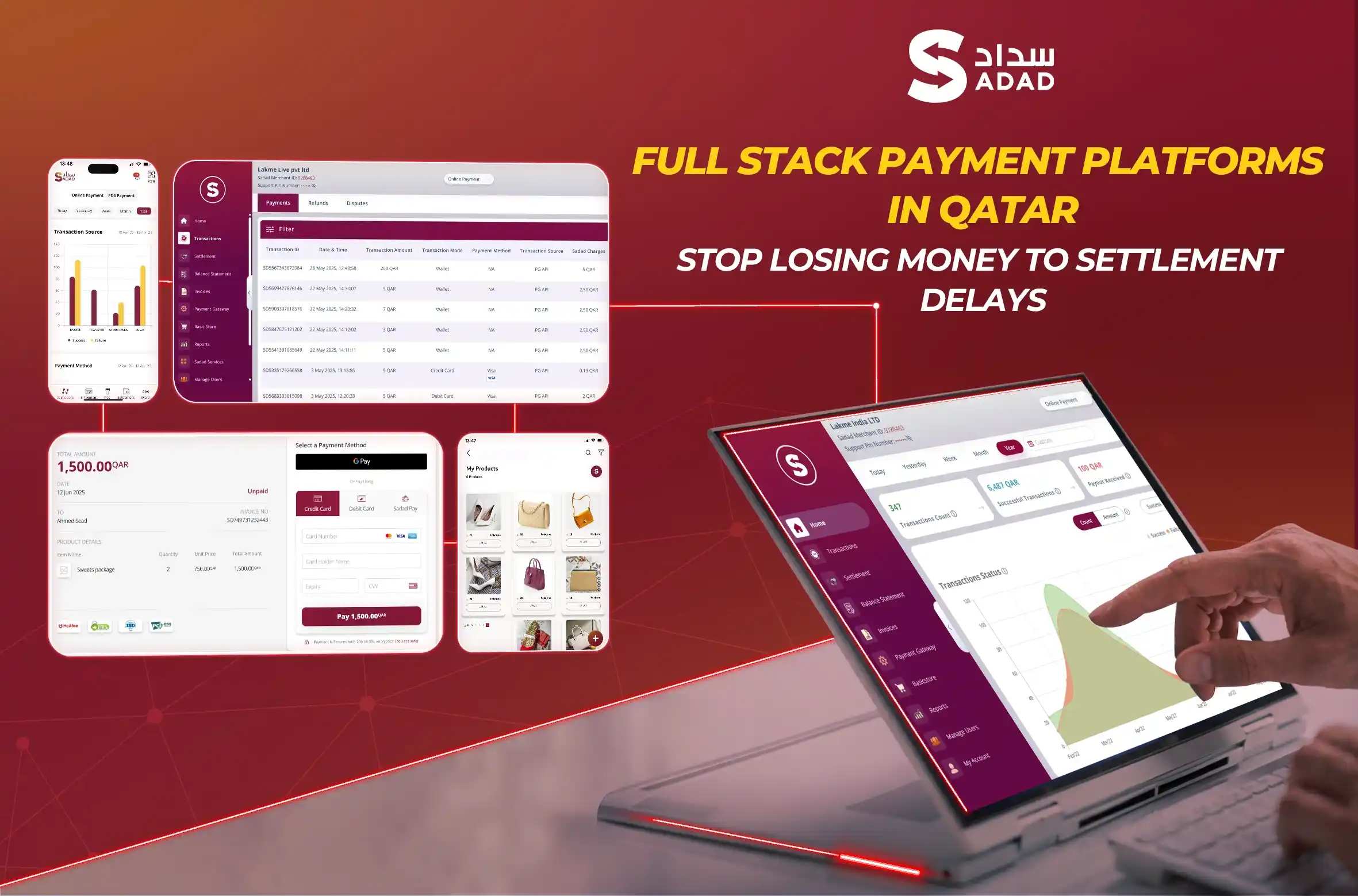

Full Stack Payment Platforms in Qatar: Stop Losing Money to Settlement Delays

Full Stack Payment Platforms in Qatar: The Complete Guide for Businesses If you're running a business in Qatar, you've probably felt the pain of cobbling together multiple payment vendors...

Read more